Team & Technology Updates

Spring 2022

We are constantly trying to improve our game here at the firm. This is what our folks are up to.

Garrett Grigas (Financial Advisor): Is as obsessed with finance as almost anyone I have ever met (even me!)

He is constantly reading and researching for his own intellectual curiosity, and to become a better advisor for our clients. Garrett holds the CFA designation, and now has years of experience here. He is leading our portfolio design, implementation, and research, and he and I are sharing duties on client planning and review meetings.

On a personal level, Garrett is a road warrior and loves to travel. He and the team just came back from a long work from home experiment in Tulum Mexico. It was quite fun for them and proved to be productive from a work perspective. The group is already planning their next remote work location. Garrett is also a monster in the gym. The team often lift weights together after work, and he has led us in some unusually painful sets!

Trey Gevers (Financial Advisor): Also a member of the “unusually obsessed with finance” club. Trey passed his Series 7 & 66 certifications last year and is currently immersed in the CFP program. Trey is responsible for income tax analysis reviews for clients, runs our retirement analysis software projections, and portfolio analysis. You will also see him helping in client meetings with Garrett and myself. He is growing rapidly in financial knowledge and experience. It probably helps that he opened his first investment account in grade school and grew up in a family where finance was a popular topic.

During his free time Trey looks for adventure. He and his sister climbed Mount Kilimanjaro last summer, did a 25-mile one day thru-hike of the Enchantments, and is planning to run a marathon this year. He is also an avid poker player, snowboarder, and drone pilot. He is all gas no brakes.

Gabrielle Gevers (Client Services Associate): Finished her master’s degree last spring Summa Cum Laude. She joined us full-time right after graduation, but also has been working here on and off all through school.

You have may have talked to her often as she is handling charitable gifts, tax questions, 529 plan funding, and many other functions. She is deeply involved in operations and is helping to run things more efficiently and smoothly and has also been helping us revise and update our systems to comply with new federal rules and regulations. Gabrielle will also be very involved in our technology update. (See notes below.) She is also arguably the nicest and sweetest person in the office ?

Outside of work Gabrielle has eclectic interests. Climbing Mount Kilimanjaro, diving through underwater cenote tunnels in Mexico, cooking Tanzanian food, handcrafting food and crafts, bow-hunting for elk, volunteering with a foster family, long weight workouts in the gym, and reading weighty books on theology. She is mindful, thoughtful and a fascinating person to have a conversation with.

Kristy Brown (Client Services Associate): We have missed her for some time as she had been taking care of a family member who was ill. Kristy and her husband Pat relocated to Boise a couple of years ago and are delighted with their new state. She is going to be re-joining us from time to time filling in during staff vacations, and busy periods like tax time, and year-end. We will enjoy the opportunity to work with her again!

Anna Williams (Client Services Associate): Is another of our remote team-members, as she and her husband Josh are in northern CA. She is the devoted mom of two small children, and works for us, when the kids are asleep – usually later in the day! Anna is very gifted at math and with processes and numbers and has a wealth of operational experience in investment management. We are grateful for her work and talent as she juggles the responsibilities of a growing family.

Barbara Stocking (Bookkeeper): Is instrumental and essential with our bookkeeping, finances, and administration, and we are very grateful for her attention to detail, accuracy, and great work. Barbara is also an interesting person! Former bike racer and collegiate swimmer, nowadays she and her husband enjoy traveling and riding their e-bikes ?

Willy Gevers (Financial Advisor): I spent much of last year taking a program through the Yale University School of Management Executive Education focusing on tax and wealth management issues for high-net-worth families. Super interesting but I must admit that I’m very happy to have more free time this year, as lost a lot of weekends and evenings to class and studying!

I’ll be focusing more of my planning time helping our clients with stock option, restricted stock, and single stock planning issues, and estate tax planning strategies.

I’m also trying my best to keep up with the rest of team in the gym! We have some fitness goals we are trying to achieve this year; “Bring Sally Up” pushups challenge, The Murph Challenge (https://themurphchallenge.com/pages/the-workout) and my lovely wife and our Executive VP Vivienne and I are planning another weeklong backpack trip on the Pacific Crest Trail this summer.

It is a pleasure and joy to work with such an incredible group of dedicated, smart and interesting people, and we are all focused on diligently serving you, and remain completely committed to helping you reach your goals.

Technology Update

Increasing and improving operational efficiency is very important to us, and we are continually looking for ways to improve. We have implemented several new things over the last few years, including our relationship with Envestnet and their best-in-class trading platform.

