Tax Preparation, Tax Hikes & Hiking the Pacific Crest Trail

Winter 2021

What will you need to prepare your taxes this year? Here are a few of the items that you might require from your investment accounts, and where and how you can find them.

IRA (and other qualified) accounts:

- Distributions: If you took a distribution last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return. If you are a seasoned investor, please remember that because of the CARES Act you may not have needed to take a Requirement Minimum Distribution in 2020. In addition, the new age to start your RMD is age 72 (it was formerly 70 ½.)

- Rollover or Transfer: If you did a rollover or transfer last year, this is typically a non-taxable event. The surrendering custodian, i.e., the place where the money was transferred or rolled over from, will send you a form indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return.

- Sales, Reinvestments, Purchases or other Re-allocations: These are typically not taxable events inside a tax-deferred account like an IRA, and you may not need or receive any tax documents regarding these.

- Roth Conversion: If you did a Roth Conversion last year, the IRA custodian will send you a form (1099R) indicating the amount. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return. We did many more Roth conversions in 2020 than normal to try and take advantage of the market downturn, and/or the waiver of the RMD requirements.

- IRA or Roth IRA Contribution: If you made a contribution, the IRA custodian will send you a form indicating the amount and tax year the contribution was credited for. You should receive this in the mail in February. Please retain this form and give to your CPA/accountant for preparation of your tax return.

Non-IRA/Taxable Accounts:

If you had interest or dividend income, you will receive a 1099 from the custodian in February. Please retain this form and give to your CPA for preparation of your tax return.

If you sold securities during the last year, you may need a Realized Gains/Losses Report:

- If you have an advisory (fee) relationship with us, you will automatically receive a realized gain/loss report for those accounts in the mail in February. Please retain this form and give to your CPA for preparation of your tax return. If you are on e-delivery for your statements, you can also access these reports through your dedicated web access.

- If you have a brokerage (non-advisory) account with us at Pershing, then you will receive a realized gain/loss report directly from the custodian for any sales you may have made during the course of last year. You should receive these reports by mid-February. If you are on e-delivery for your statements, you can also access these reports through your dedicated web access. If you have an investment made many years ago, cost basis may need to be manually input. Although we will make every attempt to help document estimated cost basis, sometimes that information is not available or incomplete, especially for investments made years ago, when investment tracking software was not always as robust as current technology. Your CPA may be able to help you with lost/missing cost basis documentation.

- If you have an investment held direct at a mutual fund, the fund company will prepare and mail you a realized gain/loss report for those accounts in February. Please retain this form and give to your CPA for preparation of your tax return.

- K-1: Some investments may send you a K-1. Please see your CPA/accountant regarding proper filing of these. Please note that the investment manager will typically send K-1s to all investors regardless of what kind of investor type they are. If you receive a K-1 for an investment that you own inside a tax-deferred account like an IRA, you may not have to file that K-1 with your tax return because of the tax-deferred nature of the IRA. Professional advice from your tax-preparer is important here.

Trust Accounts

Trust accounts typically require the same information as Non-IRA/Taxable Accounts (please see above.) There may be additional reporting necessary to complete a tax return for a trust depending on the nature of that trust. We will work with your CPA to help provide any information or reports that may be required.

“The Internal Revenue Code is about 10 times the size of the Bible – and unlike the Bible, contains no good news.”

- Don Rickles -

Potential Delays of 1099s:

Timely delivery of 1099s has been an ongoing problem in the custodian world. Investment custodians like Pershing have sometimes struggled to meet their January 31st mailing deadline for 1099s and sometimes even file an appeal to extend their filing date. This is especially challenging for the custodians in years which Congress passes last minute tax bills (like they have done several times in the last few years!) Watch for your 1099 from Pershing in early February – but don’t be surprised if it is a few days late. Custodians like Pershing have sometimes filed amended or corrected 1099s after sending the original 1099. We will also receive electronic copies of your 1099s in our office.

Contributions to IRAs/Roth IRAs:

If you are eligible and want to make a contribution for 2020, you have until April 15th (but please do not wait that long!) or when you file your tax return to make a contribution. Please call us if you need help with this. A note for 2021; the contribution limit for taxpayers has not changed and is the same as it was in 2020 at $6,000 per year, or $7,000 if you are over 50.

