We Don’t Know What We Don’t Know – CV19, Your Investments & a studious Shih Tzu

“Because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.”

Secretary of Defense Donald Rumsfeld

A few short weeks ago we were enjoying a fabulous stock market. The economy was extremely strong, business confidence high, and our portfolios were doing great. More importantly the investment and economic outlook was wonderful, and I was cautiously upbeat, thinking that we were on track for our clients to have a good year in 2020.

And then we got hit with something that we didn’t know that we didn’t know – CV19. Unknown unknowns are risks that come from situations that are so unexpected that you would not anticipate the event or the consequences. Coronavirus CV19 certainly fits that category. It seems everyone is utterly amazed at where we are today. What was inconceivable and preposterous in February – widespread shutdowns, quarantines and cessation of so much activity, is our harsh reality in mid-March.

So how should we think about our Investments & the Economy, about Social Distancing, and What Should We Do?

Our Investments & The Economy

- Up until the end of February, overall economic indicators were extremely strong. The jobs report that came out a few days ago for example was fabulous, and if we were not in the midst of this crisis, we might still be celebrating the remarkable number of jobs created.

- If someone is in sparkling health right before they become sick, they are likely to have a shorter illness and quicker recovery. The US is just like that, we entered the CV19 scare in sparkling economic health, which leaves hope for a rapid recovery. We were part of a conference call with Goldman Sachs analysts a few days ago, and they made just that exact point, and cited the low debt and good savings of the strong American consumer, and most US corporations with robust balance sheets.

- Social Distancing (SD) – while the right thing to do, is bringing the economy to a screeching halt. The US projected GDP for first quarter went from a healthy 2+% down to 0, and the projected 2nd quarter GDP is profoundly negative.

- It is expected that SD will allow sufficient time to deal with CV19 and the expected scenario is that our nation might be back and recovering by the end of this year. Goldman Sachs projects a rapid snapback as the American consumer will be eager to resume traveling, eating out, and that there will be months of deferred spending that may once again boost the economy.

- Let’s not sugarcoat the situation though – things are going to suck for a while, on a personal level and economically, to put it bluntly. Expect more stock market volatility.

- A bright spot for consumers and energy intensive businesses is that oil prices are very low. We may be heading back to gasoline prices that start with a one, if oil prices stay this low, which of course puts more spending money in the pockets of the consumer.

- Interest Rates are Low, which generally is great for bonds, for dividend stocks, for gold and real estate.

Dividend stocks (which most of our portfolios are overweighted to) might be particularly attractive going forward as the yield of US large stocks is now about a percent or more higher than most government bonds and bank CD’s. (please see

- Massive Fiscal Stimulus - The Federal Reserve has cut rates to zero AND is restarting Quantitative Easing (money printing) to help the economy. Stock prices have gone up during every previous QE episode over the last 12 years, let’s see if it happens again. Expect further stimulus from the government in the form of bailouts, tax cuts, and direct payments, if the economy continues to sputter.

- Algorithm based Computer Trading is dominating the stock market and causing huge price swings both up and down. My personal opinion is that these automated trading programs run by large institutions are causing damage to individual investors and unnecessary and unneeded anxiety as they drive prices up and down in a zig zag manner.

- Expect more CV19 cases to be reported in the US, especially since testing is now more readily available. Perhaps previously unreported cases will make the numbers shoot up. If this does happen, it may cause additional fear and more stock market volatility.

Social Distancing & CV19

Up until a short while ago, I had been frustrated with what seems like a grossly exaggerated societal response. CV19 for most of us will be a minor inconvenience if we do catch it. Many people will not even know that they are sick and most of the rest of us will feel like we had a very bad cold for a week or so. Perhaps only 5% or so who get CV19 will require hospitalization.

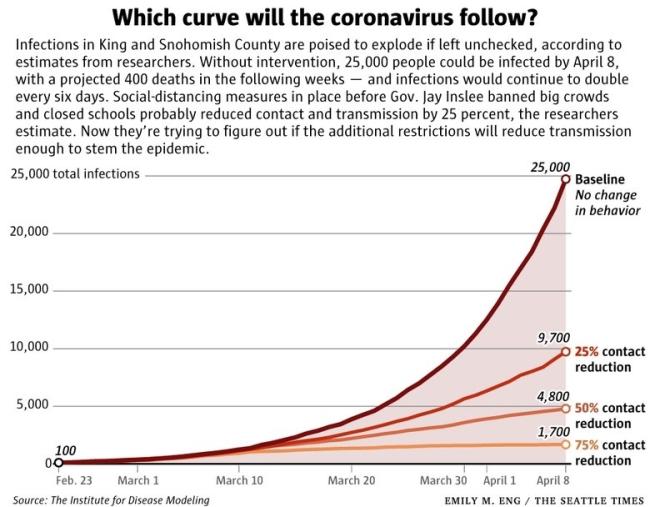

However, I have always considered myself a numbers guy and the math paints a stark picture. CV19 spreads exponentially because of the nature of the pathogen, thus it could only take a few weeks for so many people to become ill that it would completely overwhelm our medical system. Math does not lie and does not have an agenda, and the math of CV spread is disturbing. The numbers of hospital beds and the number of ventilators are limited; 4900 total beds here in King & Snohomish Counties of which only 940 are critical care and of course most hospitals are already filled with other sick patients so their capacity to accept additional patients is limited.

