It’s Almost Tax Time… Powerful Tax Strategies for 2024

2024 is a significant year for tax planning and tax code changes. There are many new regulations, and drastic tax increases scheduled for the near future. This is a very important year for tax strategies and now is the time to prepare to optimize and reduce your personal tax costs.

What are smart tax planning moves to consider with all these changes?

Let’s review; Income Tax Rate increases with the upcoming sunset of the TCJA Act., Estate Tax Rate increases also because of the sunset of TCJA, Strategies for Capital Gains liability using a custom Personal Index portfolio with robust tax-loss harvesting, and new opportunities in SECURE ACT 2.0.

Upcoming Income Tax Rate Increase

The Tax Cut & Jobs Act of 2017 (TJCA) famously lowered the federal income tax rates and also doubled the standard deduction resulting in significant tax cuts for many taxpayers. Unfortunately, the TJCA will sunset at the end of 2025, and in 2026 the personal tax tables will revert to the higher rates and lower deduction we suffered from prior to TJCA. Nationally famous tax planner Ed Slott, CPA has stated that Roth IRA conversions will be especially attractive for many people before 2026, at the lower income tax rates under TJCA. High income taxpayers should be reviewing partial Roth IRA conversions, marginal tax bracket planning and timing of income events, optimizing your qualified accounts, and how you are positioning taxable assets in your various investment accounts. At our firm, we often analyze our client’s tax returns in our planning software and look for areas of potential savings or improvements, and then we work in tandem with their CPAs to help accomplish that. We love to help our clients save taxes 😊

Upcoming Estate Tax Rate Increase

When TJCA expires, estate tax rates & exemptions will also change dramatically for the worse. Under today’s rules, a married couple may pass up to $13.61M each to their children without federal estate tax. After 2025 that amount will change significantly, and some legal analysts have suggested that it might be reduced to as low as 5M or even less, depending on how Congress acts, if at all. Whatever the final exemption amount is – the important point is that any difference between the current higher exemption amounts and the post-2025 reduced amounts will be lost if not used.

If you have enjoyed financial success and own lots of financial assets, you should be strategizing NOW before estate tax rates increase. We are talking to our clients about strategies including: utilizing the lifetime exemption via larger gifts, Spousal Lifetime Access Trusts (SLAT), Grantor Retained Income Trusts (GRIT/GRAT), Qualified Personal Residence Trusts for vacation homes (QPRT), Gifts of appreciated stock and often a general review & update of their estate documents. The news gets even worse as Washington State adds an extra estate tax on amounts in excess of $2.193M per person, and that may be in addition to any federal estate tax. If you have not done wise planning, the state of WA and the federal government might end up taking a lot of your life’s work after you are gone – instead of it going to your family.

Personal Index Portfolio + Tax-Loss Harvesting

A powerful tax-saving strategy for high income investors is a personal custom index portfolio with robust tax loss harvesting. This is a strategy that we have been using for many years for investors. It is quite effective both as a means to maximize the harvesting of losses which can be used to offset your tax bill AND as a tax-efficient investment strategy for non-IRA money. Taxpayers can review Schedule D on their return to see how bad the tax costs are of your current investment portfolio. If you are paying lots of capital gains tax based on the totals on your Schedule D, then you may benefit from a personal index portfolio strategy. Additionally, if you have a big capital gain event in your future – sale of a business, valuable real estate, or maybe company stock – you should take a look at the simple and highly effective personal index portfolio as a powerful tax saving investment strategy.

SECURE ACT 2.0 – New Opportunities

SECURE ACT 2.0, which Congress passed over a year ago, includes several new provisions and rules that may be very helpful for some taxpayers. There are too many to list here as the ACT includes about 100 separate changes to the tax code for individual, married and small business owners. I wrote about some of those changes last year. (https://www.geverswealth.com/blog-01/its-almost-tax-time-100-tax-changes-coming-are-you-prepared) It would be smart to review these changes and see if you can take advantage of any of them for yourself!

