What do Bitcoin, Scuba Diving in Maui, & Gold have in Common?

SCARCITY

I’m violating a writing convention and giving away the point in the first sentence.

My wife and I just came back from a short trip to Maui. A sunny respite from dark rainy Seattle is very precious in the winter. Because our time there was short, we tried to take full advantage of it. I was up early to work, my son and I did morning beach runs and pull-ups on the banyan tree branches, daily long walks on the beach trail, hikes to waterfalls, scuba diving, spearfishing, sunsets and great meals – we squeezed every experience we could into our short trip there as our time in Hawaii was SCARCE and thus we placed a very high value on it.

USD - Not Scarce!

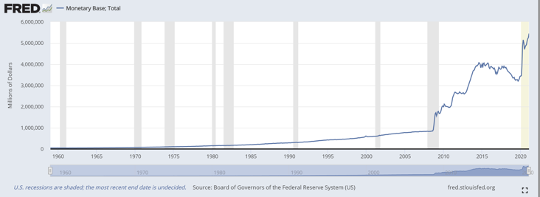

“We print money digitally. As a Central Bank, we have the ability to create money.”- Jerome Powell – Federal Reserve Chairman

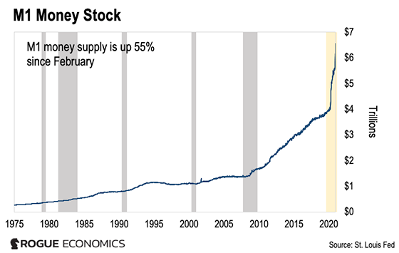

What is NOT scarce is the US Dollar. The Federal Reserve has created an astonishing amount of new USD since the start of the pandemic. The money supply of USD increased dramatically in 2020.

And the FED plans to keep printing even more USD…

It is important for investors to understand how Fed policy and stance on new money creation through Quantitative Easing (QE) has evolved over the last 13 years. At the beginning, QE was used as a last resort weapon, new and never used before, to try and prevent a global financial crisis. In 2021, QE is now considered mainstream fiscal policy, and has been and will be used to fund the upcoming stimulus bill, the proposed infrastructure program, and Treasury Secretary Yellen has even stated her support of using QE based spending for elective programs like climate change.

You may or may not agree with these proposed programs – but the key issue to remember is that the US Government quite literally does not have the money to pay for any of them! The Fed, through QE will create new money to pay for these upcoming programs, and thus even more new money will flood into the economy.

A key principle is that money tends to go to where it is treated the best.

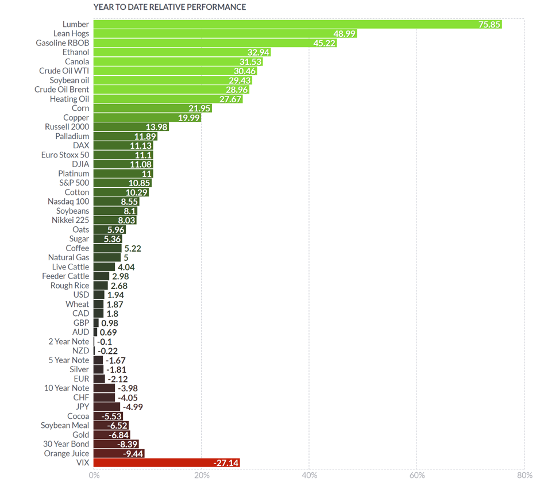

When increasing amounts of money chases after scarce goods and commodities, the price of those scarce goods tends to increase. This seems to be occurring; examples include real estate, gold and Bitcoin. I’ve even noticed it when buying athletic and outdoors equipment – flyfishing gear, bowhunting and mountain bikes have all been hard to get and prices seem to be going up. We reviewed the impact of money printing on stocks and real estate in earlier newsletters, let’s examine some other assets that have been impacted by money printing.

Gold

Gold is by its very nature scarce. The World Gold Council estimates that the gold supply increases by a minuscule amount, perhaps 1% per year. Significantly, gold is also considered a form of money and a Tier One (equal to cash) financial asset in the global banking system.

