Too Hot, Too Cold…What Should I Do? Mountain Biking & Investing

We have had lots of discussion and questions about our latest newsletter “Too Hot, Too Cold…or will the FED get it Just Right?! In summary if the FED is Too Hot on inflation, that might push the economy into a recession and the stock markets might drop even more. But, if the FED is too cold, that might push stock prices up and result in happy investors but continued inflation.

So what to do? We have been encouraging our clients to review their upcoming income needs and raise cash now from their portfolios to fund future withdrawals. That will not avoid the pain of a market drop, but it will buy time and allow you to secure some income for lifestyle without having to sell investments in a potentially worse downturn in 2023.

So which way are we headed, Too Hot or Too Cold? FED watchers’ opinions have been changing almost weekly on that question, and the stock market has zigged and zagged in response.

We have met with many of you to discuss this and raise cash, and this might be a particular favorable time to consider this, as the markets had recovered a little bit this fall.

We can review this at your next scheduled portfolio meeting (if we have not already done so), or please reach out to us if you would like to have a conversation about this sooner. The team will be available through the Christmas season if you need us.

Mountain Biking & Investing

Just came back from a mountain biking trip to Sedona and thought about the many parallels between Investing & Mountain Biking:

With Risk comes Rewards: One day we rode the Hi-Line Trail which I thought was rated black diamond. It was actually a double black, which is incredibly difficult and a little dangerous. We did it anyway, and as a consequence we enjoyed incredible views and exhilarating scenery that was far better than from the easier flatland trails below us. Similarly, investors that are willing to take the risks of owning stocks have often been rewarded greatly over the long haul.

With Risk comes Rewards – Part II: On Hi-Line, I rolled down some rock walls that had higher consequences and much sketchier than anything I had ever done before. I have been mountain biking for a long, long time, but am a slightly cautious middle-aged rider. Nonetheless, I tried some difficult features which I cleaned. I’m still glowing with the thrill of that a week later. I did not crash, and although a bike crash is rare it sure hurts. Stock market crashes are also rare and infrequent, and also hurt while they are happening. The rewards over the long term far outweigh the crashes, both the potential growth of wealth from investing, and the sheer joy of cycling in the wilderness.

A Good Mountain Bike is like a Well-Diversified Portfolio: I ride a beautiful, full suspension carbon mountain bike with amazing technology that allows me to take more risks, and ride features I could not do on a lesser bike. In much the same way a well-diversified portfolio may help you ride out some of the rough times and tribulations of a bad stock market like the one we are experiencing right now, or like the horrible 2008-2009 downturn. Diversified portfolios that are based on data-driven design and historical trends may help an investor, just like my amazing bike helps me when I ride.

It helps to have an Experienced Advisor Coach you through Difficult Times: My son Spencer is a superb mountain biker, extremely skilled, and also a gifted teacher and encourager. He helped me to ride things on those Sedona trails that I had never done before. If he had not been there with me both coaching and encouraging, I would not have accomplished those difficult trails on my own. In the same way, an excellent financial advisor relationship may help a client achieve goals that they might not have been able to reach on their own without the appropriate coaching encouragement, and planning through both good markets as well as bad ones.

Spencer Gevers and I had a fantastic week of riding in Sedona, Arizona. The trails are amazing, views incredible and the geography of the area is stunning. It was wonderful to get some sunshine in the middle of a cold, dark Seattle winter! Big thanks to Thunder Mountain Cycles in Sedona and Downhill Zone in Issaquah for help and support on out trip.

Last but not least from the team at Gevers Wealth Management, LLC – Merry Christmas & Happy New Years! Wishing joy to you and your family during this wonderful season. We look forward to seeing you soon.

Warm Regards,

Willy Gevers

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him."