We can review any or all of these strategies and tax law changes at your next review meeting, or please feel free to call us if you have questions before your next scheduled review. Our whole team gets excited about finding ways to help our clients become better off! We keep our schedule flexible during tax season so we can be available to help our clients and their CPA’s. Please feel free to reach out to us if we can help in any way with your 2023 tax return preparation. And speaking of your tax return, let’s review what you might need.

What will You Need to Prepare Your Taxes this Year?

Here are a few of the items that you might require from your investment accounts, and where and how you can find them.

IRA (and other qualified) accounts:

- Distributions: If you took a distribution last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give it to your CPA/accountant for preparation of your tax return. If you are a seasoned investor, please remember that the new age (starting in 2023) for your RMD is age 73. (it was formerly 72 and will eventually increase to age 75.)

- Rollover or Transfer: If you did a rollover or transfer last year, this is typically a non-taxable event. The surrendering custodian, i.e., the place where the money was transferred or rolled over from, will send you a form indicating the amount. You should receive this in the mail in February. Please retain this form and give it to your CPA/accountant for preparation of your tax return.

- Sales, Reinvestments, Purchases, or other Re-allocations: These are typically not taxable events inside a tax-deferred account like an IRA, and you may not need or receive any tax documents regarding these.

- Roth Conversion: If you did a Roth Conversion last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give it to your CPA/accountant for preparation of your tax return.

- IRA or Roth IRA Contribution: If you made a contribution, the IRA custodian will send you a form indicating the amount and tax year the contribution was credited for. You should receive this in the mail in February. Please retain this form and give it to your CPA/accountant for preparation of your tax return.

Non-IRA/Taxable Accounts:

If you had interest or dividend income, you will receive a 1099 from the custodian in February. Please retain this form and give it to your CPA for preparation of your tax return.

If you sold securities during the last year, you may need a Realized Gains/Losses Report:

1. If you have an advisory (fee) relationship with us, you will automatically receive a realized gain/loss report for those accounts in the mail in February. Please retain this form and give it to your CPA for preparation of your tax return. If you are on e-delivery for your statements, you can also access these reports through your dedicated web access.

2. If you have a brokerage (non-advisory) account with us at Pershing, then you will receive a realized gain/loss report directly from the custodian for any sales you may have made during the course of last year. You should receive these reports by late February. If you are on e-delivery for your statements, you can also access these reports through your dedicated web access.

(If you have an investment made many years ago, cost basis may need to be manually input. Although we will make every attempt to help document estimated cost basis, sometimes that information is not available or incomplete, especially for investments made years ago, when investment tracking software was not always as robust as current technology. Your CPA may be able to help you with lost/missing cost basis documentation.)

3. If you have an investment held direct at a mutual fund, the fund company will prepare and mail you a realized gain/loss report for those accounts in February. Please retain this form and give it to your CPA for preparation of your tax return.

4. K-1: Some investments may send you a K-1. Please see your CPA/accountant regarding proper filing of these. Please note that the investment manager will typically send K-1s to all investors regardless of what kind of investor type they are. If you receive a K-1 for an investment that you own inside a tax-deferred account like an IRA, you may not have to file that K-1 with your tax return because of the tax-deferred nature of the IRA. Professional advice from your tax-preparer is important here.

Trust Accounts

Trust accounts typically require the same information as Non-IRA/Taxable Accounts (please see above.) There may be additional reporting necessary to complete a tax return for a trust depending on the nature of that trust. We will work with your CPA to help provide any information or reports that may be required.

“The Internal Revenue Code is about 10 times the size of the Bible – and unlike the Bible, contains no good news.” - Don Rickles

Potential Delays of 1099s & Delays at the Internal Revenue Service:

Timely delivery of 1099s has been an ongoing problem in the custodian world. Investment custodians have sometimes struggled to meet their mailing deadlines for 1099s and sometimes even file an appeal to extend their filing date. This is especially challenging for the custodians in years which Congress passes last minute tax bills. Watch for your 1099 from Pershing in February – but don’t be surprised if it is a few days late. Custodians like Pershing have sometimes filed amended or corrected 1099s after sending the original 1099. We will also receive electronic copies of your 1099s in our office.

