Is Your Portfolio Up to Date? – Model Changes & Rebalancing

Summer 2020

There have been many dramatic moves in the economy and investment markets over the last few months. Interest rates have dropped to near zero, gold prices have soared, The Fed is printing money, “Stay at Home” stock prices have rocketed, retailers, real estate, airlines and small company stocks are down, healthcare companies may see even more profits in treating CV… and much more. 2020 has been a year of increased volatility and as of mid-summer the various components of a well-diversified portfolio are behaving with great disparity. Investors would be wise to watch their portfolios and consider if now is an appropriate time for a rebalance, and if their portfolio is up to date.

Rebalancing

Rebalancing your portfolio is widely recognized as a best practice for investors. Vanguard in a recent white paper stated that, “…the true benefit of rebalancing is realized in the form of controlling risk. If the portfolio is not rebalanced, the likely result is a portfolio that is overweighted to equities and therefore more vulnerable to equity-market corrections, putting a client’s portfolio at risk of larger losses.”

(Vanguard Research Francis M. Kinniry Jr., CFA, Colleen M. Jaconetti, CPA, CFP ®, Michael A. DiJoseph, CFA, Yan Zilbering, and Donald G. Bennyhoff, CFA September 2016)

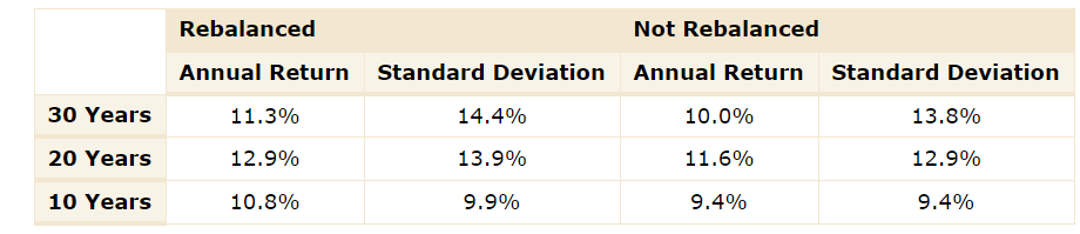

Another white paper by SigmaInvesting found that regular rebalancing might even increase returns over longer time periods.

(Portfolio consists of 40% US Large stock, 20% International equities, 20% Emerging Markets, 20% US Treasuries. Indexes used to represent the asset classes S&P 500, MSCI EAFE, S&P IFC Emerging Markets, S& REIT, and US 5-year Treasury bonds. 10-year time frame 1975-2004, 20-year time frame 1985-2004, 30-year time frame 1975-2004. Full study at https://www.sigmainvesting.com/advanced-investing-topics/value-of-rebalancing Investors can not directly invest in an index.)

The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

What is rebalancing? It means to return your portfolio to the pre-determined asset class allocation. As the investments in the various asset classes go up (or down) they may move significantly from their initial percentage in your portfolio. Thus, you might sell some investments that are up, and perhaps buy some investments that are down to shift your portfolio back to the original goal. As Vanguard emphatically stated, an important reason for doing this is to try and control your risk to not get too overweighted in one sector.

When our firm moved to the new advisory platform a few years ago, we did so partially because of the wonderful best-in-class rebalancing technology we can utilize to help our clients enjoy the potential benefits of rebalancing. As the markets and various sectors have taken wild swings recently, we have tried to take advantage of that by reviewing client portfolios for rebalancing opportunities. You may have noticed a rebalance in your portfolio recently, and we have been discussing rebalancing in our recent client reviews. We will review rebalances as always in our regular client review meetings, and of course we are always available if you have questions before your next appointment.

Portfolio Changes

Along with rebalancing, which is a normal and periodic part of the investment management process, the current economic environment might encourage some shifts to the portfolio, and we have been discussing some of these items in our recent reviews. Let’s review interest rates/bonds, tech, healthcare and gold and The Fed.

