2025 Tax Changes and Good Music

2025 Tax Changes and Good Music

Happy Fall! We hope the 4th quarter of this year treats you well.

Our team is excited to finish out the year strong. Garrett is enjoying time with his wonderful new wife, Andrea is gearing up for her son’s first high school football season, Willy is spending some time out on the sound fishing, and Nicole and I are expecting another baby in the spring. Exciting times at Gevers Wealth!

The focus of this newsletter is to highlight the multitude of tax changes we’ve observed this year on both the federal and state level.

Tax changes can be mundane, so to make this update more exciting, I will compare each tax change to some of my favorite songs from the 60s, 70s, and 80s.

Federal Changes Under the One Big Beautiful Bill (OBBB)

On July 4, 2025, the OBBB was signed into law. These changes were strategically focused on retirees. Here’s some key changes you should be aware of.

1. Tax Cuts Made Permanent

Celebrate Good Times! – Kool and the Gang

As Kool and the Gang loves to say in their 1980 hit, let’s Celebrate Good Times! The OBBB locks in many provisions from the 2017 Tax Cuts and Jobs Act, avoiding the scheduled 2026 sunset. This includes:

- Lower individual income tax brackets

- A higher standard deduction

- Favorable capital gains thresholds

This is good news for a multitude of reasons. First off, you will continue to pay a lower overall tax rate on your income. Additionally, knowing what tax brackets will be for the time being allows us to be more precise in our planning.

Celebrate Good Times!

2. Senior Deduction

When I’m 64 (65) – The Beatles

I’m guessing Ringo Starr didn’t have tax planning on his mind when he wrote the song “When I’m 64” on the hit album Sgt. Peppers Lonely Hearts Club Band. However, if he did, he was only one year off the age of the new senior tax deduction.

Starting in 2025, individuals aged 65 (not 64) or older may claim an additional $6,000 deduction (or $12,000 for couples).

How it works:

- This is on top of the existing standard deduction

- It begins in tax year 2025

- It phases out for higher earners:

- Phase-out begins at $75,000 (single) or $150,000 (married)

- Fully phased out by $175,000 (single) or $250,000 (married)

- The deduction is temporary, expiring after 2028

3. Expanded SALT Deduction

Margaritaville – Jimmy Buffet

This one is a stretch… But I’m sure that Jimmy Buffet would agree that any good margarita is accompanied by salt on the rim.

Speaking of salt, the state and local tax (SALT) deduction cap rises from $10,000 to $40,000 for taxpayers with income under approximately $500,000. This change applies through 2029.

If you itemize, this should be a benefit to you. Property taxes aren’t going down any time soon, so you may be able to deduct more than you have in the past.

4. Charitable Giving Incentives

Give a Little Bit – Supertramp

Supertramp said it best “Give a Little Bit!”

This is especially applicable now thanks to a newly introduced change: Non-itemizers can now take a $1,000 charitable deduction ($2,000 for married couples filing jointly) in addition to the standard deduction in 2026. If you are already giving but not itemizing, this is small but helpful reduction to your taxes.

Action step: Consider accelerating or consolidating giving into 2025–2028 to maximize this benefit.

5. Higher Federal Estate and Gift Tax Exemption

Joy to the World – Three Dog Night

Three Dog Night loved joyful news. More good news here. The estate tax threshold has increased, rather than decreased as some had speculated.

Beginning in 2026, the federal exemption rises to $15 million per person ($30 million for couples), indexed for inflation. This may reduce the need for complex trust planning for many estates, however there are significant WA state estate tax changes that will be covered below.

Why is this good news? The Federal Estate tax rate is 40% for any amount over the exemption amount. The higher the exemption amount, the more buffer room we have from a costly estate tax bill passed on to your heirs.

6. Social Security Changes

A Life of Illusion – Joe Walsh

Many are “backed up against a wall of confusion” as to what the new Social Security changes mean, as Joe Walsh of the Eagles referenced in his hit song “A Life of Illusion”

Contrary to some public claims, the bill does not eliminate federal taxes on Social Security income. As described above, there is an additional $6k senior deduction that can reduce your taxable income, and in some cases, bring your provisional income below certain thresholds that would decrease the amount of your Social Security income that is taxable.