The IRS has struggled greatly the last several years and has been woefully understaffed because of the widespread labor shortage. At the beginning of 2022 they reportedly had over 6 million unprocessed returns. According to IRS commissioner Doug O’Donnell the IRS has “trained thousands of new employees to answer phones and help people. While much work remains after several difficult years, we expect people to experience improvements this tax season." We all hope that he is right – but based on what’s happened the last few years, I would encourage you to exercise patience!

Additionally, prominent CPA Ed Slott is on record as saying, “Review Form 1099s, as they can be rife with errors. We’re finding there are lots of mistakes in there — maybe some of these institutions were short-staffed or people were working from home …, he explained. “You type the wrong code into a 1099-R for retirement distributions, it can make the difference as to whether something is taxable or not or subject to a penalty.” I would note that we have seen errors in coding Qualified Charitable Distributions (QCD’s) on clients’ tax returns over the last several years. You may want to ask your CPA to double-check QCD status on your 2023 return (if you made a QCD last year.)

Contributions to IRAs/Roth IRAs:

If you are eligible and want to make a contribution for 2023, you have until April 15th (but please do not wait that long!) or when you file your tax return to make a contribution. Please call us if you need help with this. A note for 2024; the contribution limit for taxpayers has increased and is now $7000 per year, or $8000 if you are over 50.

“Worried about an IRS audit? Avoid what’s called a “Red Flag.” That’s something the IRS always looks for. For example, say you have some money left in your bank account after paying taxes. That’s a Red Flag!” - Jay Leno

Our whole team is ready to help you and your CPA with your 2023 tax preparation, and of course please feel free to call us if we can help in any way.

Help for those just Starting Out

My wife and I have been teaching classes at our church about the principles of personal finance, and we have also been meeting individually with some younger families to provide some advice and encouragement as they start their journey with money through life. It has been a privilege, and we really enjoy this. If you have kids just starting their financial lives and need some help with financial basics, please let me know.

Humor for my CPA Friends

I really feel for my CPA friends – this is a grueling season filled with long hours and looming deadlines. I spent my first year at UW Foster School of Business in the school of Accounting, so I have an extra level of empathy for my tax professional friends and colleagues!

When April 15th has passed, a shopping trip could be a nice reprieve… and of course you know a CPA’s favorite place to shop?

The GAAP

And, why did the CPA keep falling over?

She could not find her Balance Sheet.

Do you know why CPA’s self-esteem is always so low?

They never give themselves enough Credit.

Why did the CPA throw his wallet into the river?

He wanted to see the Cash Flow.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

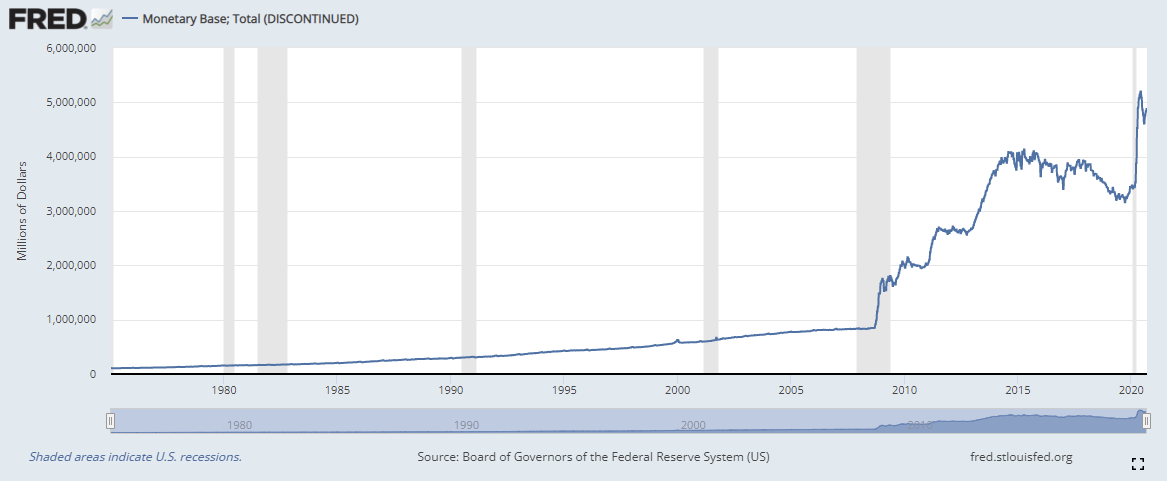

US Money Supply –Monetary Base

US Dollar Price – (DXY) USD Index measured against other currencies.