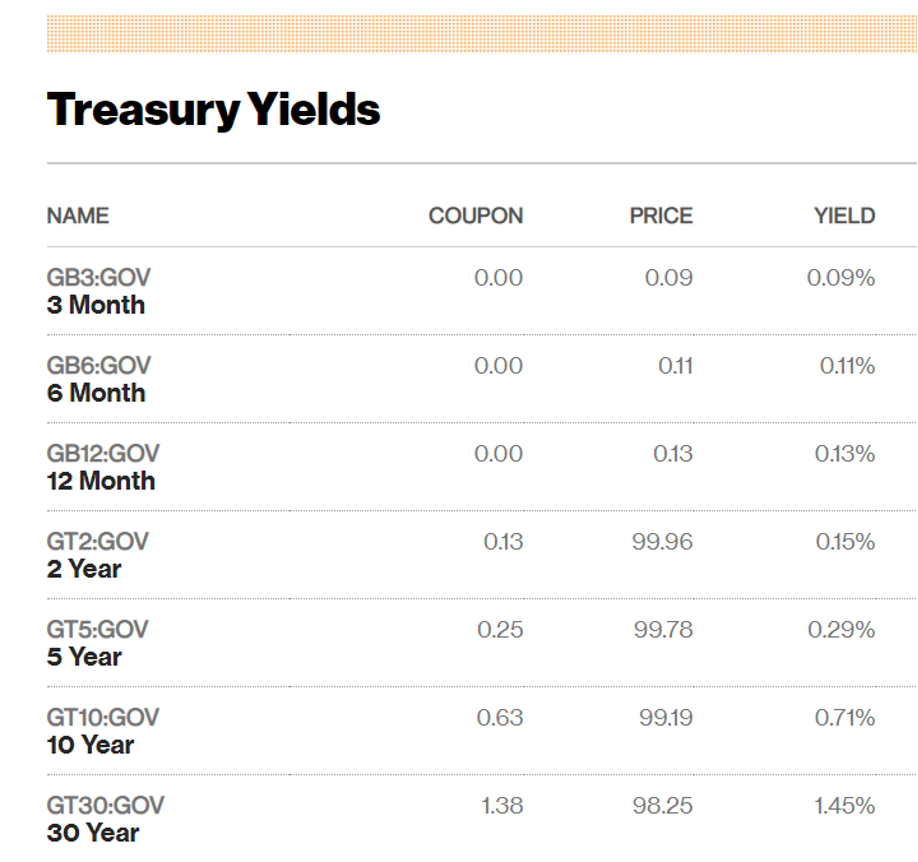

Bonds

We own bonds in our portfolio for 2 primary reason, to reduce risk by owning some non-stock investments, and also to hope to earn some return. Earning a decent return in bonds has become extremely challenging in the near zero interest rate environment we find ourselves in. There may not be much improvement in rates, at least for a while, as the Fed has clearly signaled that they are going to hold rates down for “as long as it takes.” Government bond rates are close to historical lows in the United States. Short term bonds are just above zero, and even a 5-year Treasury bond is only paying a measly 0.29%.

Source: Bloomberg. Stated yields are as of 8/14/2020, are subject to change and cannot be guaranteed. Treasuries are backed by the full faith and credit of the US Government as to the timely payment of principal value will fluctuate with changes in market conditions. If they are not held to maturity, they may be worth more or less than their original value.

As a result of these low rates, there is very little hope for any significant return in short term bonds. Longer term bonds however still have potential of positive return if rates go down further, and they also tend to be a haven when stocks drop.

Therefore, on the bond/fixed income side of the portfolio the shorter term bonds have been eliminated and shifted to longer term high quality bonds, senior loans (which currently are paying a little higher yield) and a slightly higher cash position than normal. This is more of a “tweak” than anything, but the hope and intent is to improve the bond portion of the portfolio in an almost zero interest rate world.

Technology

Tech stocks have overperformed since the pandemic struck. It is easy to see why, as these “Stay at Home” companies have seen their businesses grow by orders of magnitude due to the sudden reliance on online shopping, video and web conferencing, heightened internet and cloud usage by home bound employees, and video games and streaming content by bored shut- ins. Many major US companies have seen their business plans and adoptions of new technology accelerated from a ten year plan, to implementing in just a few months because of the restrictions from the pandemic.

