There’s a Bear in our Backyard! – Three Kinds of Bear Markets

Summer 2022

My wife looked out of our kitchen window and yelled in surprise – “There is a bear in our backyard!”

A large black bear was rollicking about in our Issaquah suburban yard, dashing from one side to the other, seemingly in a very happy and playful mood. We watched him in amazement and laughed at his antics.

At one point as he galloped through the bushes, he was garroted by a string of outdoor lights which swept him off his feet, and of course took down all of our lights and their poles. When Mr. Bear recovered from his dramatic fall, he took out his embarrassment and injuries on a good-sized tree which he ripped down with several powerful blows. After circling the carnage and carefully inspecting his trail of destruction, he huffed and stomped off. We later learned from our neighbor that the bear had gorged on overripe plums right before heading to our home, so we suspected he might have been a little inebriated before rampaging through our yard. Mr. Bear left us with a giant mess to clean up, and an unforgettable experience.

Another bear is currently making a mess of our investment portfolios – a Bear Market.

Investors are asking lots of questions right now. How long do Bear Markets last? What causes Bear Markets – and what about recessions? What should I do in a Bear Market?

Three Types of Bears

The bear that ravaged our backyard was an Ursus Americanus (black bear), but there are many other types of bears that differ in size and behavior and danger. You could think of Bear Markets in the same way. I would suggest that there are three common types, a Recessionary Bear Market, a Black Swan Bear Market, and a Financial Crisis Bear Market.

-

Bear Markets and Recessions

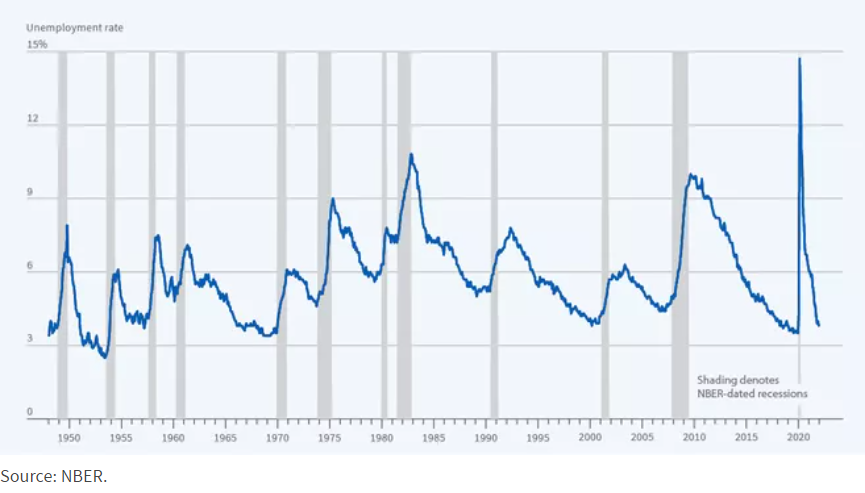

A recession is a period of slowdown in economic growth. My macro economics professor at the UW explained to us that when Gross Domestic Product (GDP) the most prevalent measure of our economy, is negative for two consecutive quarters, that is the criteria for a recession. It’s important to remember that recessions happen frequently and are a normal and necessary part of the economic cycle. There have been about a dozen recessions in the US since 1950 as you can see from the chart below. The gray shaded areas denote a recessionary period. Notice also that Unemployment (the blue line) usually increases during a recession.