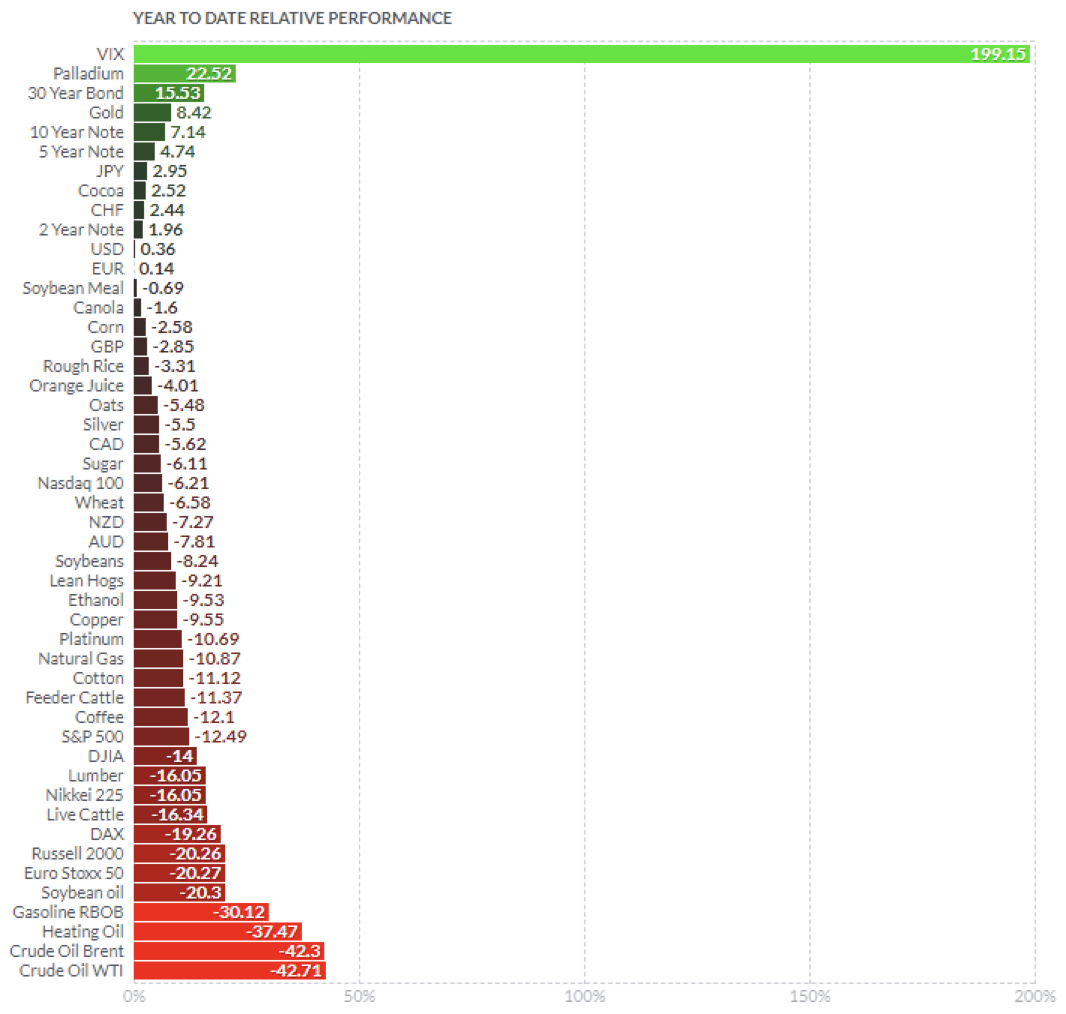

Inflation/Deflation: Year to Date price change in commodities as measured by futures.