The Institute for Disease Modeling (part of the Intellectual Ventures Lab in Bellevue) has done some work to illustrate how social distancing might impact the spread and number of CV19 cases. Keep in mind that without special measures current thinking is that the number of cases doubles every 6 days.

It seems clear and logical that social distancing and self-isolation is the necessary strategy to follow for our country. We are essentially sacrificing our convenience, and our economic well-being for the 5% or so of the population that CV19 is actually dangerous for. If that 5% includes one of your loved ones or friends, it is a sacrifice worth making.

So the strategy we are following in the state of WA and around the country will be inconvenient and painful in the short run, and there has been and will be continued economic fall-out until the CV19 runs it course. And, after we have gotten through this challenge, we might expect a rapid economic and financial recovery after things get back to normal, as everyone, myself included, will be eager to resume their normal lives.

What Should We Do?

Winston Churchill famously said, “Never let a good crisis go to waste!” There are significant actions and strategies that may make financial sense to consider given the sharp drop in stock market prices and unusually low interest rates.

Rebalance Portfolios: High quality bond prices are up YTD helping to offset some of the fall in stock prices. At some point it may make sense to rebalance portfolios to take advantage of gains in the bonds and reposition those profits back to stocks. A rebalance might be optimum when stock prices have stopped their descent.

Refinance Debt: The rate on government bonds have hit lifetime lows as of the last week of February. Intermediate bond rates are lower than we have ever seen them; expect loan rates to follow. With rates this low you will want to review all your debt; mortgages, HELOCS, HECM, personal loans, asset-based loans, student loans, etc. and see if now is an opportunity to refinance and save on future interest costs. If you call your banker or mortgage broker, it may take some time for them to get back to you. Loan applications soared in February, and there is certain to be a flood of even more new loan activity now. Again, I can’t overemphasize how low rates have gone. This might be a wonderful opportunity to save money by lowering your interest costs. Please feel free to contact us if you want a referral for a mortgage broker, or you would like us to look at the numbers of a refi you are considering.

New Money to Invest:If you have new/uninvested cash, perhaps you might consider adding to your portfolio while the markets are down, and prices are more attractive. Be sure to review your spending and liquidity needs beforehand. The lower prices are, the higher the potential future returns for new money. Warren Buffett said to be fearful when others are greedy, but greedy when others are fearful.

An investor might also want to look carefully for sectors and opportunities that have disproportionately dropped. We have been building an opportunity portfolio of airlines, oil companies, precious metal and entertainment properties for our clients. High risk and highly speculative, but it might also reward investors when we finally get through the CV19 crisis.

Famed value investor Shelby Davis observed… “You make most of your money in a bear market; you just don’t realize it at the time.”

Roth Conversion: If you have been contemplating a Roth conversion in 2020, this might be an opportune time to implement that. The lower prices are, the more shares you might be able to convert for a given dollar amount. When the market finally recovers, the price appreciation rebound inside the Roth IRA might now be tax-free. Many savvy investors have used Roth conversions in past downturns as an important planning tool. (Of course, be careful to check with your tax professional about other tax impacts that might be caused by a Roth conversion.)

Tax-Loss Harvesting: If your non-IRA portfolio has investments with a negative cost basis, now might be a good time to consider if you want to exercise a tax-loss harvesting strategy. Realizing a tax-loss might allow you to save on your taxes, and there are methods to harvest losses and still stay invested in the market. Tax-loss harvesting is an example of turning a lemon into lemonade – creating some good out of a bad situation.

Income & Liquidity: If you have not reviewed your near-term income needs and cash needs for a while, do so now. If you have immediate need for cash, it might make sense to raise a little cash in the portfolio now, in case the markets slump even further. We walked most of our clients through a Robust Income Plan exercise last year to try and plan and prepare for a possible downturn. The goal is to try and match near-term spending needs with our cash and portfolio, and have a well thought income plan and possibly some room and time to wait out a downturn without needing to disturb our investments.