Recessions in the United States since 1950

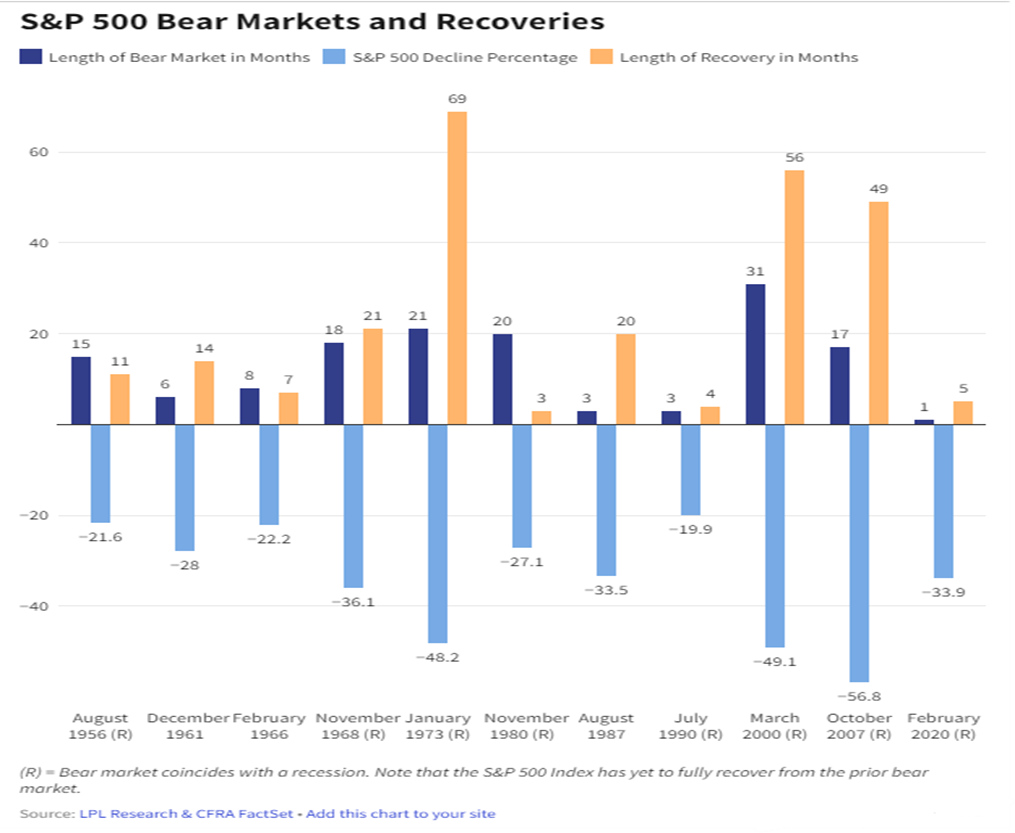

When economic growth slows down during a recession, corporate earnings usually suffer, and this leads to stock prices dropping and sometimes a Bear Market. You can see from the chart below that many of these stock market downturns (but not all) were associated with a recession.

(Most – but not all Bear Markets – happen during recessions.)

Recessions are a normal cyclical event. Just like winter precedes spring and is necessary part of life, a recession has healthy long-term effects for the economy. Capital may be diverted away from poorly performing companies and sectors and may instead flow to more profitable or promising areas.

New companies often spring out of recessions. Titans of industry like GE, GM, Disney, IBM, Hewlett Packard, Trader Joes, Fed Ex, Microsoft – were all founded during gloomy economic periods.

Because they are a normal cyclical event, they also tend to be over quickly. Investors fully recovered from most Bear Markets in 20 months or less.

Generally, Bear Markets are relatively short, and set the table for the next Bull Market, which often last a longer time, and are when most investors create wealth.

So here is the lesson for investors, if this Bear Market is like many other recession caused ones we have lived through – then don’t fret about it. It is normal, it may be over relatively soon, and it may be the precursor for the next Bull Market.

2. Black Swans and Bear Markets

A “Black Swan” is an event that is completely unexpected and unpredictable and has widespread and severe consequences. In financial terms, a Black Swan event is one that was not expected or anticipated, and wreaks havoc on the stock market – often causing a Bear Market as a result.

We can all recall some dramatic Black Swans in our recent past. Who would have imagined that a group of madmen would fly multiple commercial airliners into the World Trade Center and the Pentagon on the same day? Who would believe that the entire world would be shut down for over a year because of a pandemic? Both 9/11 and CV19 were Black Swan events and in both cases the stock market suffered a tremendous beating.

Although the stock market reaction to a Black Swan event like 9/11 is swift and brutal – the good news is that recovery is usually just as quick. The US stock markets fully recovered from 9/11 in a few weeks, and from the pandemic in about 5 months.

Will we have another Black Swan event? Most assuredly. We know that because we just don’t know what can happen in the future.

What is the lesson from history for investors when the next Black Swan and accompanying stock market plunge happens? If they are like previous events, then don’t panic, hang on and wait. It may be over almost as quickly as it started.

But what if the stock market is dropping for reasons more than a normal recession or a Black Swan?

3. Bear Markets and Financial Crisis

In early 2007 I felt that something was going seriously awry with the financial markets. I wrote a very long letter to our clients and outlined some of my concerns. (Some Thoughts on Risk, or… “When the tide goes out, you get to see who is swimming naked.” May 2007) We decreased bank and derivatives exposure in our portfolios, and it helped lessen the blow of what turned out to be one of the worst financial calamities since the Great Depression. The Bear Market of 2008-2009 was caused by innate and systemic flaws that almost led to the collapse of the global banking system.

There have been perhaps only two great financial crises in the last 100 years – the Great Depression in the 1930’s and the Great Financial Crisis of 2008. Both had the potential to cause global economic collapse, and both had severe financial consequences attached to them.

Is that what is happening today? There are always risks for investors, but perhaps today’s risks are not as obvious and potentially damaging as were present in 2008 preceding the Great Financial Crisis, and before the Great Depression.

A huge risk issue for investors to watch closely is the massive expansion of the money supply and how that plays out in our future. Our country’s reckless and explosive increase of USD has had many consequences, some good and some bad.

The Fed now stands at the crux of a dilemma; do they continue printing money and suppressing interest rates to try and keep the economy growing – OR - do they start to start shrink the money supply (they are calling it Quantitative Tightening/ QT) to try and tame inflation at the expense of lower stock and real estate prices?

