Winners and Losers – 2024 Halftime Review

It’s been a mostly positive start to the year for investors, and we have had several major positive events in the beginning of 2024. It’s time to look at who are the biggest winners and losers in the financial markets this year, as well as some news about us as well. If you want to skip ahead to the company updates it starts at page 4!

In the financial markets

Winners

The Stock Market

Source: https://am.gs.com/en-us/advisors/insights/market-monitor/081624

The first half of the year has been great for the stock market, with every sector outside of real estate showing positive returns. Like last year, the tech and communication sectors continue to be the highest returning portions of the market. This might be a good time to use some of these stock market gains for spending or set aside to lock up income for later in the year.

The AI industry and Chipmakers

Some of the biggest investment winners of 2024 are companies connected to artificial intelligence. Both the providers of AI products and chip manufacturers have led the market in investment returns. This continues the trend of outperformance we saw in 2023, and so far the results have kept up with the AI hype. The Magnificent Seven, a grouping of largely AI related companies, was up 41% as of July 1st.

Gold

While not as flashy as AI stocks, gold has kept its luster this year. It shone with a 12.5% return at the halfway mark and is off to a bright start in the second half. Gold can play an important role as a diversifying asset in investment portfolios, and performance like this is a boon to investors who have gold in their portfolio.

Interest Rates for Savers

Interest rates have stayed high, despite many experts consistently predicting rate drops in the first half of the year. The top money markets are paying over 5% and many of the top banks are paying over 4%. It has been a good environment for savers who have been intentional with where they keep their cash. Where interest rates go is important to watch, because when rates do go lower, the interest paid on these accounts will quickly go lower too.

We have been helping a lot of our investors with cash planning strategies to try and best take advantage of the current rates. This is a great time to review your cash and how it is positioned.

Losers

Commercial Real Estate

Real estate has been the worst performing sector of the US stock market year to date. Although we haven’t seen housing prices drop in the Seattle area, rising interest rates, too much supply in the office space, and some deflating price bubbles have made it a difficult year for real estate investors. Office buildings especially have struggled, but most other real estate sectors have underperformed too.

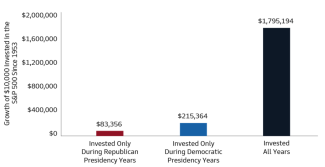

Investing by Political Party

Source: https://am.gs.com/en-us/advisors/insights/market-monitor/081624

Facing a very polarizing presidential election that is increasingly sensationalized by the media, it is easy to let political leanings bleed into our investing style. This research by Goldman Sachs illustrates the dangers of investing along party lines. Investors who got out of the market for one political party or the other saw major shortfalls over the last 70 years of investing. However difficult this election is, it is important to allow the markets to continue to work for our portfolios. It is clear that staying invested long term, no matter who is in office, has been the winning strategy by far.

Valuation Levels

Source: https://fred.stlouisfed.org/tags/series?t=equity%3Bmarket+value

Stock valuations are a bit like wildfire risk. Although a hot and dry summer doesn’t guarantee there will be a wildfire, it does make the risk of one much higher. Like heat and dry conditions can lead to a fire, in the same way, the higher stock valuations go, the greater the risk of a market correction. Again, the higher valuation doesn’t mean there will be a correction, but the risk is elevated. The P/E valuation metric for the S&P 500 has been rising and is about 27 now, compared to the long-term average of about 16.

We can help combat this risk of ‘wildfire’ for our clients by rebalancing, making sure income plans are secure, having adequate cash reserves, and checking that portfolios are at proper risk levels. Your financial security is very important to us and if you would like to discuss your portfolio’s risk level please reach out and we can schedule a special review meeting.

At Gevers Wealth Management, LLC

Winners

Trey & Nicole are Expecting!

We have some very special news from our team, Trey and Nicole are expecting! They have a baby boy due in November and couldn’t be more excited. Trey is already looking at running strollers to be sure he can still get a workout in while watching his son.

Garrett Proposed and Is Now Engaged!

Continuing with the big wins, I proposed to my girlfriend Katie and got a YES! I planned dinner for her by Lake Union in Seattle and went for a walk beforehand down to the water where I got on a knee and asked the question. Safe to say I am a very lucky man!

The Gevers Family Trip

The Gevers family had another fantastic vacation, this one in Costa Rica! This was an adventure filled trip of ziplining through the jungle, diving in azure water, spice filled local cooking classes, scuba diving, white water rafting, fly fishing on jungle beaches, and golfing in a tropical storm. They have plenty of stories to share about this trip and would love to share their favorite Costa Rica spots if you have a trip planned there!

New Financial Certifications

When not planning my proposal, I have been busy studying for and earning my CFP designation and now join Trey as a Certified Financial Planner. The education this provided has helped expand my knowledge of specialized areas of financial planning and pairs well with my CFA education. Although not as exciting as new babies and proposals I am excited about the additional tools and knowledge I have to help our clients!

Losers

Gabrielle Working Less With our Company

Many of you have gotten to know and grown close with our team member Gabrielle over the years. She is an all-star on our team and has chosen to make an even bigger impact by working to provide mental health counseling and services for the homeless with a local non-profit. This is a big win for many reasons, but it is bittersweet because she has switched to only working for us on Fridays. We are excited for her for this new opportunity she has and will continue to support her in her goals both with her new company and our team.

Closing Notes

It has been an honor to serve all our clients this year, and we were blessed to see the positive impact prudent investing and planning has had for them and their families. We stay committed to your financial success and look forward to both the opportunities and challenges the rest of this year will bring with it.

Garrett Grigas, CFA®

Investment Advisor

Phone: 425-902-4840

Email Ggrigas@geverswealth.com

5825 221st Pl SE

Suite 102

Issaquah, WA 98027

Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a Broker-Dealer and Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information.

Confidential: This email and any files transmitted with it are confidential and are intended solely for the use of the individual or entity to whom this email is addressed. If you are not one of the named recipient(s) or otherwise have reason to believe that you have received this message in error, please notify the sender and delete this message immediately from your computer. Any other use, retention, dissemination, forward, printing, or copying of this message is strictly prohibited.

Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a Broker-Dealer and Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

Cetera does not offer direct investments in gold/silver (commodities). Commodities are volatile investments and may not be suitable for all investors.

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.