It’s Almost Tax Time… 100 Tax Changes Coming, are you Prepared?

Winter 2023

Congress just passed SECURE Act 2.0 which includes about a hundred changes and additions to the tax code. Which if those changes might impact you? What are smart tax planning moves to consider with the new rules? Let’s try and answer those questions, but first since it is getting close to April…

What will you need to prepare your taxes this year? Here are a few of the items that you might require from your investment accounts, and where and how you can find them.

IRA (and other qualified) accounts:

-

Distributions: If you took a distribution last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return. If you are a seasoned investor, please remember that the new age (starting in 2023) for your RMD is age 73 (it was formerly 72, and see the comments about the new changes below.)

-

Rollover or Transfer: If you did a rollover or transfer last year, this is typically a non-taxable event. The surrendering custodian, i.e., the place where the money was transferred or rolled over from, will send you a form indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return.

-

Sales, Reinvestments, Purchases, or other Re-allocations: These are typically not taxable events inside a tax-deferred account like an IRA, and you may not need or receive any tax documents regarding these.

-

Roth Conversion: If you did a Roth Conversion last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return. We helped clients implement many Roth conversions in 2022 because of the depressed stock and bond markets

-

IRA or Roth IRA Contribution: If you made a contribution, the IRA custodian will send you a form indicating the amount and tax year the contribution was credited for. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return.

Non-IRA/Taxable Accounts:

If you had interest or dividend income, you will receive a 1099 from the custodian in February. Please retain this form and give to your CPA for preparation of your tax return.

If you sold securities during the last year, you may need a Realized Gains/Losses Report:

- If you have an advisory (fee) relationship with us, you will automatically receive a realized gain/loss report for those accounts in the mail in February. Please retain this form and give to your CPA for preparation of your tax return. If you are on e-delivery for your statements, you can also access these reports through your dedicated web access.

- If you have a brokerage (non-advisory) account with us at Pershing, then you will receive a realized gain/loss report directly from the custodian for any sales you may have made during the course of last year. You should receive these reports by late February (but see my notes on Internal Revenue delays below!) If you are on e-delivery for your statements, you can also access these reports through your dedicated web access.

(If you have an investment made many years ago, cost basis may need to be manually input. Although we will make every attempt to help document estimated cost basis, sometimes that information is not available or incomplete, especially for investments made years ago, when investment tracking software was not always as robust as current technology. Your CPA may be able to help you with lost/missing cost basis documentation.)

- If you have an investment held direct at a mutual fund, the fund company will prepare and mail you a realized gain/loss report for those accounts in February. Please retain this form and give to your CPA for preparation of your tax return.

- K-1: Some investments may send you a K-1. Please see your CPA/accountant regarding proper filing of these. Please note that the investment manager will typically send K-1s to all investors regardless of what kind of investor type they are. If you receive a K-1 for an investment that you own inside a tax-deferred account like an IRA, you may not have to file that K-1 with your tax return because of the tax-deferred nature of the IRA. Professional advice from your tax-preparer is important here.

Trust Accounts

Trust accounts typically require the same information as Non-IRA/Taxable Accounts (please see above.) There may be additional reporting necessary to complete a tax return for a trust depending on the nature of that trust. We will work with your CPA to help provide any information or reports that may be required.

“The Internal Revenue Code is about 10 times the size of the Bible – and unlike the Bible, contains no good news.”

- Don Rickles

Potential Delays of 1099s & Delays at the Internal Revenue Service:

Timely delivery of 1099s has been an ongoing problem in the custodian world. Investment custodians have sometimes struggled to meet their mailing deadlines for 1099s and sometimes even file an appeal to extend their filing date. This is especially challenging for the custodians in years which Congress passes last minute tax bills (like they did this December!) Watch for your 1099 from Pershing in February – but don’t be surprised if it is a few days late. Custodians like Pershing have sometimes filed amended or corrected 1099s after sending the original 1099. We will also receive electronic copies of your 1099s in our office.

