Who CARES about Recessions? Swans, CV19, & Market Risks

We have been having long conversations about risk, the future of the markets and what actions to take in response to the coronavirus stock meltdown.

Risk and more important, how to respond to and mitigate risk are mission critical to successful investing and retirement planning. We discuss this as part of our bi-annual reviews and have also written about it extensively in our newsletters. https://www.geverswealth.com/blog

Let’s examine three primary types of stock market downturn scenarios so we might better understand our risk as investors.

Downturn due to Recession: Recessions happen regularly and are nothing to fear. There have been about 12 recessions since the start of the last century, and they have occurred at the rate of about one every 4-5 years during our investing lifetime. A recession is a slowdown in the economic cycle and is a completely normal part of the business cycle. Just as summer comes every June, and it is winter in December – the economy goes through seasons, shrinking during a recession and growing during the expansion that follows a recession.

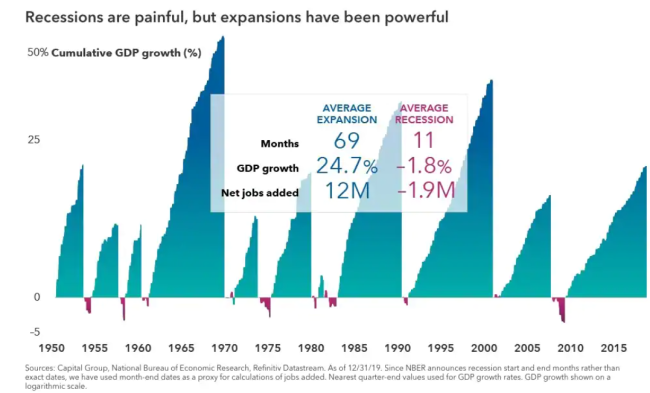

This is why an investor should not fear a recession; recessions are typically short, and expansions are long, and the growth of the stock market during expansion is when investors enjoy most of their success. According to Capital Group; over the last 65 years, the U.S. has been in an official recession less than 15% of all months and the net economic impact of most recessions has been relatively small. The average expansion increased economic output by 25%, whereas the average recession reduced GDP by less than 2%. Stock market returns may even be positive over the full length of a recession since some of the strongest stock rallies have occurred during the late stages of a recession.

How should an investor prepare for a recession? We know that recessions occur, but don’t know when. A wise investor will periodically monitor and understand the level of risk in their portfolio and keep an appropriate level of cash on hand for spending necessities. It is also smart to be careful about debt and have a robust income plan in place so you might be able to maintain your lifestyle. Rebalancing a portfolio during a recession can add value and even possible future returns.

The key principle according to history, is to be able to hang in through a recession without needing to sell beaten down investments, and without getting scared out of your portfolio.

To be clear – what we are experiencing in 2020 is NOT a recessionary downturn.

Downturn Due to Financial Catastrophe: The US has suffered through two financial catastrophes in the last 100 years. A financial catastrophe could be thought of as a systemic collapse of the economic and financial system. Far different than a recession which is simply a slowdown, in a catastrophe some or all of the financial structures that we depend on for everyday business and life just stop working. The two great financial catastrophes of our and our grandparent’s lives was the Great Depression of the 1930’s and the Great Financial Crisis of 2008-2009.

During both catastrophes there was widespread failures in the banking system, the credit markets froze, and many financial institutions were close to failing or failed. This is obviously very serious and something any investor should be quite concerned about. The Great Depression took an investor over a decade after WWII to recover from, and the Great Financial Crisis took almost 5 year for markets to get back to the pre-crisis levels.

Again, to be clear – what we are experiencing today in 2020 is NOT a financial catastrophe. By contrast, up until a few weeks ago, our country was experiencing wonderful growth and an extremely strong economy.

