Retiring from Costco? Here’s What You Need to Think About

Retirement is an exciting life transition. However, this change prompts many questions that don’t seem to have clear answers. This guide was created to provide clarity on what retirement might look like for you, and how to start laying the foundation in a strategic way.

The Good News:

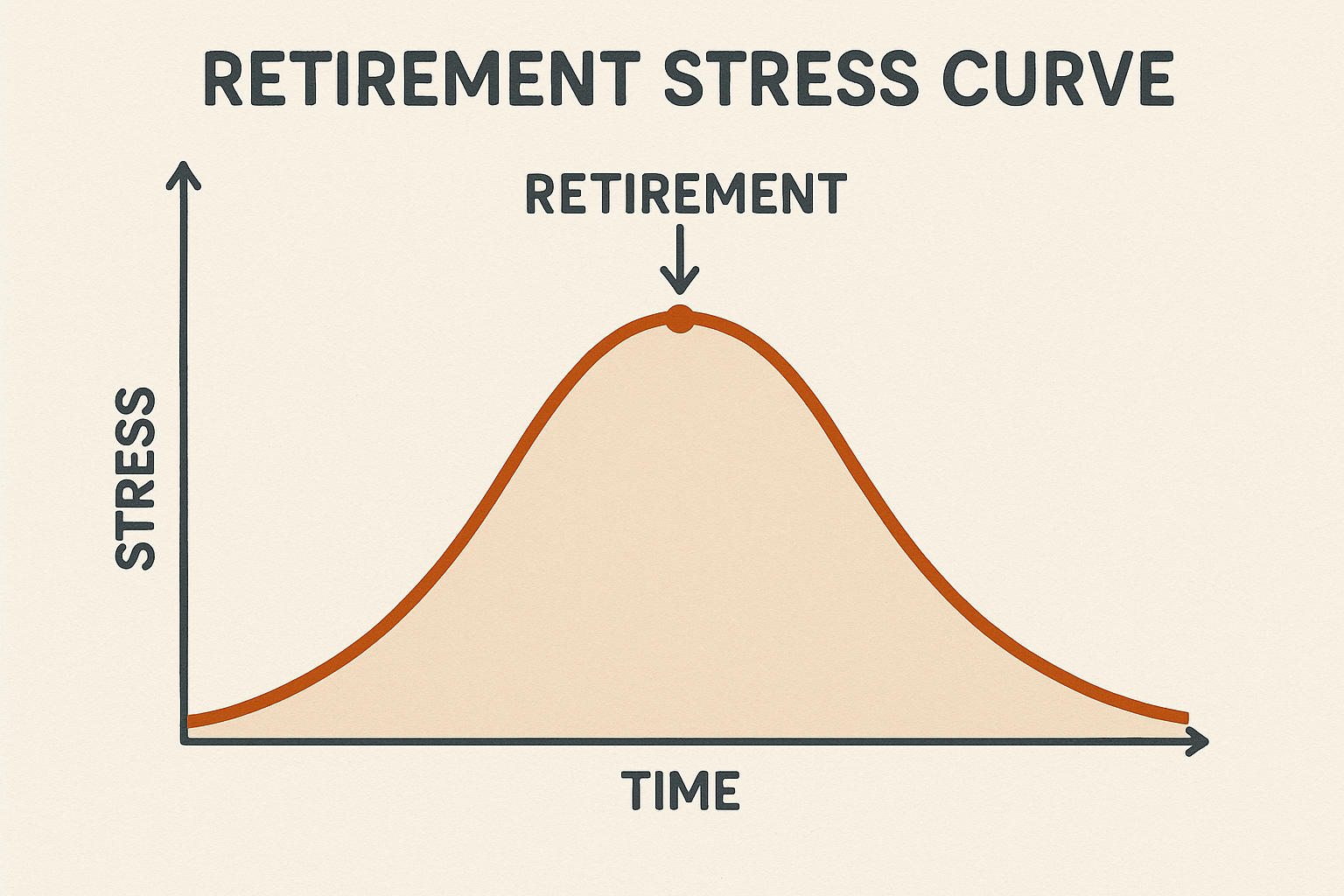

Retirement stress often looks like the chart below. The closer you get to retirement, the more stress you might have. But once you get over the hump and have a solid plan in place, the stress seems to subside as you get more comfortable in this new stage of life.