The IRS has struggled greatly the last several years and has been woefully understaffed because of the widespread labor shortage. At the beginning of last year they had over 6 million unprocessed returns. According to IRS commissioner Doug O’Donnell the IRS has “trained thousands of new employees to answer phones and help people. While much work remains after several difficult years, we expect people to experience improvements this tax season." We all hope that he is right – but based on what’s happened the last few years, I would encourage you to exercise patience!

Additionally, prominent CPA Ed Slott is on record as saying, “Review Form 1099s, as they can be rife with errors. We’re finding there are lots of mistakes in there — maybe some of these institutions were short-staffed or people were working from home …, he explained. “You type the wrong code into a 1099-R for retirement distributions, it can make the difference as to whether something is taxable or not or subject to a penalty. Due to COVID-19 we are seeing more mistakes on the 1099s this year.”

I would note that we have seen errors in coding Qualified Charitable Distributions (QCD’s) on client’s tax returns over the last several years. You may want to ask your CPA to double-check QCD status on your 2022 return (if you made a QCD last year.)

Contributions to IRAs/Roth IRAs:

If you are eligible and want to make a contribution for 2022, you have until April 18th (but please do not wait that long!) or when you file your tax return to make a contribution. Please call us if you need help with this. A note for 2023; the contribution limit for taxpayers has increased and is now $6,500 per year, or $7,500 if you are over 50.

“Worried about an IRS audit? Avoid what’s called a “Red Flag.” That’s something the IRS always looks for. For example, say you have some money left in your bank account after paying taxes. That’s a Red Flag!”

- Jay Leno

Our whole team is ready to help you and your CPA with your 2022 tax preparation, and of course please feel free to call us if we can help in any way.

SECURE ACT 2.0 – 100 New Changes!

We like learning about new tax strategies!

Our advisor team spent the first days of the new year studying the new tax law changes – the smiles on our faces are because we really enjoy this ? Saving our clients taxes is a big thrill in our world!

Did you know that there are about 100 new regs and revisions in the tax code that Congress just passed?! I can’t remember a year in my career that there have been so many changes. We are particularly interested in the ones that our high-income executive clients, both post-career and still working, might be able to take advantage of.

Here are just some of the tax-law changes that we are most interested in:

1. RMD age increased to 73. (Longer Roth conversion window for large IRA owners)

2. RMD start date waived for 2023 (Hooray if you turn 73 this year!)

3. 529 to Roth conversions!

4. Younger IRA owner can act as decedent. (Potentially significant for marriages with wide disparity in age.)

5. IRA catch-up contributions increased.

6. 401k catch-up contributions, extra increase for those 60-63 (only) “Rothification” if high income.

7. QCD - One time privilege to move $50k to a split-interest gift (Non-profits are cheering)

8. Early withdrawal allowed from qualified plan if 25+ yrs. of service. No 10% penalty. (Early tech retirees and FIRE are cheering!)

9. No w/d penalty for terminal illness (now 7 years)

10. No w/d penalty for domestic violence.(starts in 2024. Subject to $ or half of plan balance.)

11. Qualified LTC distribution to pay LTC premiums.

12. Relaxation of 72t rules. (Early retirees are cheering)

13. ESA starting in 2024. Auto enrolled up to 3% of comp. HCE not eligible. Max $2500 but treated like Roth distributions. If >$2500 employer can transfer into the 401k

14. RMD penalty reduced to 25%. 10% if fixed on timely basis. Effective now. EPCRS to waive penalty altogether.

15. New 401k/DB/DC set up this year, but can still fund for last year! (Great for Self Employed!)

16. QLAC increased to $200k. No 25% limitation

17. Retirement Account annuities - relaxation of tax regs. ETF based annuities allowed.

18. ABLE expanded to Age 46. (Disabled and developmentally disabled.)

19. SIMPLE contributions increased. Small Employers (typically less than 25 employees) additional contributions of 10% comp or $5k. Contribution limits and catch-ups increased by 10%.

20. Employers match student loan payments (If plan allows)

21. All 401k plans required to offer auto-enroll (with some exceptions) starting 2024

22. HH employees eligible for SEP IRA (Bless the people that work at your home)

23. Starter 401k plans (Easier plan set up for small businesses.)

24. Relaxation of rules for 10b5-1 stock sale plans (Restricted stock owners and company stock holders cheer!)

But No Changes In: Back- Door Roth IRA or Roth Conversions.