How should an investor prepare for a financial catastrophe? That would be obvious if you knew it was coming. Sometimes there are some clues that there is trouble ahead. In retrospect there were some warnings of impending disaster before the Financial Crisis, and perhaps there were before the Depression too. I wrote a lengthy paper in mid-2007 warning of heightened levels of risk, and in 2008 we reduced our weighting to bank related investments, and screened our portfolios to try and avoid OTC derivatives, CMBS, CDS, and other nasty financial instruments that caused much pain and loss. As a result, we reallocated accordingly to help our clients mitigate the risk of a market downturn. Even though the loss might have been less, it was still painful. The practical reality though is that many very smart and highly successful investors were hurt badly during the Great Financial Crisis.

Along with the practical steps for a recession that we mentioned above, it is smart to “stress test” your financial life periodically to see if you are prepared for a financial catastrophe situation. For folks that are still working, I like my “30 Percent Rule” which asks the question; If my family income declined by 30% - could I still pay my expenses, debts and obligations? What adjustments could I make and how long could I sustain at that reduced income level? Of course, you could make it 40 or even 50 percent if you wanted to be especially conservative.

For families that are retired, we like to walk through a “Robust Income Plan” exercise that models how much of our income is protected and how much income is subject to market risk, and projects what income might look like during downturns of various magnitudes. If we feel that the results of the exercise are unsatisfactory, we walk through a checklist of action items that might potentially make our income plan more robust and able to withstand market downturns.

(If you are not a client, please feel free to email us at info@geverswealth.com and put Robust Income Plan in the subject line and we would be happy to share this valuable exercise with you.)

Downturn due to Exogenous Event – the Black Swan

Black Swan - An event that deviates far beyond what is normally expected of a situation and that would be extremely difficult if not impossible to predict.

Nicholas Taleb: Black Swan; The Impact of the Highly Improbable

Who would have expected in 2001 that multiple airliners would be simultaneously hijacked and flown on suicide missions into offices in the United States? Who isn’t shocked and stunned in 2020 that our entire country is in quarantine, and that we have a worldwide health crisis that probably came from someone eating a diseased scaly anteater?

When we have an exogenous shock like September 11th, or the coronavirus pandemic, the stock markets plummet. Investors crave confidence, and an event like this creates a great deal of fear and uncertainty. Investors and stock markets hate uncertainty. Consider the uncertainties we face today. How long and how many people will the virus sicken? How long will the shutdowns and Shelter in Place orders be in place? How many people will lose their jobs? What will company earnings look like when this is over, and how long until they recover? No one know the answers, and while uncertainty lingers, stock prices will most likely continue to suffer.

How should an investor prepare for a Black Swan? The answer – you can’t. There is no way to prepare for an event that is inconceivable and unimaginable. We just don’t know what we don’t know.

It is always wise to consider the “30 Percent Rule” (above) as a stress test for your plan, but even that may not be enough in the case of a black swan event. I have close friends that are business owners that have had to lay off all their employees and have gone from a thriving business to no revenue. I’m praying for them and their businesses, but have to acknowledge that there was just no way they could have possibly been ready for or anticipated what CV19 has done to their business and the economy as a whole.

I have been critiquing our own research and thinking about CV19. I read some of the early reports, then heard some first-hand news from a client who had been in Shanghai. The initial stock market response to the virus in January through most of February was almost non-existent, and some of the early reports seemed to indicate that CV19 was not that big of a deal. We started mentioning CV as a potential market threat early in the year as part of our periodic client reviews. As a precaution, we screened portfolios for China exposure and liquidated some positions that were heavily exposed to Chinese stocks. Additionally, we raised cash for many of our clients in late 2019 or early 2020 while the markets were still way up. Of course in the perfect clarity of hindsight, we might have taken more drastic measures if we had only known how bad CV19 actually really was and how sudden and dramatic the markets both in the US and around the globe would drop because of it. Our moves did help a little.