This guide, written by local Issaquah financial advisors, outlines financial strategies and retirement resources tailored to Costco employees in the final stretch of their careers. (And will hopefully reduce some retirement stress)

Step 1:

Quantitative vs qualitative:

What do you want to get out of retirement?

Before looking at any numbers, we recommend some intentional thinking on how you want your retirement to look like. We’ve seen many people skip past this part, and a few weeks after their last day, the look around and ask: “Now What?”

When we help guide people into and through retirement, we always look at this through the lens of their life goals. Maybe you’d like to travel, volunteer with an organization you love, or simply play golf (Which I am all on board for). Understanding your goals can also better solidify the financial approach you take when creating a retirement plan.

Note: Understanding when you can retire is a larger topic to cover in itself. We’ve written about this here if you’d like more details. We assume that you have already decided to take this next step and want to understand what to do next.

Step 2:

Get organized. Here is a bullet list of key things you will want to have in place:

- An income plan – Your paycheck shuts off, where is your income going to come from?

- Expenses – What do you expect to spend in retirement?

- A tax strategy – Your tax bracket often changes in retirement; do you have a plan to pay as minimal taxes as possible?

- An investment plan – How you approach investing in retirement should look much different to when you were accumulating assets. You have a lower threshold for risk, as your investment portfolio is now an income source.

- Social Security Plan – When will you start?

- Healthcare coverage – How much will it cost? What if you retire before age 65?

- Estate and legacy Plan – Will your money go where you want it to? Will you avoid state and federal estate taxes?

Step 3: Build a Reliable Retirement Income Plan

Once the paycheck stops, your focus shifts from accumulating assets to generating income. You may have assets spread across many accounts. Creating a system for where you will generate income is paramount -- And doing so in a tax efficient manner.

Key Considerations

- Sources of Income: Identify all sources—401(k), IRAs, Costco Deferred Compensation, Social Security, pensions, and other savings.

- Consolidating your accounts to one platform is often a very helpful way to approach this.

- Withdrawal Strategy: Decide which accounts to draw from first. Generally, taxable accounts are used first, then tax-deferred accounts, and finally Roth accounts.

- One simple way to do this is to set up an automatic monthly withdrawal.

- An industry rule of thumb is to aim for <4% withdrawal rate from your portfolio each year.

- Tax Planning: Retirement can shift your tax bracket significantly. Coordinating withdrawals, Social Security, and Roth conversions can minimize overall taxes.

Example: A retiree with both a 401(k) and taxable brokerage account might withdraw from the brokerage first while letting tax-deferred accounts grow, converting some to Roth accounts gradually before RMDs begin at age 73.

Understanding Expenses

Retirement expenses often look different from working years. Many retirees spend more in the early years on travel and leisure, then see expenses level out, and later face rising healthcare costs.

An easy way to estimate expenses is to use 70%-80% of your pre-retirement income. This works as a good starting point.

- Fixed Expenses: Housing, utilities, insurance, groceries, transportation

- Variable Expenses: Travel, hobbies, dining out, gifts for family.

- Healthcare Expenses: Premiums, out-of-pocket costs, long-term care planning

- Taxes: Even in retirement, taxes remain a top expense and should be planned for alongside income

It is helpful to break expenses into two buckets:

- Essential expenses

- Discretionary expenses

It’s also important to understand what the net amount you will need each month looks like. $10k withdrawn from an IRA or 401k does not mean you get $10k in your bank account. There will be taxes withheld on your withdrawal based on your tax rate.

If your monthly expenses are budgeted out to $8k a month and you are in the 20% tax bracket, a $10k IRA withdrawal will work great. ($10k withdrawal-20% taxes= $8000 net)

Step 3: Invest for Income and Stability

Your approach to investing in retirement is different than during your accumulation years. You are now withdrawing income, which increases sensitivity to market swings. Having an investment allocation that you are comfortable with and suits your retirement goals is mission critical.

Strategies for Retirees

- Lower Risk Threshold: Most folks we see entering retirement have a heavy weighting toward stocks. This is a good time to re-evaluate the risk you feel comfortable taking and reduce if needed by introducing bonds.

- Diversification: Ensure the stock portion of your portfolio is well diversified (And not concentrated in one stock)

- Tax Efficiency: Hold income-generating assets in tax-deferred accounts where appropriate and growth-oriented assets in Roth accounts.