Dwight D. Eisenhower

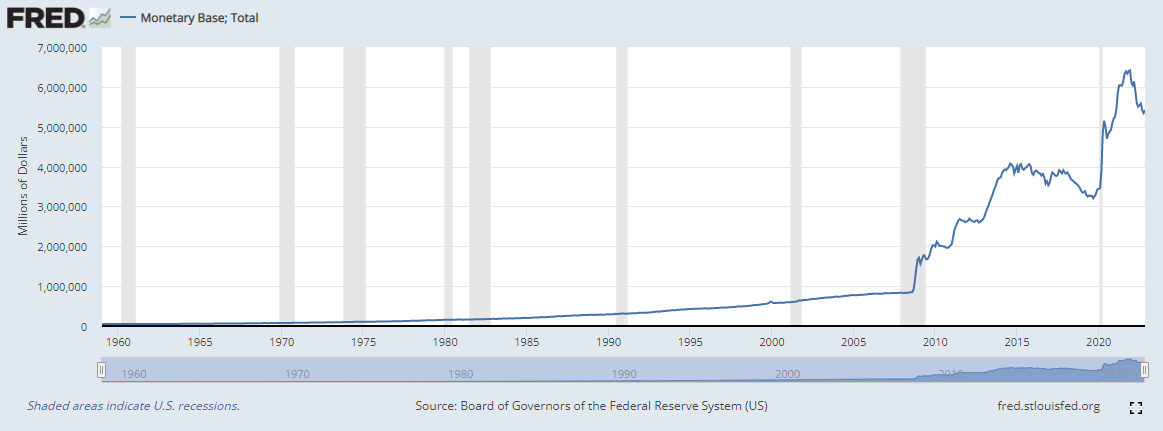

US Money Supply –Monetary Base

https://fred.stlouisfed.org/series/BOGMBASE

US Dollar Price – (DXY) USD Index measured against other currencies

(http://www.barchart.com/chart.php?sym=DXY00&style=technical&template=&p=MC&d=X&sd=&ed=06%2F11%2F2015&size=M&log=0&t=LINE&v=0&g=1&evnt=1&late=1&o1=&o2=&o3=&sh=100&indicators=&addindicator=&submitted=1&fpage=&txtDate=06%2F11%2F2015#jump)