Perhaps more importantly, habits and mores seem to be shifting for the long term. You might have read recently that REI, who just completed a huge 8 acre campus for their world HQ in Bellevue, decided they would not move in and are putting the brand new, unused complex up for sale. The CEO in his announcement stated that they are making a long term move to “dispersed workforce” the new corporate buzzword for work at home.

“The dramatic events of 2020 have challenged us to re-examine and rethink every aspect of our business and many of the assumptions of the past,” REI CEO Eric Artz said “That includes where and how we work.” PSBJ August 2020

This change creates an amazing opportunity for technology entrepreneurs to meet the needs of the now mobile workforce and the tools, products, and services they might need to be productive. Obviously there has been much disruptive technology in the last several years, but perhaps the future may hold even more change and opportunities for investors.

The large and small cap indexes (which each have a healthy dose of tech) and technology-focused funds have participated in the performance in this sector up to this point. To try and capture more of the possible benefits of these changes we are adding an active manager that specializes in investing in disruptive technologies, to our tactical portfolio. We can review this with you if your portfolio includes a tactical sleeve.

Healthcare

Another investment sector that potentially benefits from the pandemic is healthcare. For example, the estimates of potential revenues from a CV vaccine is in the billions of dollars, and of course there are other associated costs as well.

Large and small cap indexes have a healthy healthcare dose in them, and our tactical sleeve has a healthcare-focus. Again, we can review this with you if your portfolio includes a tactical sleeve.

The Fed, Money Printing, and Gold

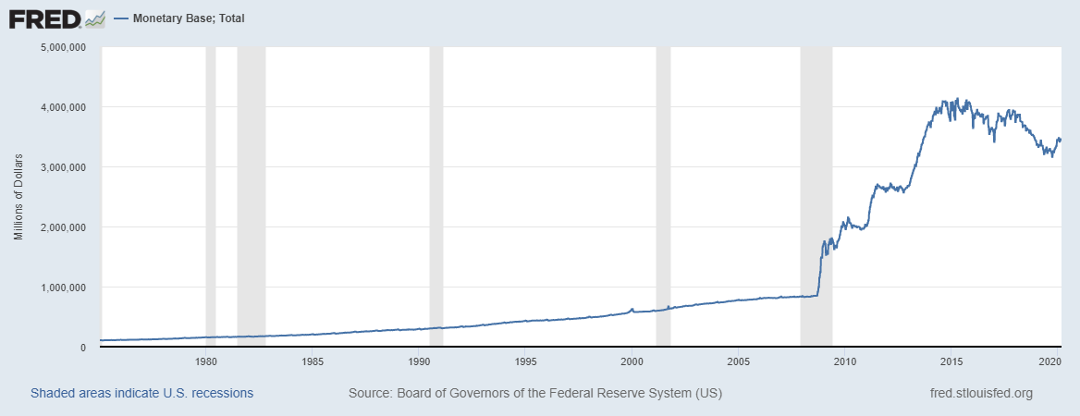

The Fed has created an astonishing amount of new money in an effort to battle the economic problems surrounding the pandemic.

Fed Chair Jerome Powell: “do whatever we can, for as long as it takes.”

At the recent Federal Open Market Hearing (FOMC) Fed Chair Jerome Powell stated;

“We remain committed to using our tools to do what we can and for as long as it takes to provide some relief and stability to ensure that the recovery will be as long as possible and to limit lasting damage to the economy.”

Simply put, the Fed will keep printing more money. Did you know that the Fed is now purchasing $120 billion per month of Government backed bonds?

Federal Reserve Balance Sheet over $6 Trillion… headed to $10+ Trillion?

https://fred.stlouisfed.org/series/BOGMBASEW

The rate of money creation is the highest and largest ever. I wrote in our last client newsletter about this phenomenon, and the positive impact that it seemed to be having on stocks.

Longer term, the impact of excessive money creation is uncertain. In fact, we are living through a giant real-life fiscal experiment, and no one knows what the long-term ramifications might be.