We follow and read several tax attorneys and tax specialists, and as tax law changes, we try to stay on top of that, as well as any strategies to try and mitigate or avoid new or higher taxes. We can review these changes with you at our review meetings and this may be an important part of our meeting agenda with you for this year.

Reducing and or/avoiding taxes becomes increasingly more valuable and significant the higher tax rates are, and the more complex the tax code becomes. We work closely with our client’s CPAs to try identify and implement strategies to lessen tax burdens.

We frequently help our clients analyze and implement tax-efficient portfolio distribution strategies, tax-loss harvesting and tax-efficient portfolios, Roth conversions, optimization of company Qualified and non-Qualified plans, and Medicare Means threshold planning. We also are familiar with using trusts in tandem with income tax strategies, with charitable tax strategies, both current and deferred, and with stock options and timing and selling and exercise strategies – again all with the goal of reducing or avoiding taxes.

And, our whole team gets excited about finding ways to help our clients become better off!

We keep our schedule flexible during tax season so we can be available to help our clients and their CPA’s. Please feel free to reach out to us if we can help in any way with your 2022 tax return preparation.

We look forward to seeing you soon for your next review meeting.

Learning About Taxes for the First Time…

My wife and I have been teaching classes at our church about the principles of personal finance, and we have also been meeting individually with some younger families to provide some advice and encouragement as they start their journey with money through life. It has been a privilege, and we really enjoy this.

Saw this video about a young woman learning about taxes. Thought it might bring some levity to our otherwise serious tax newsletter!

https://twitter.com/yvtweets/status/1482477560483270665?s=20

Warm regards,

Willy Gevers

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

US Money Supply –Monetary Base

(https://fred.stlouisfed.org/series/BOGMBASEW)

US Dollar Price – (DXY) USD Index measured against other currencies

(http://www.barchart.com/chart.php?sym=DXY00&style=technical&template=&p=MC&d=X&sd=&ed=06%2F11%2F2015&size=M&log=0&t=LINE&v=0&g=1&evnt=1&late=1&o1=&o2=&o3=&sh=100&indicators=&addindicator=&submitted=1&fpage=&txtDate=06%2F11%2F2015#jump)