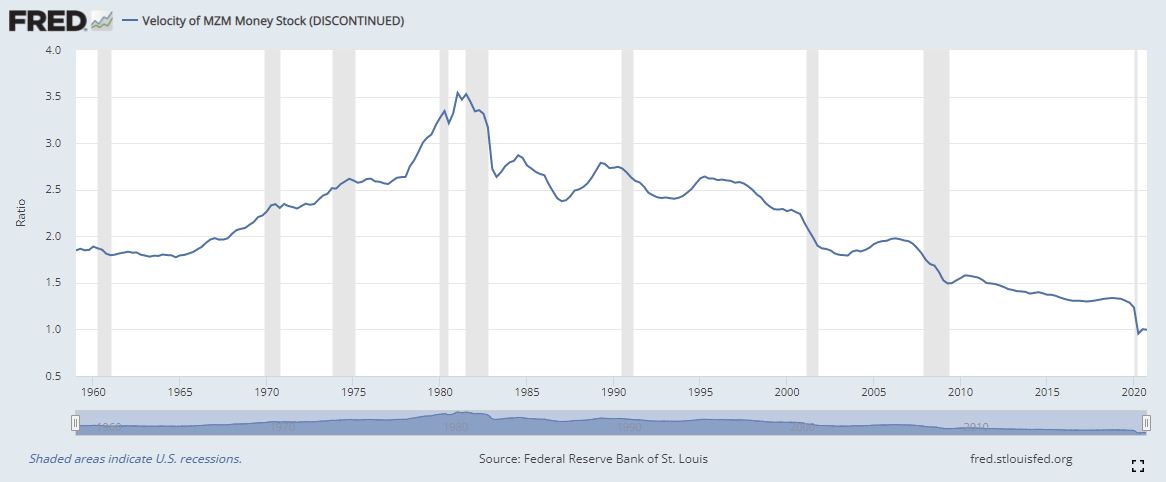

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

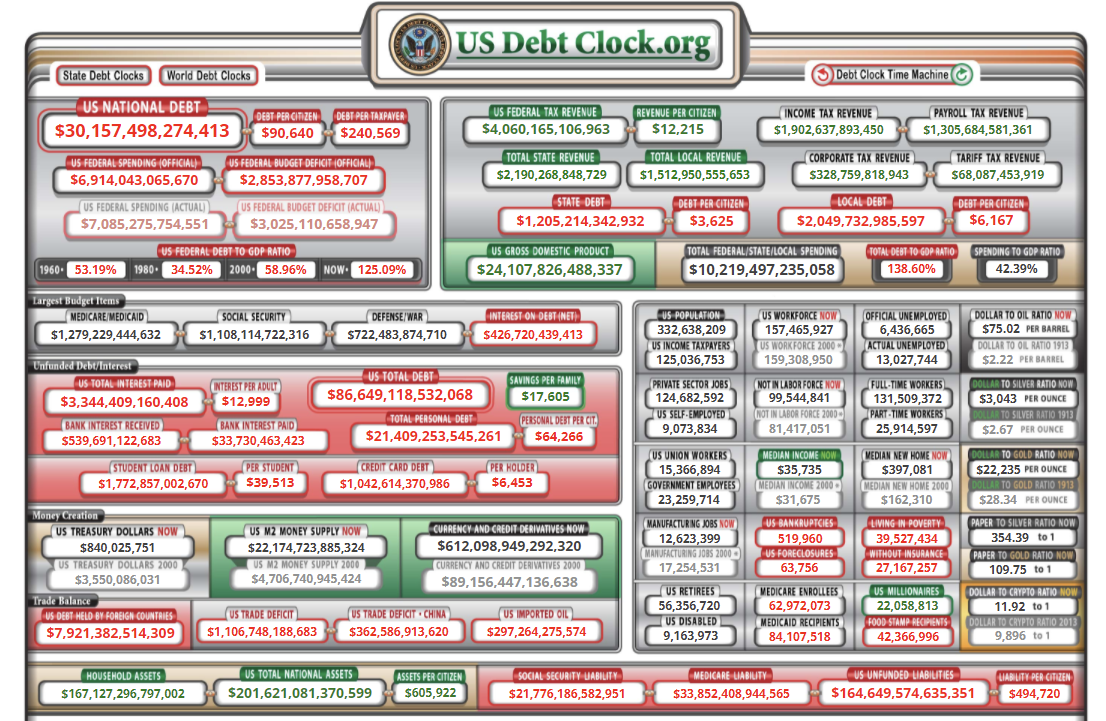