I first started studying this monetary creation trend in the early 2000’s and we started adding a gold allocation to client portfolios in 2004, when the price of gold was in the low $400’s. During that time, the price of gold has surged upwards in tandem with Federal Reserve printing binges. As we are currently in the largest money printing episode in history, gold might do well, and not surprisingly is one of the best performing asset classes YTD in 2020.

The purpose of having a gold allocation is not necessarily high returns – rather it is to try and provide some diversification and mitigation of the possible negative impacts of the Fed’s incredibly profligate fiscal policies. We will be reviewing portfolios and may add or increase to your gold allocation if it makes sense for your situation.

We have been reviewing these changes in recent meetings. For all I have written above, the changes are minor with the goal and intent to try and improve the return and risk profile of investment portfolios. Our focus remains on long term trends and evidence-based investing principles, and we remain staunch believers in the long-term potential for growth in equity investments and the incredible power of capitalism to create wealth.

Reviewing your portfolio and current market conditions is always part of our review meetings, and of course please feel free to contact us if you have questions before your next appointment.

Opportunity Portfolio Update

When stock prices cratered in March, we looked for sectors that dropped “too much.” After consideration and research, we built a speculative opportunity portfolio consisting of harder hit parts of the US equity markets. Some of our clients chose to participate in this risky mix, and we are delighted to help our clients find and take advantage of future asymmetric market opportunities.

Very rarely the markets present asymmetric windows of opportunity. Asymmetry means that the potential returns are far greater than the potential risk. We are constantly looking for opportunities to take advantage of perceived asymmetric market movements in our clients’ investment portfolios.

The whole team is obsessed with economics and the markets, and we read and study constantly. We remain committed to your investment success, and it gives us joy to help our clients meet their financial goals.

We look forward to seeing you soon.

Warm regards,

Willy Gevers

Copyright 2020 William R. Gevers. All rights reserved.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." – Dwight D. Eisenhower

US Money Supply – Monetary Base

(https://fred.stlouisfed.org/series/BOGMBASEW)