- Align With Goals: Your portfolio should provide predictable income streams to support your lifestyle priorities, such as travel or charitable giving.

Step 4: Social Security Planning

Social Security can be one of your most important sources of income. Planning when to claim is critical:

- Claiming Early vs. Late: Benefits can be claimed at 62, but delaying until 70 maximizes your monthly payout.

- Spousal and Survivor Benefits: Married couples should evaluate the timing of claims to maximize household benefits.

- Tax Considerations: Up to 85% of Social Security benefits can be taxable depending on income. Smart planning can minimize this.

Choosing when to take your social security is dependent on your life goals. Some people say, “I’ve been contributing to this for decades, I’d like my money as soon as possible.” This can make sense.

- Some prefer to claim early at 62 to enjoy funds during more active years.

- Others delay until 70 to lock in higher benefits for life.

Step 5: Healthcare Coverage

Healthcare is often the largest retirement expense. Costco benefits, combined with Medicare, can help you manage costs:

- Estimate Health Care Costs: If you retire before age 65 and do not have continued health insurance benefits, you will need to find a healthcare solution during that time.

- Medicare Enrollment: Sign up at 65 to avoid late penalties. Evaluate supplemental insurance options to cover gaps.

- Health Savings Accounts (HSAs): Use pre-tax contributions to cover medical expenses in retirement. After enrolling in Medicare, you can no longer contribute, but the funds continue to grow tax-free.

- Long-Term Care: Medicare does not cover extended nursing home or in-home care. Consider insurance or dedicated savings for these potential costs.

Step 6: Estate and Legacy Planning

Estate planning ensures your assets are managed according to your wishes and minimizes the burden on loved ones:

- Wills and Trusts: Keep documents updated and consider a living trust to avoid probate and maintain privacy.

- Beneficiary Designations: Ensure all accounts, including retirement and insurance, have current beneficiaries.

- Power of Attorney and Healthcare Directives: Designate trusted individuals to make financial and medical decisions if you become incapacitated.

- Gifting Strategies: Use annual gifting limits ($19,000 per recipient in 2025) to reduce estate size and pass wealth efficiently.

- Washington State Estate Tax: Planning is especially important under current estate tax rules, even for mid-sized estates.

If your estate is over $3m, you will be hit with the Washington State estate tax. Setting up a disclaimer trust can double that $3m exemption amount to $6m for married couples. Having a proper estate plan is as important as ever in retirement.

Step 8: Creating Your Retirement Checklist

Use this checklist to ensure you have covered the major aspects of retirement planning:

Financial Planning & Income

- Build a clear income plan showing which accounts to draw from first.

- Develop tax-efficient withdrawal and Roth conversion strategies.

- Maximize 401(k) contributions and employer match while still working.

- Review Deferred Compensation eligibility and strategy.

- Diversify ESPP and Costco stock holdings (Utilize NUA strategy if applicable)

Social Security & Healthcare

- Determine optimal Social Security claiming age.

- Evaluate spousal and survivor benefit strategies.

- Enroll in Medicare and review supplemental coverage.

- Maximize HSA contributions before retirement.

Investing & Risk Management

- Shift portfolio toward income stability and risk management.

- Maintain adequate diversification across asset classes.

- Align investments with personal goals and cash flow needs.

Estate & Legacy

- Update wills, trusts, and beneficiary designations.

- Establish powers of attorney and healthcare directives.

- Review Washington estate tax exposure and gifting strategies.

Lifestyle Planning

- Define personal goals: travel, volunteering, hobbies, family time.

- Align retirement budget with your intended lifestyle.

- Consider phased retirement or part-time work if desired.

Conclusion

Retirement is a personal journey, and the choices you make today will shape your experience for decades to come. By combining a thoughtful review of your goals with careful planning of income, taxes, investments, Social Security, healthcare, and estate matters, Costco professionals can retire with confidence.

Taking the time to understand both your goals and financials ensures that retirement is not just a financial milestone but a fulfilling next chapter in your life.

Trey Gevers CFP®

Financial Advisor & Partner

Phone: 425-902-4840

Email:tgevers@geverswealth.com

5825 221st Pl SE

Suite 102

Issaquah, WA 98027

geverswealth.com

All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Wealth Services, LLC, nor any of its representatives may give legal or tax advice.