Debt

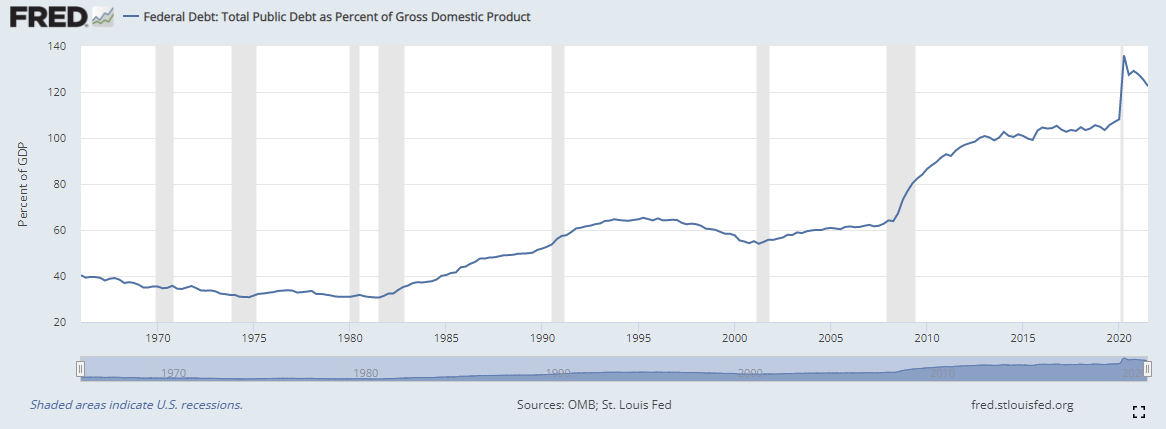

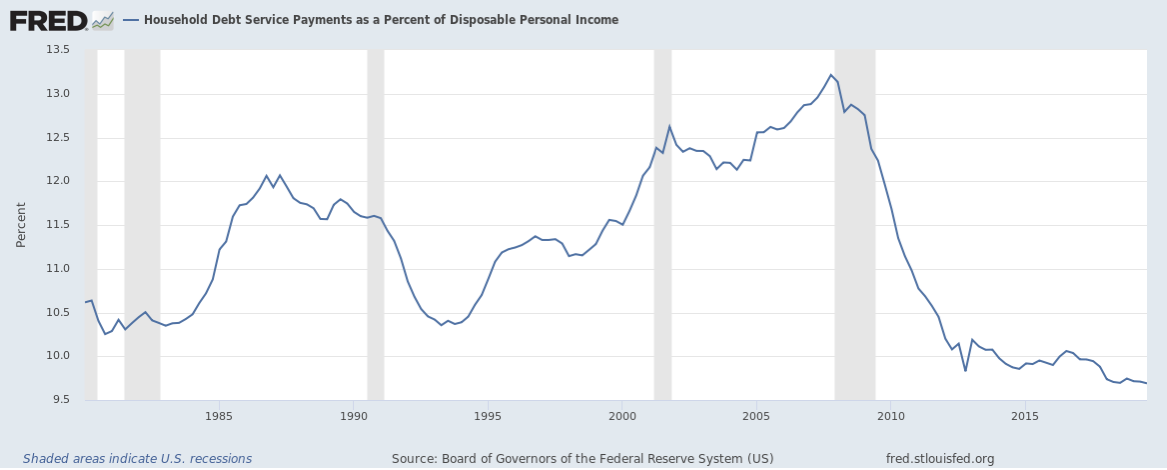

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.