US Dollar Price – (DXY) USD Index measured against other currencies

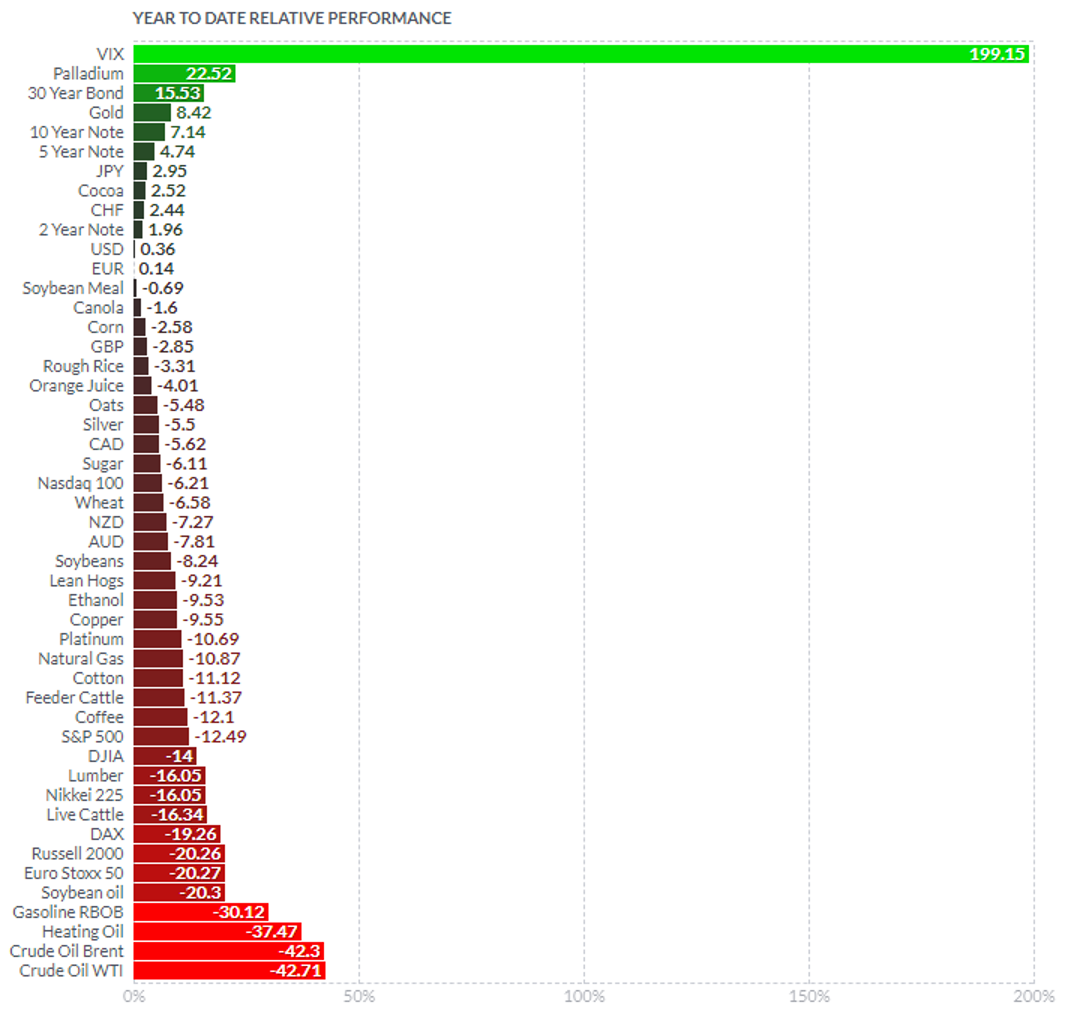

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

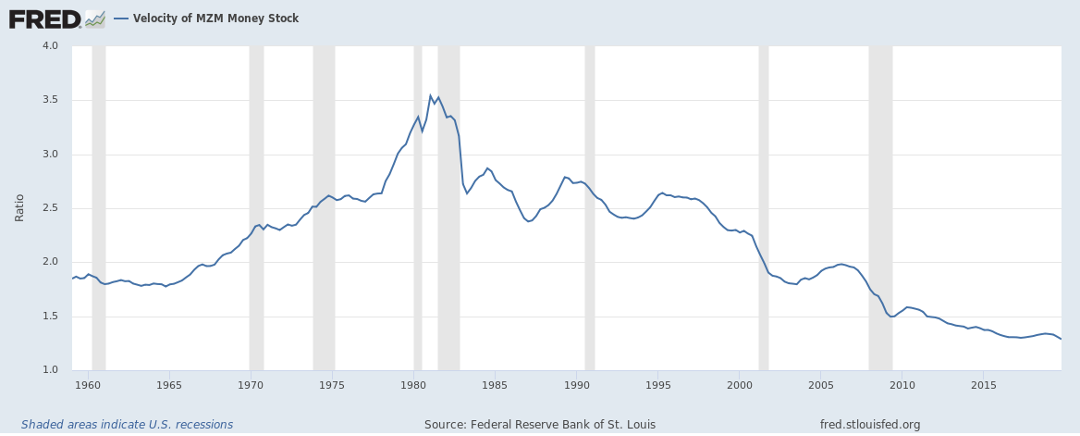

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we will reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.” Paul