The next update and enhancement for us is to take better advantage of the technology stack that we have available to us through Cetera Advisors Network, LLC (our long-time broker/dealer.) They are a national firm with considerably more resources than we have and have built out a tech platform that should allow us to enjoy much greater operational efficiency and allow us to serve our clients more promptly and effectively. We plan to start this project soon and be fully implemented this year.

Our clients will notice very little change. We will assign a new account number for your Pershing custodial accounts, and you may have a new log-in for online access. We will continue to use our current trading platform but will also have access to Cetera’s technology as well.

We will follow-up with all our clients over the next several months with paperwork for DocuSign signature. We will also use this as an opportunity to update our risk review of your current portfolio, which may be timely given the current economic environment.

The outcome of this change is that our team will have access to additional automated tools that allow us to set up new accounts, process distributions, transfer, and deposit money, make charitable gifts and many other important functions. Cetera will also provide additional funding to us because of this, which we plan to use to re-invest back into our team and into our company.

It will also allow us to in many cases to eliminate some back-office service calls to service people and allow our team to directly implement our client’s request. Perhaps you have noticed problems with the labor shortages – over the last year we have frequently experienced hold times of up to an hour before reaching an actual service person. We hope to eliminate some of this frustration and impediment by utilizing some of the automation through this improvement in our technology. Bottom Line – we are hoping to serve you better.

“The biggest room in the world, is the room for improvement.”

– Helmut Schmidt

We look forward to our next meeting, and as always please contact us if you have any questions or we can help in any way.

Happy Spring!

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2022 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him."

- Dwight D. Eisenhower

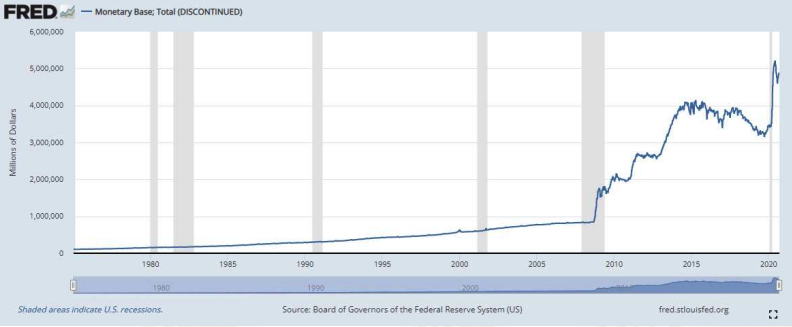

US Money Supply –Monetary Base

(https://fred.stlouisfed.org/series/BOGMBASEW)