Washington State Tax Changes for 2025

1. Capital Gains Tax Increase

Higher Ground - Stevie Wonder

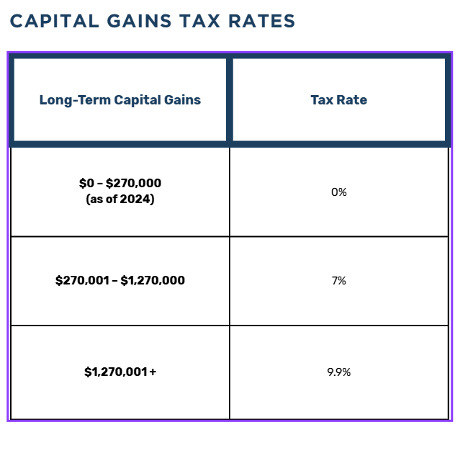

“Higher and higher” Stevie Wonder says. The same applies to the WA state capital gains tax. The original state capital gains tax was introduced in 2022. Three years later, we have already tacked on a higher rate.

The state tax on long-term capital gains above $1 million rises from 7% to 9.9%, retroactive to January 1, 2025.

Exemptions remain for:

- Real estate

- Retirement accounts (IRAs, 401(k)s)

- Sales of qualified small business stock

- Certain livestock and goodwill sales

Action step: If you are considering the sale of appreciated securities, timing and transaction structure matter more than ever.

2. Estate Tax Adjustments

You Can’t Always Get What You Want - The Rolling Stones

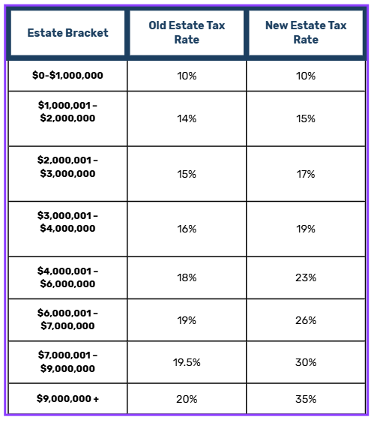

The Washington State estate tax exemption increases from roughly $2.193 million to $3 million starting July 1, 2025. At the same time, the top estate tax rate climbs from 20% to 35% for estates above approximately $9 million.

For some Washington families, this will increase the estate tax their heirs pay. However, some families “might get what they need” as the increased exemption amount could reduce or eliminate their estate tax exposure all together.

There is a break even at about $8,833,250 in gross estate value, meaning estates smaller than that generally pay less under the new law because of the higher $3,000,000 exclusion, estates larger than that generally pay more because the new marginal rates climb much higher for big estates.

Action step: Even with the higher exemption, larger estates may still face significant state-level tax. We can review gifting strategies or charitable tools to manage exposure.

Our Key Planning Takeaways

- We’re reviewing 2025 tax withholdings to capture the new senior deduction and potential removal of federal tax on Social Security benefits.

- We’re reassessing whether itemizing or taking the standard deduction makes more sense given the larger SALT deduction and new charitable giving incentives.

- We’re updating estate plans to reflect both the new federal and Washington state estate tax rules.

- We’re planning large asset sales strategically to help limit exposure to Washington’s higher capital gains tax rate.

- We’re monitoring eligibility for state property tax relief programs that could benefit clients.

Closing Thoughts

The tax code seems to change every year. The good news is the core financial planning principles we follow remain unchanged.

If you’d like to review any of these changes, please feel free to schedule a meeting with our team.

Lastly, one of the benefits of working with us is that we’re always happy to meet with your friends and family. If someone you care about could use guidance on their finances, feel free to send them our way—we’d love to help!

Trey Gevers CFP®

Financial Advisor & Partner

Phone: 425-902-4840

Email:tgevers@geverswealth.com

5825 221st Pl SE

Suite 102

Issaquah, WA 98027

geverswealth.com