“Less Bad”: Another liquidity strategy is to have a HELOC or perhaps a HECM in place. This is a “Less Bad” strategy. It is not great to have debt, but it might be less bad to draw on some home equity for our spending needs, than it would be to sell investments in our portfolios when the markets are so far down. Your bank might set up a HELOC easily and inexpensively, and this could be an important financial tool in case you need to use it.

Watch Your 401k Stable Value Fund: Review your retirement plan fund options carefully as many plans’ conservative options are tied to prevailing rates. For example, stable value type funds pay interest to investors based on current bond rates. Those types of funds might see their returns drop dramatically in the near future and follow prevailing rates downward. The issue of course is if those types of funds will still be appropriate for a future retiree’s financial goals and needs, given their now lower rates. A review of your allocation and goals might be very important to your financial future.

Transfer Assets to Family: If you have a larger estate and are considering strategies to transfer significant assets to your children and grandchildren, these low rates might provide an incredible planning opportunity. Some types of trust and estate transfer strategies become much more favorable and effective at reducing tax and minimizing the costs of transferring and gifting assets the lower interest rates are. Now might be a great time to confer with an advisor who is knowledgeable in these types of strategies for higher net worth families. Low rates might provide a great window of opportunity to bless your family and save taxes at the same time.

finally…

Be Kind to One Another: One of the (few) blessings of this situation is that it seems to be drawing people together. My wife has commented several times that she has noticed a general increase and sense of kindness in others. In our neighborhood, some of the families have been gathering in our park to pray on Sunday mornings. It is heartening to see the best come out in neighbors and strangers as we all suffer through this.

I feel like I did after September 11th, I now know something that I did not know before, and I did not know that I did not know it. CV19 is tragic, scary and unfamiliar – I wish that we had never come upon this disease.

But just like in the aftermath of Sept. 11th when our country banded together and many smart, driven and service minded folks helped us to recover. I believe with all my heart that our great country will come together in strength and unity to overcome this challenge – and perhaps we will be stronger, wiser and better prepared because of it.

Social Distancing at Gevers Wealth Management

A view from our new webcam

We greatly enjoy meeting in-person with our wonderful clients, and we have a beautiful conference room with a serene outlook onto a greenbelt with deer often frolicking just outside. However, we want to do our part to minimize social contact during the CV crisis. To help with that we just upgraded our conference room webcam, and we are strongly recommending that (at least for now) that all of our clients have our review and planning meetings via video conference or telephone call.

And, when we next see you in person, after this wanes, we will be well stocked with wipes, hand cleaner, and air filters. We will have been practicing our best hygiene practices, we’ll have snacks and treats waiting for you – and we will greet you with a fist bump or an air hug when you get here! We are also doing everything we can to keep ourselves healthy and fit so we can be here to serve you.

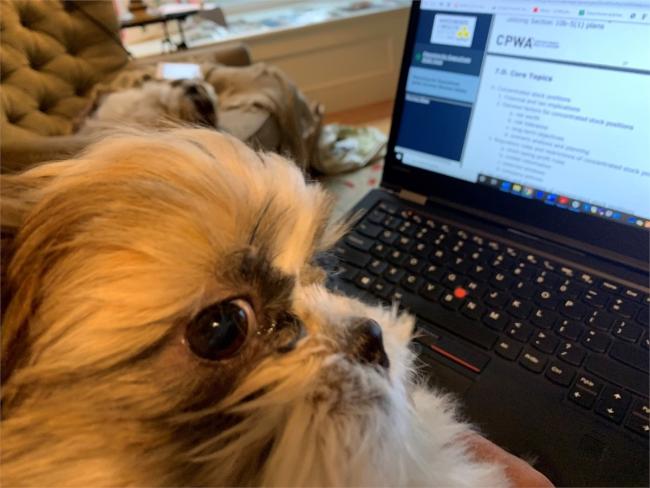

Studying Stock Options with Murphy

Murphy GooGoo Cluster is his name

To finish our letter on a lighthearted note – my wife’s new puppy, a Shih Tzu with the exceptional moniker of Murphy GooGoo Cluster, has been studying diligently with me. I am taking an advanced wealth planning certification course, and the puppy loves to sit on my lap while I read.

There is not a dog in Seattle that is more versed in the intricacies of Concentrated Stock and Stock Option planning, on formation and taxation of Family Limited Liability Corporations, or familiar with Rule 144 stock, 10b5-1 plans & 83b stock elections. If we review one of these wealth management topics at our next meeting, perhaps Murphy can join us to add both expertise and a large dose of amazing puppy adorableness ?

We have been working Saturdays and many nights to try to be completely available to all of our clients. We look forward to our next meeting, and of course please contact us if you have any questions before your next scheduled appointment.

With our Wishes for your continued Good Health,

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback.If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com