US Dollar Price – (DXY) USD Index measured against other currencies

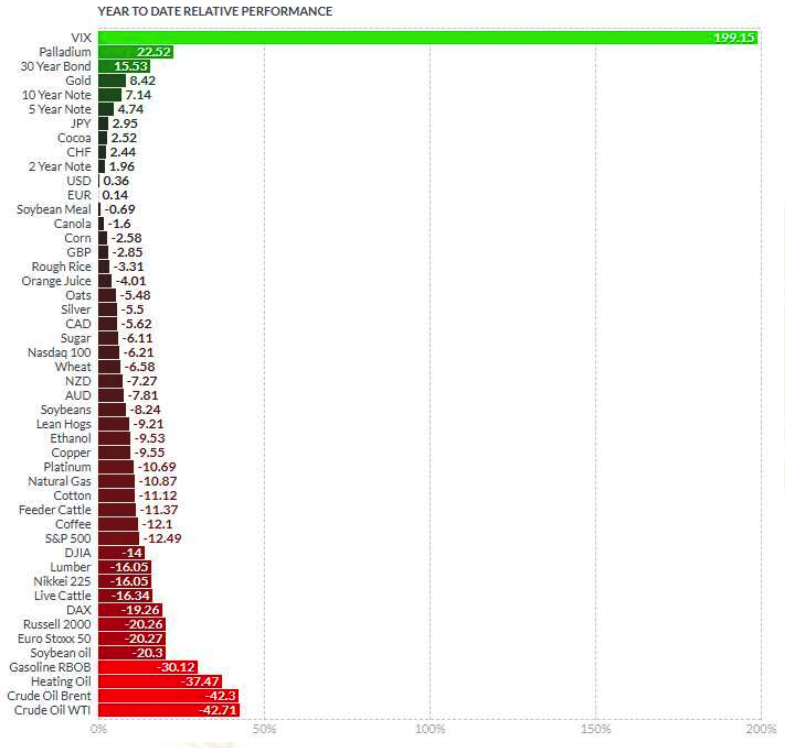

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

Debt

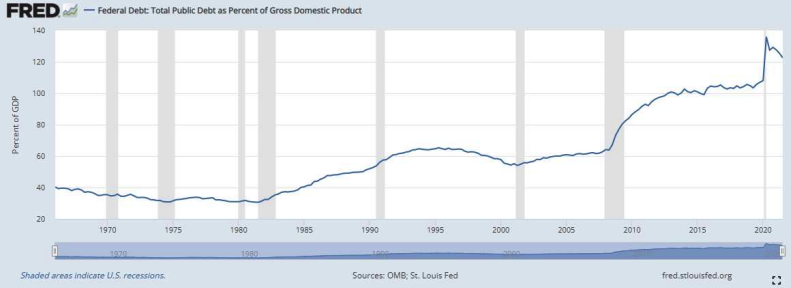

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

- Paul

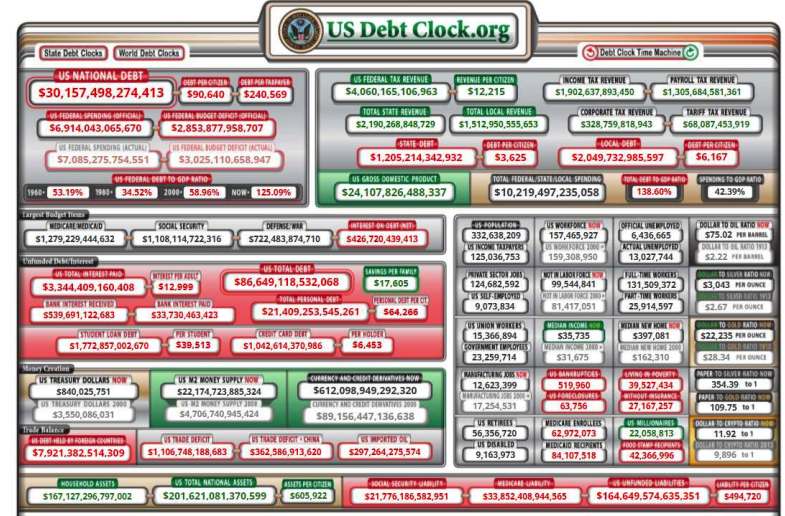

Total US Debt

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

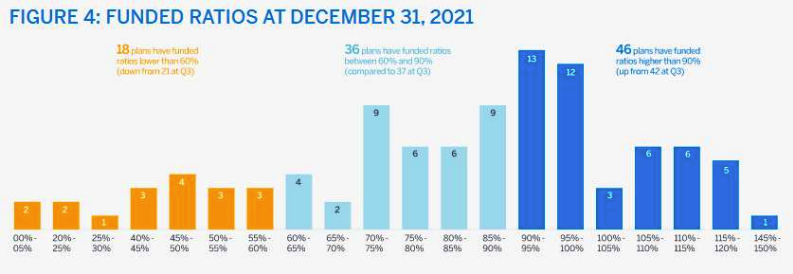

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

http://www.milliman.com/ppfi/

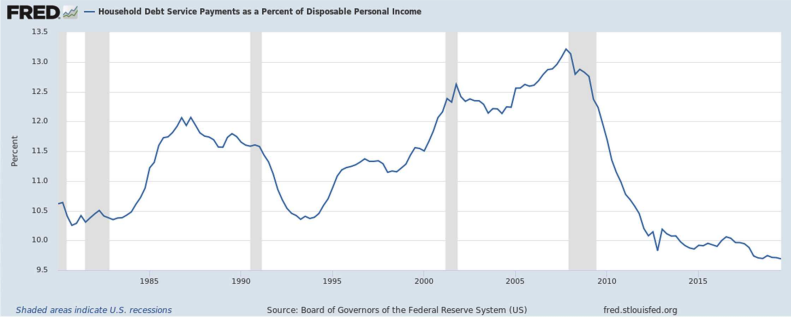

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)

https://fred.stlouisfed.org/series/TDSP

https://www.thinkadvisor.com/2022/02/16/ed-slotts-tax-season-game-plan-for-advisors/ https://www.thinkadvisor.com/2021/12/22/prep-your-clients-for-2-bills-that-could-change-iras-in-2022-ed-slott/