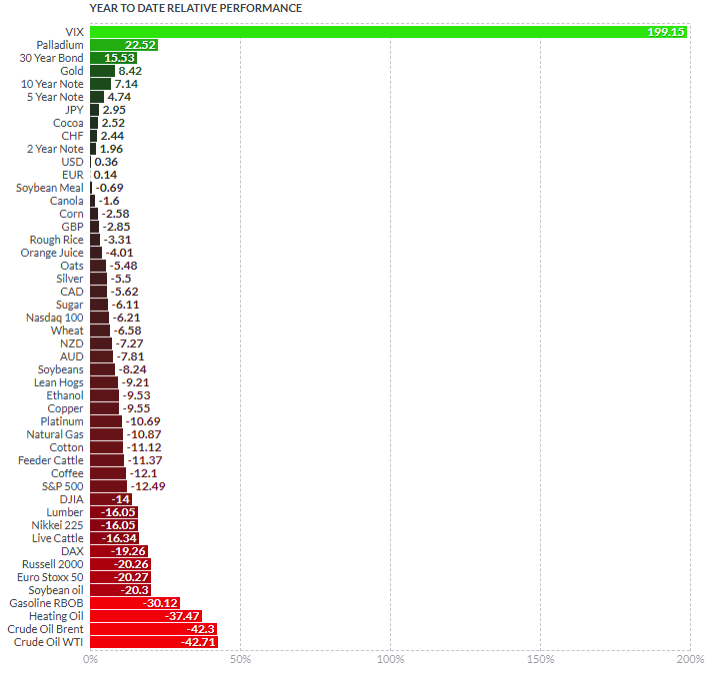

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

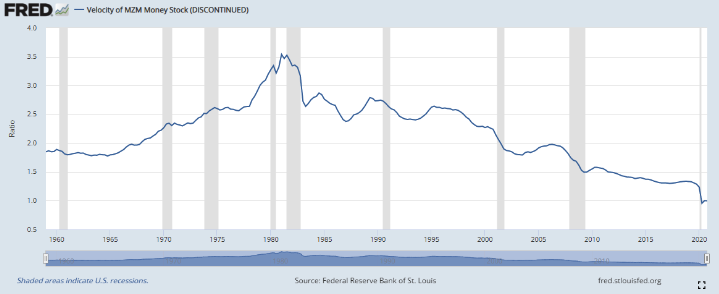

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.” - Paul

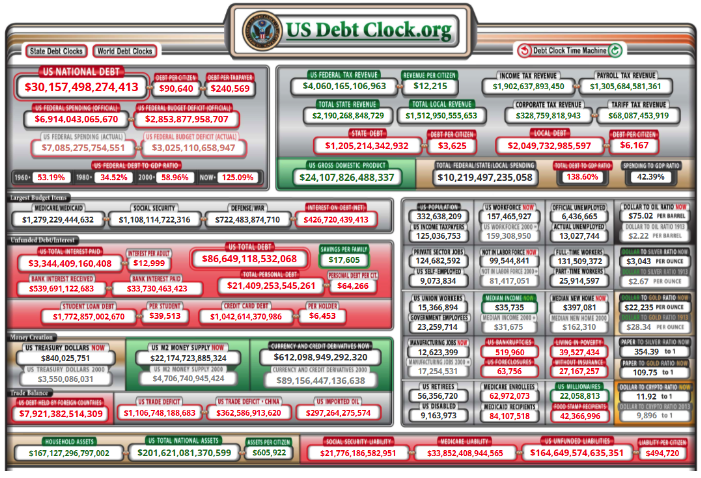

Total US Debt

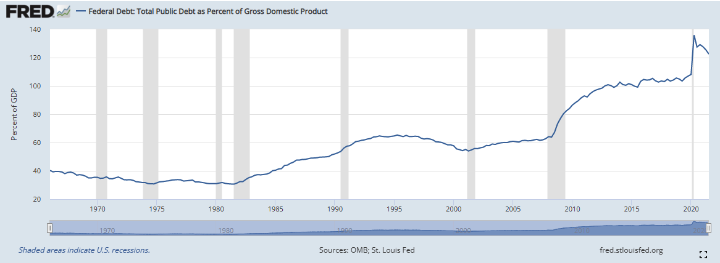

US Debt to GDP Ratio

(Note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy.) https://fred.stlouisfed.org/series/GFDEGDQ188S )

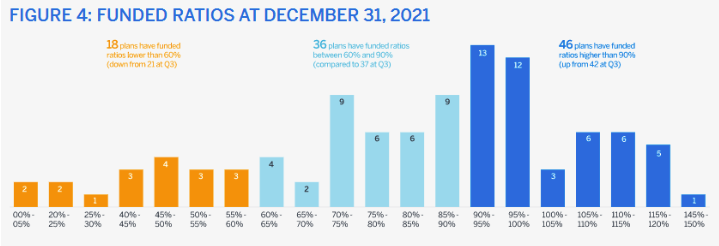

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

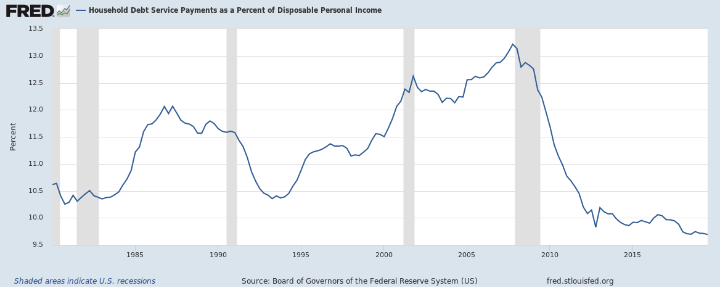

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.) https://fred.stlouisfed.org/series/TDSP

https://www.thinkadvisor.com/2022/02/16/ed-slotts-tax-season-game-plan-for-advisors/

https://www.thinkadvisor.com/2021/12/22/prep-your-clients-for-2-bills-that-could-change-iras-in-2022-ed-slott/