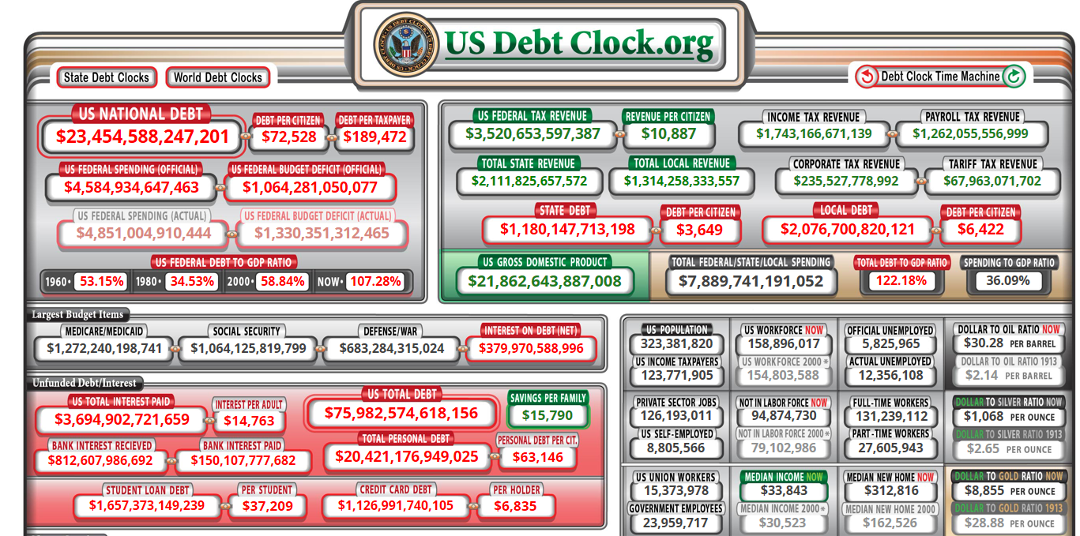

Total US Debt

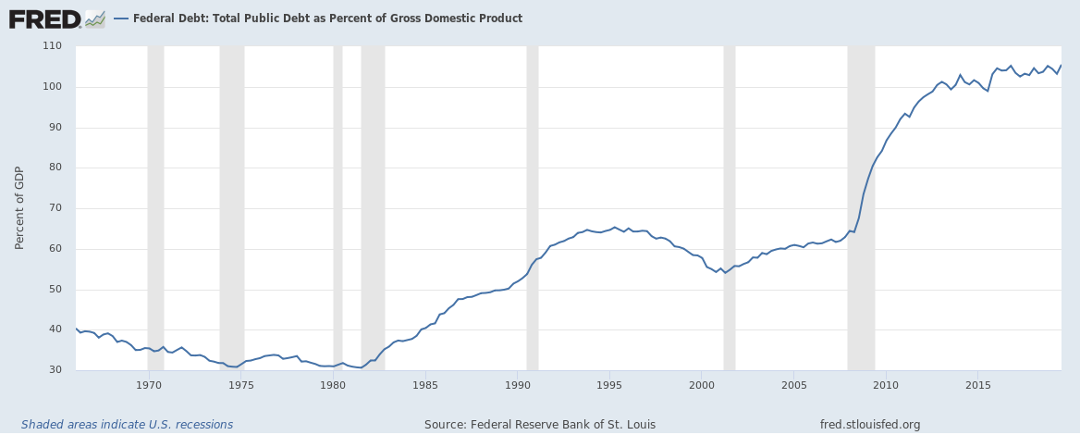

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

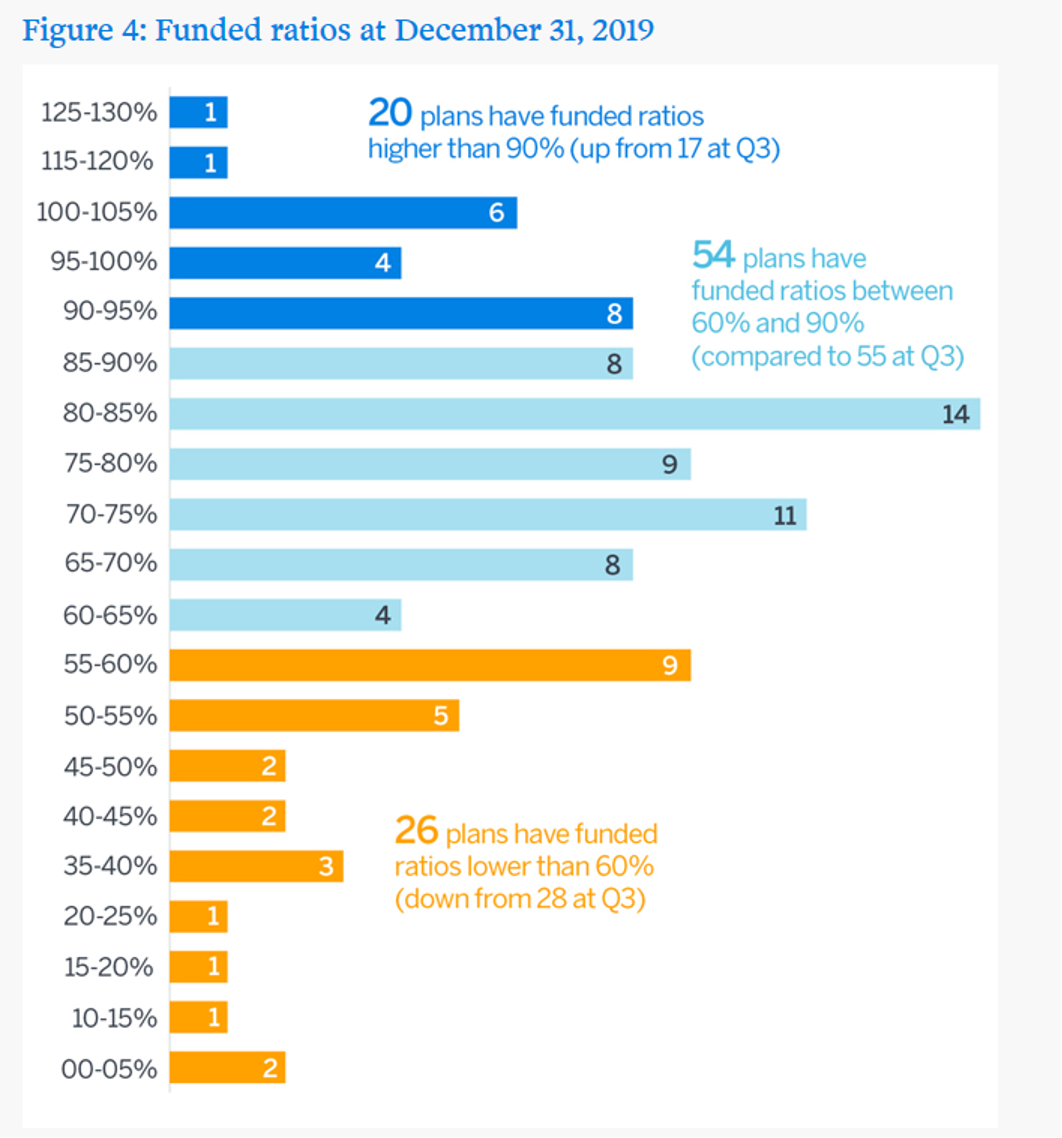