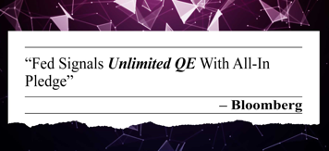

(Gold price over previous three years. Price increased rapidly with 2020 money printing. Source: stockcharts.com)

Not surprisingly, the price of gold has risen rapidly since the beginning of 2020, and that rise directly mirrors the rate of new money creation.

An increasing amount of money chasing a scarce good = rising prices.

Bitcoin

Bitcoin (BTC) is rapidly becoming part of the mainstream financial world. It has a market cap of ~$1 trillion, but more importantly major financial institutions like MasterCard, BNY Mellon, Fidelity and many others are adopting and facilitating BTC based transactions and holdings. Paypal, Venmo and Square all allow BTC purchases, and most significantly major corporations like Mass Mutual and Tesla are even substituting BTC in lieu of cash as part of their corporate assets.

“When the oldest bank in the United States decides to adopt the newest money in the world, that shows the inevitable convergence between cryptocurrency and banking.”- Brian Brooks, former Comptroller of the Currency of the OCC. Forbes, Feb. 2021

I might modify that quote to say that when both the most progressive company in the US (Tesla) and the oldest bank both decide to adopt Bitcoin it is a sign that cryptocurrency is starting to become widely accepted.

I first started studying BTC years ago, and at first, like many other people didn’t see the utility and use of a cryptocurrency. However, it has grown tremendously in both acceptance and usage over the last several years.

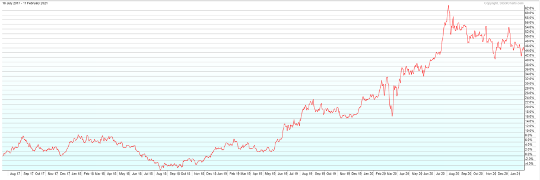

Two important points. First is that the profligate printing of the USD and the debasement of value that necessarily accompanies that, is what has opened the door for the possibility of an alternative currency like BTC to exist and flourish. Second is that BTC by design is scarce – there will never be more than 21 million BTC based on the supply algorithm that BTC is built on. The built-in scarcity AND the massive debasement of the USD are the driving forces behind the adoption and popularity of BTC.

My personal belief, and that of many others, is that if the Fed had not embarked on a crazed money printing program in 2009, that BTC would have never been born or perhaps would have died a quick death. Instead BTC today is becoming more popular as a form of currency and potential hedge to the USD. Perhaps the success of BTC is a sign to investors that there are problems with the USD.

“…both gold and bitcoin are out of the hands of politicians and are the liabilities of no one.”Forbes, December 2020

(A note about BTC – there is a great deal of risk to this asset, including volatility, security and lack of custody, regulatory uncertainty along with the normal and high level of risk of any currency. This article is not a recommendation to invest in BTC, but rather an examination of the economic forces that have caused its popularity. Full disclosure; my wife and I allocated a small percentage of our portfolio to BTC sometime ago.)

So what does an investor do about a rapidly growing money supply that is chasing scarce assets like gold, BTC and real estate?

Cash Planning – Watch out for the Twin Enemies of Cash!

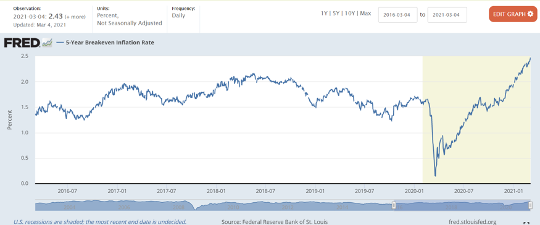

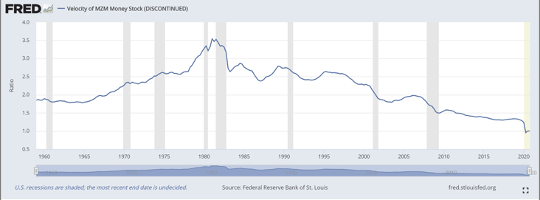

Cash has two mortal enemies – Inflation and Low Interest Rates. Both are incredibly harmful to an investor’s cash in the bank. We want to be especially mindful of how much cash we hold today. With banks paying essentially zero, and inflation as reflected in the prices of many goods starting to increase, the purchasing power of our cash may deteriorate fairly quickly.

