2025 Washington State Tax Changes: What You Need to Know

Washington State has passed significant tax law changes that could impact your long-term financial plans—especially if you're a high-income earner, hold appreciated stock, or have a sizable estate.

Here’s a breakdown of the key changes and smart strategies to consider.

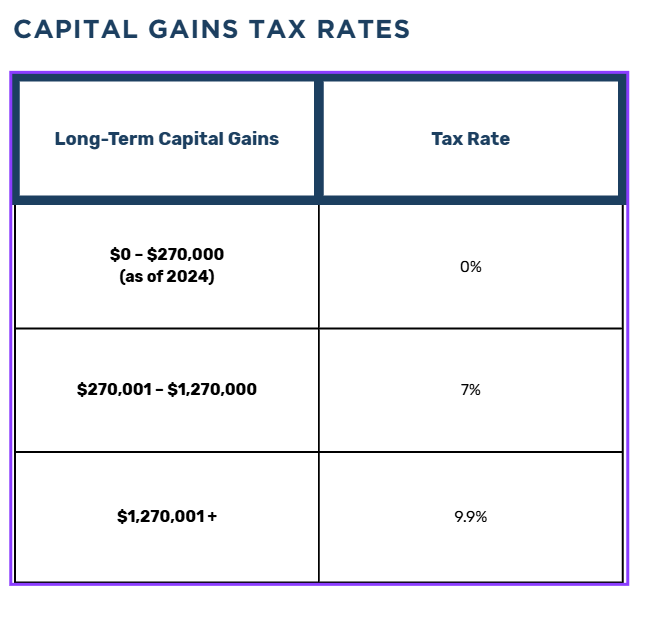

If you own appreciated stock, this change is particularly important:

- Washington already imposed a 7% tax on long-term capital gains over $270,000. (2024 Inflation adjusted exemption amount)

- Now, a new 2.9% surtax applies to net gains above $1 million, bringing the top rate to 9.9%.

- The new surtax is retroactive to January 1, 2025.

What’s Still Exempt:

- Real estate

- Retirement accounts (IRAs, 401(k)s)

- Small business sales (qualified)

- Certain livestock, timber, and goodwill sales

Here are the new tax rates:

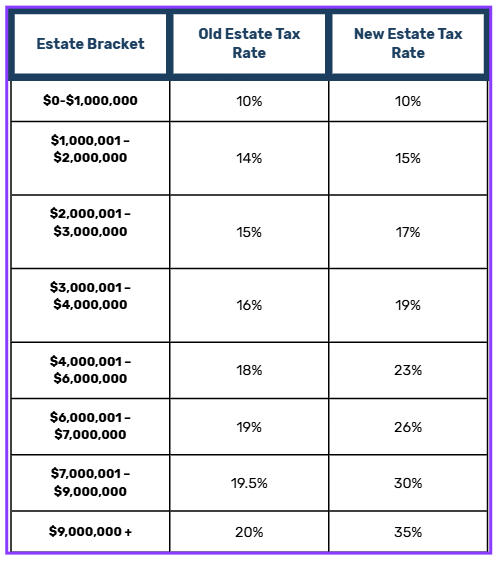

Estate Tax Changes

What Changed:

- The estate tax exemption increases to $3 million on July 1, 2025, and will be indexed to inflation going forward.

- However, the top tax rate increases to 35% for estates above $9 million—the highest of any U.S. state.

Here are the new estate tax rates:

If your estate is worth $10 million, $7 million of that may be taxable in Washington. At a top rate of 35%, that’s a potential $1.33 million estate tax bill.

Strategies to Reduce Tax Exposure

Strategic planning just became even more critical for Washington families. Here are some strategies to consider utilizing to promote an intelligent financial life

1. Tax Gain Harvesting (Yes, You Read That Right)

If you have appreciated stock but are under the $1M gain threshold, consider harvesting gains strategically over time to reset your cost basis.

2. Tax Loss Harvesting

Sell underperforming investments to realize losses that can offset current or future capital gains – Direct Indexing is a great way to automate this.

3. Charitable Giving with Stock

Donating appreciated stock allows you to:

- Avoid capital gains tax

- Receive a full-value charitable deduction

- Free up cash while supporting causes you care about

4. Installment Sales

Spreading a large gain over multiple years (if possible) can help you avoid crossing the $1M surtax threshold in a single year.

5. Trust Planning for Estate

Use tools like:

- QTIP Trusts – to defer estate tax at a spouse’s death and maintain control over distribution.

- Disclaimer Trusts – to allow post-death planning flexibility based on tax laws at that time.

- Irrevocable Nongrantor Trusts – to move appreciating assets out of your estate and potentially avoid WA capital gains tax altogether.

What Should You Do?

Tax planning isn’t just for April. These changes make it even more important to evaluate your investment strategy and estate plan. We recommend:

-Reviewing your portfolio for concentrated stock risk

-Revisiting your estate plan if your net worth exceeds $3M

-Mapping out stock sales or liquidity events for tax efficiency

Let’s Talk

Our team at Gevers Wealth Management is ready to help you navigate these changes. Whether you’re considering a stock sale, revising your estate plan, or gifting assets, we can help you create a customized strategy that fits your goals and keeps more money in your pocket.

Schedule a call today to update your financial plan for 2025 and beyond.

Trey Gevers CFP®

Financial Advisor & Partner

Phone: 425-902-4840

Email:tgevers@geverswealth.com

5825 221st Pl SE

Suite 102

Issaquah, WA 98027

geverswealth.com