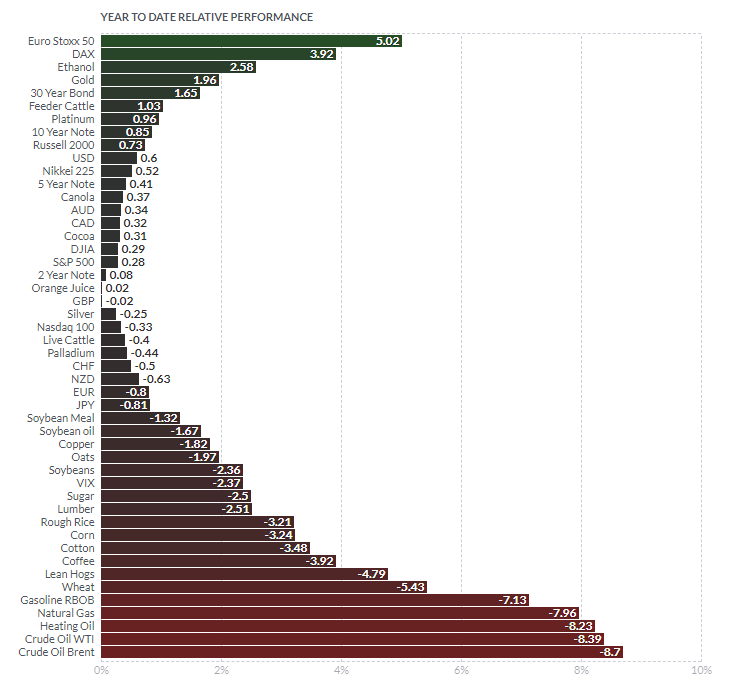

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

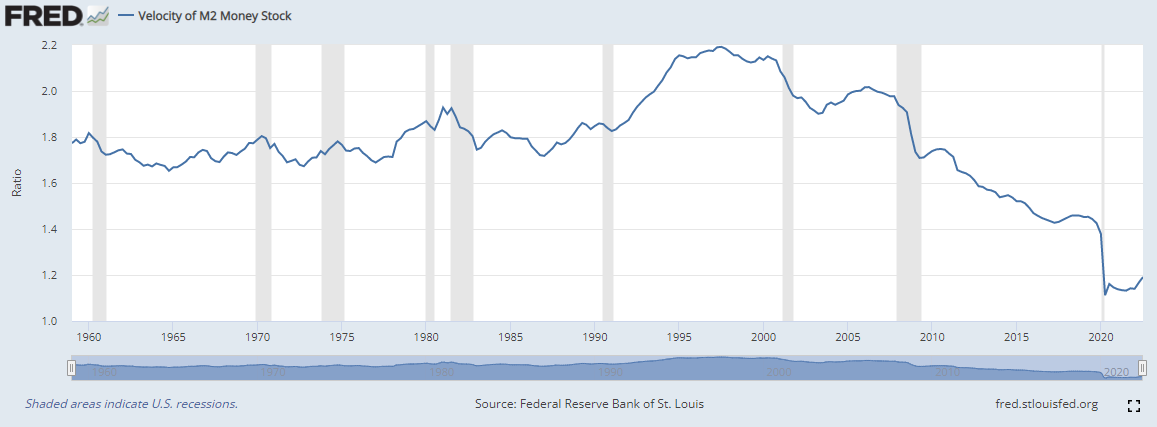

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Paul

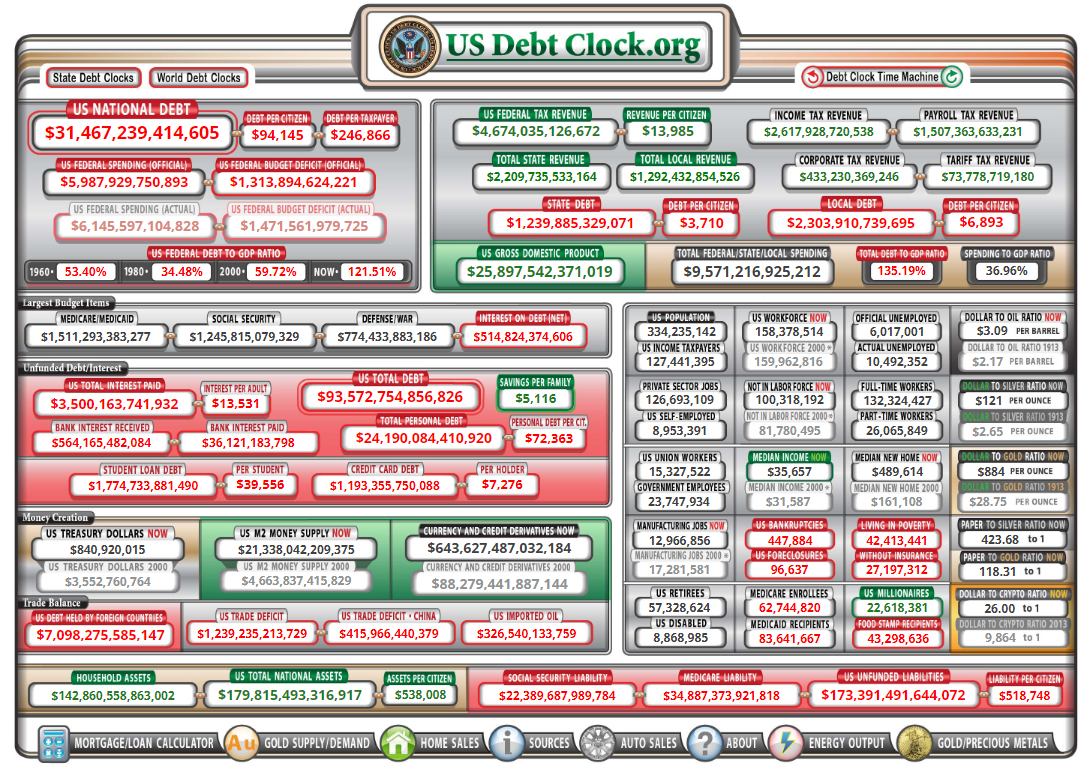

Total US Debt