(Notice how inflation expectations have jumped since last year.)

Many families we meet with have substantial amounts of cash. In the good old days of high yielding CD’s and money markets, it was not a bad thing to have excess cash – but again in a zero-interest rate higher inflation environment it can be damaging to our financial health.

We suggest that families set some cash goals and to create a plan and parameters for how much cash to have on hand. First step is to determine how much cash we should have for our emotional comfort. I like to call this amount your “Sleep at Night” bucket, the amount we want to keep readily available in the bank. We also like to review major spending for the next 12 -24 months that we can’t pay from our regular income, e.g. a new car, kitchen remodel, gifts to children. These shorter-term spending amounts are probably also best to keep in the bank.

If there is excess cash over your “Sleep at Night” and spending needs, this excess might be repositioned to try and earn a better return and maintain purchasing power and even some potential growth. Where could you reposition your excess cash? Here are some options that we have helped our clients implement.

- Cash Plus Dividends Portfolio: When interest rates went to zero after the 2009 recession, we began offering clients a “Cash Plus Dividends” portfolio as a place to reposition their excess cash. The portfolio goal is minimal risk and a return goal that is a little higher than bank rates. This might be an easy first step to move excess cash from a zero-rate bank account with the goal of earning a slightly higher return with out taking on too much risk.

- Addition to your Conventional Stock portfolio: We have been especially fond of tax- sensitive stock portfolios utilizing pro-active tax strategies to try and optimize after-tax returns for our higher tax bracket clients. Dividend investment portfolios can also be a suitable solution to reposition excess cash, and we are also particularly fond of Growing Dividend strategies. For many clients, moving cash to their existing investment portfolios is an easy and suitable move.

- Gold & other Alternatives: We have seen a significant number of investors purchasing physical gold and silver with the hope of protecting against rising costs of goods. Both gold and silver prices are up substantially since the beginning of 2020, perhaps as a response to concerns about money printing and potential inflation. Gold and silver in physical form have been difficult to come by in recent months, and you may find that it will take some time to purchase it.

(Please note that Cetera Advisor Networks nor any of its affiliates may offer direct gold and silver investments, such investments will fluctuate in value in and involve investment risks including possible loss of principal.)

A number of prominent investment managers and economists have also suggested that an allocation to BTC might also be another strategy to try and protect against rising costs. (For example, Jurien Timmer, Fidelity’s head of Global Macro Strategies recently published a paper suggesting a small allocation to BTC.) https://institutional.fidelity.com/app/literature/item/9901337.html?pos=T

There are challenges to purchasing and storing physical precious metals and BTC, but the fact that many investors have taken positions here regardless of these challenges is an indication of a widespread concern about inflation and loss of purchasing power.

- Real Estate: Rental real estate can be a powerful inflation hedge. If you already own rental real estate, you may have enjoyed wonderful appreciation in both property values and rents. We have seen many investors add or increase real estate holdings in their investment portfolios recently.

(Please note that Cetera Advisor Networks nor any of its affiliates may offer direct real estate investments, such investments will fluctuate in value in and involve investment risks including possible loss of principal.)

The key planning issue is to carefully consider if you might be holding on to too much cash in a low interest rate/high inflation world.

"Stock prices will always be far more volatile than cash-equivalent holdings. Over the long term, however, currency-denominated instruments are riskier investments — far riskier investments — than widely diversified stock portfolios that are bought over time and that are owned in a manner invoking only token fees and commissions. That lesson has not customarily been taught in business schools, where volatility is almost universally used as a proxy for risk. Though this pedagogic assumption makes for easy teaching, it is dead wrong: Volatility is far from synonymous with risk. Popular formulas that equate the two terms lead students, investors and CEOs astray.”