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

http://www.milliman.com/ppfi/

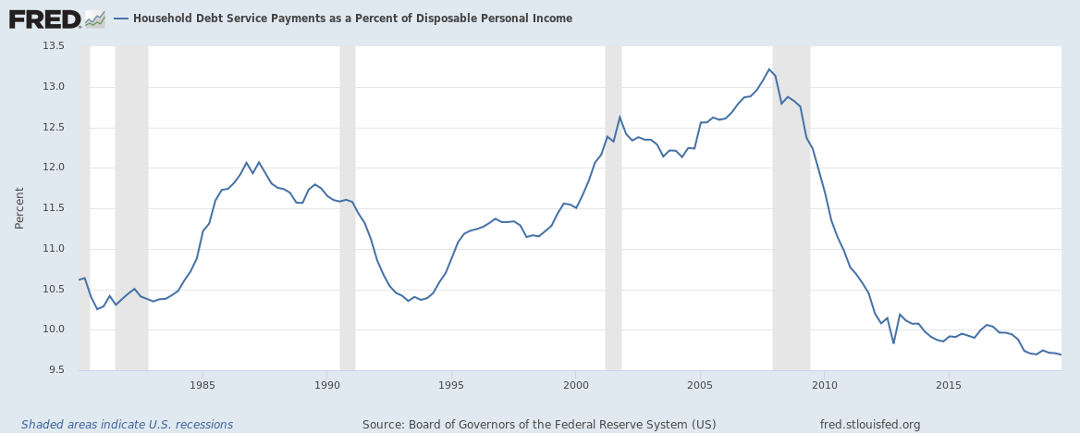

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)