As of now, the Fed has chosen the latter and it seems to be resulting in drooping stock and bond prices and a significant drop in our portfolio values. The monetary decisions they make will be the major determinant in not only the stock market direction, but also inflation and the direction of the USD. We will want to continue to watch this closely.

What is the lesson from history regarding financial crises like the Great Depression? Unfortunately, it is difficult if not impossible to avoid damage during periods like these. The prosperity of the country as a whole drops, and many people suffer. During times of great financial stress, alternative investments may act as a hedge for our portfolios. For example, gold performed very well during both the Great Depression and the Great Financial Crisis. We have maintained a gold allocation in most of our portfolios for just such a reason.

To be clear, most analysts do not believe that we are in a financial crisis of the magnitude of the Depression or 2008, however, it is quite possible that the Fed’s monetary policies could cause more problems in the stock market going forward, at least until interest rates and inflation move back to some sort of equilibrium.

We are in a Bear Market today, and possibly in a recession as well. So, what should an investor do?

Action Items

First, the fundamentals of successful investing should always be our guide; have a well thought out diversification plan, know your portfolio and your personal risk levels, have a rebalancing protocol in place, review your financial goals in light of current market conditions.

You may also review your portfolio and see if any adjustments are necessary. For example, Value/dividend investment have been outperforming Growth stocks by a large margin this year.

US Stock YTD Returns by Size and Style

(source: Bloomberg & Goldman Sachs Management as of 6-10-2022)

Value and dividend stocks also have a history of performing well in inflationary and higher interest rate environments like the one we are now in. If you are underweighted to Value (as most people seem to be) you may be missing out. We have made several tweaks to our model portfolios for just those reasons.

We can also make some lemonade out of the lemons by taking advantage of robust tax-loss harvesting. When our investments are down, we may be able to realize tax losses, without impacting the portfolio, and those tax losses may help us to reduce future income taxes and capital gains taxes, and put some tax dollars back in our pockets.

We also want to be alert for special investment opportunities. Our clients remember the Opportunity Portfolio we created in early 2020 to take advantage of unusually depressed prices in oil and airlines, and which subsequently turned out to be very profitable. Perhaps a down market will again give us an opportunity like that.

There are also some actions specific to what type of investor you are; Taking Withdrawals, No need for Withdrawals, Adding new Money.

The “Taking Withdrawals” Investor who regularly uses their portfolio for income has to be wise about bear market planning. At our firm we like to say that “You can’t time the market, but you can time your income.” We want to project our income and spending needs for at least a year or two into the future and have a plan in place for where to take those withdrawals if we are in a bear market. Many of our clients have a year or more of their cash needs in their portfolios, and maybe even another year or more in low-risk investments or cash. If you look back at the last chart above you can see that most Bear Markets were over in less than 20 months, but occasionally lasted three+ years. If we have planned our income needs for the next two or three years, we may be able to outlast a Bear Market without having to sell any investments, putting us into a position to benefit from the next Bull Market.

The “No Need for Withdrawals” Investor needs to exercise patience. Even though they may not need to withdraw anything, it is still painful and uncomfortable to watch the value of your portfolio dwindle. Make sure you have a well thought out plan and discipline, and then wait for conditions to improve and for the next Bull Market to begin.

The “Adding New Money Investor” is in the sweet spot and should be cheering with joy at the downturn in stock prices. Remember that risk decreases in proportion to the price you pay – the cheaper you can invest at, the higher the potential return. Remember also though that stock prices could drop even more, a lesson that we learned after the 2000 tech crash. Some of the largest and most successful tech stalwarts plunged in value in 2000 – and then kept dropping even further, eventually bottoming out at 80% or more below their previous highs – a stunning loss in value.

NASDAQ Chart

If you invest new money in a Bear Market, you may need patience – but your patience might be greatly rewarded.

We will review your portfolio and plan at our next review meeting, and of course we are always available to discuss by Zoom or phone before your next scheduled appointment.

In summary – Bear Markets can be caused by recessions, Black Swan events or financial crisis. They tend to be over in a few years (or less) and they set the stage for the next Bull Market.

I’ll be looking for the next Bull… but I just don’t want one in my backyard, it took too long to recover from our Bear attack!

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2022 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

NOTE: Rebalancing may be a taxable event. Before you take any specific action be sure to consult with your tax professional. Asset allocation is an investment strategy that will not guarantee a profit or protect you from loss. A diversified portfolio does not assure a profit or protect against loss in a declining market.

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

US Money Supply –Monetary Base

https://fred.stlouisfed.org/series/BOGMBASE

US Dollar Price – (DXY) USD Index measured against other currencies

Inflation/Deflation: Year to Date price change in commodities as measured by futures

http://www.finviz.com/futures_performance.ashx?v=17

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

https://fred.stlouisfed.org/series/M2V

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices, stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Paul

Total US Debt

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)

https://fred.stlouisfed.org/series/TDSP