Warren Buffet Berkshire Hathaway Annual Investor Letter

For 2021 investors should keep a close eye on the not scarce USD, and its impact on the aforementioned scarce assets. We are available to discuss this in your regular review meeting, and of course please call us if you have questions before your next scheduled appointment.

Back to Hawaii – our family had an amazing vacation, and we used every precious minute of our short and scarce time there. Our scuba charter with Lahaina Divers https://lahainadivers.com/scuba-charters/dive-lanai/ was a highlight, and highly recommended! We dove in underwater caverns formed by hot lava. It was a thrill to squeeze through rock tubes formed by the cooling lava, and emerge into an underwater grotto below the ocean floor.

(Trey and Willy about to enter an underwater cavern at the Cathedrals off the coast of Lanai.)

We are looking forward to our next meeting. Our whole team is dedicated to your financial well-being and success.

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2021 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

https://www.forbes.com/sites/haileylennon/2021/02/12/bitcoin-welcomes-tesla-mastercard-bny-mellon-venmo-to-the-cryptocurrency-party/?sh=2ee84bd9123e

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

US Money Supply – Monetary Base

https://fred.stlouisfed.org/series/BOGMBASE

US Dollar Price – (DXY) USD Index measured against other currencies

(http://www.barchart.com/chart.php?sym=DXY00&style=technical&template=&p=MC&d=X&sd=&ed=06%2F11%2F2015&size=M&log=0&t=LINE&v=0&g=1&evnt=1&late=1&o1=&o2=&o3=&sh=100&indicators=&addindicator=&submitted=1&fpage=&txtDate=06%2F11%2F2015#jump)

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

- Paul

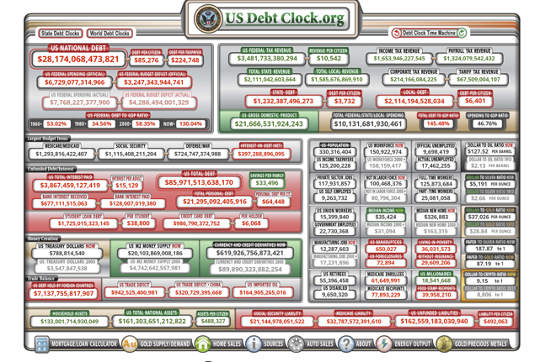

Total US Debt

http://www.usdebtclock.org/#

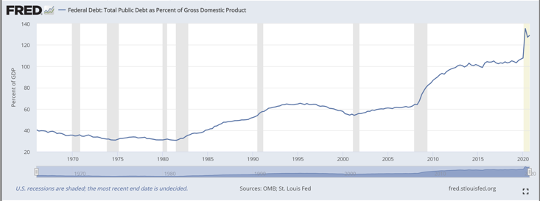

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

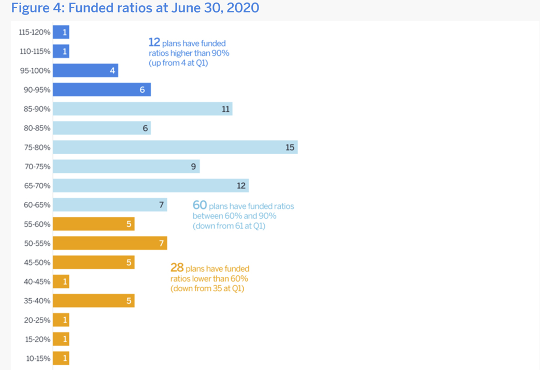

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

http://www.milliman.com/ppfi/

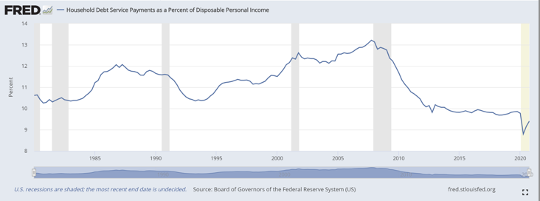

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)

https://fred.stlouisfed.org/series/TDSP