The potential good news is that rapid recovery from an exogenous event tends to be the norm. Remember that the stock market dropped 14% the week after September 11th, and performed poorly thereafter, but subsequently completely recovered before the end of the year. Because the US economy was so strong before the CV19 crisis started, it is possible and probable that we could come roaring back after the quarantine ends and we can leave our homes. In the meantime, expect more volatility, and many astute observers are suggesting that the stock markets will continue to struggle in the midst of a remarkable shutdown of economic activity, jobs and companies

So, when will the Black Swan fly away? Here are some things for investors to watch:

Bridge over Troubled Waters – CARES, Stock Prices & Earnings and QE

The CARES Act is essentially a financial bridge of sorts. It provides payments to individuals with the intent that it might allow them to pay for housing and food until the shut down is over; and more significantly it allows small businesses an eight week lifeline to help cover payroll and rent, again until the shutdown has been lifted. The banks have done a remarkable job distributing a tremendous amount of those funds to business owners over a very short period of time.

Stock prices are first and foremost driven by company earnings. Corporations large and small in the United States have enjoyed fabulous earnings for the last eight quarters and because of that we have enjoyed wonderful growth in our portfolios and stock prices during that time. Investors need to understand though, that earnings are going to reverse sharply and the forecasts for the 2nd quarter (April – June 30th) look gloomy and bleak. Some think that the percentage drop in company profits and increase in unemployment will mirror that of the Great Depression. It is quite possible that stock prices will drop even more when the 2nd quarter numbers come out.

However – the US has unleashed a spectacular amount of financial stimulus and monetary creation, the largest in history. Congress has passed two stages thus far of the CARES Act with direct payments to citizens and small business owners and tax-breaks for many, AND the Fed has announced a massive intervention in the banking, bond and credit markets and will print trillions in new money through a Quantitative Easing program.

Former Dallas Federal Reserve President Richard Fisher joked that;

Investors like seeing the world through "Beer Goggles” - things often look better when one is under the influence of free-flowing liquidity!

The tremendous monetary profligacy of CARES and QE might also be advantageous for other assets. Many clients have a small precious metal allocation (gold) and have participated in the market swings of their PM positions. Precious Metals tend to rise in price when money printing runs rampant and quantitative easing (QE) is exactly that.

While the government might be an investor’s friend through stimulus plans and QE, our government also poses a real threat to us as well.

Shutdowns, Shelter in Place, Quarantines – How long will it Last?

Our leaders face a critical ethical dilemma – balancing health concerns against economic damage. When restrictions were first mandated, it seemed clear based on projections and advice of scientists that it was the right path to take. However, by late Spring, weeks after the shutdown, the medical evidence is almost overwhelmingly pointing to considerably lower mortality rates, a much much lower death toll than first feared, and a close to zero threat for folks under the age of 40. Most significantly the coronavirus seems to be much more widespread than officially reported, in other words many people seemed to have already caught CV and recovered, the majority without even knowing they had it.

Given this evidence, investors hope that restrictions might lift sooner and faster, but in many states like here in Washington, in Michigan and some others, the governors seem unwilling to change course. The problem of course is the financial havoc wreaked by the shutdown; the destruction of small businesses, families draining retirement accounts, loss of jobs, and the emotional carnage as well. My daughter is a Marriage and Family Therapy grad student, and she tells me that cases of domestic violence, spousal abuse, mental health issues and suicides are skyrocketing – unreported and unnoticed consequences of the CV shutdowns.

What is the problem? In plain language – The longer the restrictions are in place, the greater the financial damage, and perhaps if this goes on much longer some of that damage may be permanent and irreparable.

To be fair, I am glad that it’s not my responsibility to make these incredibly difficult policy decisions. I do hope though that our leaders would have an open and fair debate about balancing the costs of economic & financial destruction against what seems to be the waning risks of coronavirus. As investors we will want to watch this closely.

The Lower High and the Lower Low - Do you Need Cash for Income?

Another caution for investors comes from history. During prolonged market downturns the phenomenon of Lower Highs and Lower Lows is commonplace. The first initial market drop is then followed by a recovery, but that recovery is not back to the previous high, in other words a Lower High. Then – and this is the painful part - the recovery is frequently followed by another downturn, and this one deeper and more painful than the first one – the Lower Low. During the major market downturn of 2000-2002 this occurred 5 times, until the market went down to its Lowest Low in fall of 2002.