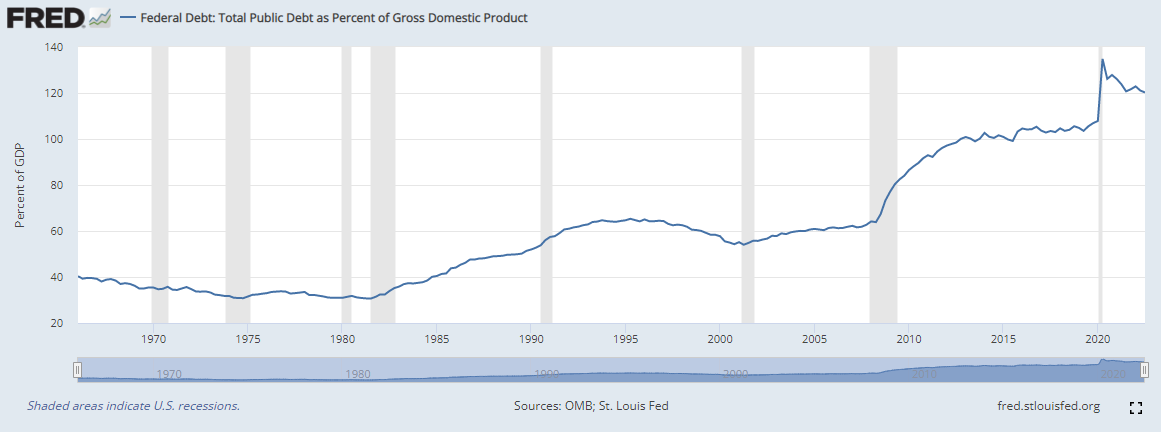

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

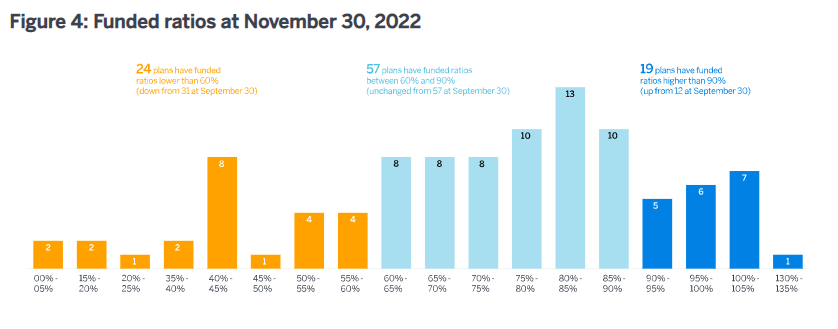

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

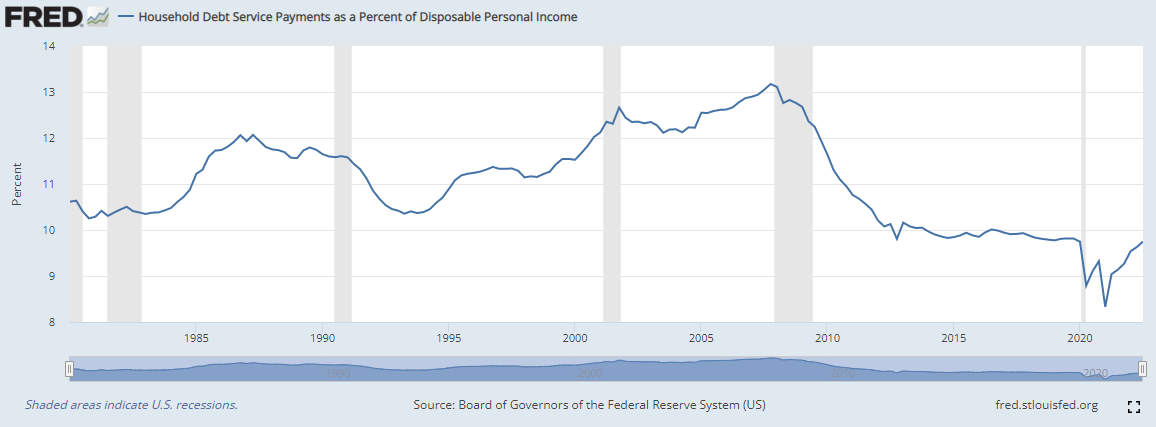

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)