Please understand that I am not predicting this will happen, and certainly do not want it to, but based on market history it is quite possible that this could occur. If this did happen, understand that means the markets might go down again even below the 18,591 level that the Dow hit near the end of March.

Perhaps because of the exogenous shock nature of this downturn, the markets will continue to recover robustly as the shutdowns end – but keep in mind that we could have another lower low.

As I write this, the US stock market is back to the prices of mid 2019 and has recovered considerably.

With the possibility of this phenomenon – this might be a great window to check your need for income and cash from your portfolio for the next year or two and consider taking a distribution from the portfolio if necessary.

We will be reviewing this in our upcoming meetings, and of course please let us know if your income and cash needs have changed since our last meeting.

Ten Financial Strategies for CV19

Winston Churchill famously said, “Never let a good crisis go to waste!” There are significant actions and strategies that may make financial sense to consider given the sharp drop in stock market prices and unusually low interest rates. We have prepared a checklist of ten financial strategies that might be opportunistic and advantageous given the current financial climate, and many of our clients are implementing these strategies.

With crisis sometimes comes opportunity, don’t miss this window.

(Please email us at info@geverswealth.com for a copy of Ten Financial Strategies to Cope with CV19)

These three types of stock market downturns are all different and we may need to think about them and respond to each in a unique way. We are in a once in lifetime exogenous event due to CV19, and hopefully closer to the end than the beginning. We look forward to reviewing this in more detail at our next review meeting, and of course please contact us if you have questions before our next scheduled meeting.

Personally Speaking…

Many of you have graciously asked about the team here and how we are doing, and we are grateful and touched with your concern. We are considered essential, so our office has been open the whole time, although we are doing all meetings virtually through our conference room webcam. Garrett Grigas and I have been in the whole time (and we worked three weeks straight at the beginning of the crisis!) Kristy worked remotely from home for several weeks but is back in the office now, and Anna and Barbara have also continued to work remote. To my disappointment and also delight, my son Trey’s college classes were cancelled, so he moved home to finish his classes remotely, and has been working at the office full time, which has been a real treat for Dad. You may be speaking with him soon as he will be taking over some of our projects include the roll-out of our new client dashboard.

We are healthy and well. The office is well stocked with wipes, hand cleaner, disinfectant and Kleenex. We also have herbal and green tea, vitamin D, Elderberry, and taking a heaping tablespoon of cod liver oil and turmeric every morning to boost immune system. (By the way – did you know that some recent studies have observed that high levels of Vitamin D are associated with lower probabilities of getting CV19, and reduced severity of symptoms if you do catch it? It has not been established if this is just correlation or if there is actual causation.

However, there seems to be little downside to taking Vitamin D supplements, and perhaps it may offer some defense? I take some now every morning.)

Our personal lives have been cloistered perhaps just like yours as my life consists only of shuttling between work and our home. I did take off one day in May to celebrate the reopening of fishing in Washington by floating the Yakima River ?

A post coronavirus native Yakima River Rainbow Trout!

Our hope for all of you is for health and safety, and that you can get outside and enjoy the great weather and the outdoors. We look forward to seeing you soon, via Skype, Zoom, or better yet in-person when life goes back to normal.

Warm regards,

Willy Gevers

PS: During the horrific Spanish Flu of 1918, President Warren Harding outlined the US economic response. Notably, the stock market behaved normally, and unemployment was almost unchanged.

“We must face the grim necessity… no statute enacted by man can repeal the inexorable laws of nature. Our most dangerous tendency is to expect too much of government…

The economic mechanism is intricate and its parts interdependent, and has suffered the shocks and jars incident to abnormal demands, credit inflations, and price upheavals. The normal balances have been impaired, the channels of distribution have been clogged, the relations of labor and management have been strained. We must seek the readjustment with care and courage.…

All the penalties will not be light, nor evenly distributed. There is no way of making them so. There is no instant step from disorder to order. We must face a condition of grim reality, charge off our losses and start afresh. It is the oldest lesson of civilization. No altered system will work a miracle. Any wild experiment will only add to the confusion.”

President Warren Harding

PPS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com