“Worried about an IRS audit? Avoid what’s called a “Red Flag.” That’s something the IRS always looks for. For example, say you have some money left in your bank account after paying taxes. That’s a Red Flag!”

- Jay Leno -

Our whole team is ready to help you and your CPA with your 2020 tax preparation, and of course please feel free to call us if we can help in any way.

Tax Hikes?

Watch for tax changes, both corporate and personal in 2021. The democrats now have control of all three branches of government and have announced that they will raise taxes. We follow and read several tax attorneys and tax specialists, and if and when tax law changes, we will analyze them as well as any strategies to try and mitigate or avoid new or higher taxes. We can review these with you at our review meetings and this may be an important part of our meeting agendas for 2021.

Some of the changes that have been discussed include; increase in the corporate tax rates, elimination of the step-up in basis when someone passes, a major change in 401(k) plan taxation where the individual participant gets only a tax-credit and loses the tax-deduction, rescission of the 2017 Tax Cuts and Jobs Act, and perhaps lots of other unpleasant surprises.

Reducing and or/avoiding taxes becomes increasingly more valuable and significant the higher tax rates are, and the more complex the tax code becomes. We work closely with our client’s CPA’s to try and look for strategies to lessen tax burdens. We frequently help our clients analyze and implement tax-efficient portfolio distribution strategies,tax-loss harvesting and tax-efficient portfolios, Roth conversions, optimization of company Qualified and non-Qualified plans, and Medicare Means threshold planning. We also are familiar with using trusts in tandem with income tax strategies, with charitable tax strategies, both current and deferred, and with stock options and timing and selling and exercise strategies – again all with the goal of reducing or avoiding taxes.

And, our whole team gets excited about finding ways to help our clients become better off!

Moving on from Tax Hikes to Hiking…

High Above the World on the Pacific Crest Trail

My wife Vivienne and I spent a week backpacking the Pacific Crest Trail at the end of last summer. We swam in impossibly clear mountain lakes and bathed in frigid Alpine streams. Trudged cautiously on the crest of knife-edged ridges overlooking Mt. Rainier and vast forests of evergreens. Gorged ourselves as we wandered through lush meadows chock-full of wild blueberries. Huddled in our tiny ultralight tent through a high-altitude downpour.

Of course, I did my usual overscheduling of commitments and worked until way past midnight on a project the night before we left, and so consequently hiked the first day on only a few hours of sleep. I powered through it but thought of my friends who went through Army Ranger school - I could barely put up with the sleep deprivation for one day and it increased my respect for our friends and family in the military. A little humor from the first afternoon; when we got to our campsite, we made a quick meal and were both so beat that we immediately crawled into our sleeping bags. Vivienne woke up several hours later and nudged me sleepily and said, “is that a full moon? It’s really light in here!” I laughed at her and told her no, that the sun was still up, and it had not even gone down yet! The travails of middle-aged office workers trying to make it in the wilderness.

(High Above Chinook Pass on the PCT)

We were also inspired by the through-hikers, adventurous souls who commit to hiking the entire 2653-mile trail. They begin their trek in early spring at the border of Mexico. The successful ones traverse the penultimate WA section by August. One memorable evening we camped out in a mice-infested ancient log cabin with a group of other through-hikers and shared stories about adventures on the trail. We met bankers, architects, adventure athletes, and unemployed wanderers, all dedicating six months to suffering, adventure and the experience of a lifetime.

Please don't be concerned about me departing on a quixotic trek! My wife and I do not have any desire to quit normal life to join one of these quests. It is however very inspiring to watch ordinary people transcend levels of effort that are almost unthinkable, hiking 20+ miles a day for months at a time all while carrying food, shelter and supplies on their backs. It makes my air-conditioned lovely offices with a refrigerator stocked with food seem decadent and hedonistic in comparison.

(Lunch on the trail; salami, couscous and dried fruit)

The freedom to be able to untether, even for a week. To revel in the beauty of the creation and the wondrous outdoors. To have your time and activities stripped down to the bare essentials of life, walking, setting up camp, sleeping and eating, this ascetic discipline is refreshing. The physical challenge is somewhat difficult, but brings a sense of empowerment and renewed focus, vigor, and clarity for life. It's something my wife and I greatly enjoy and treasure. We have been scheduling one long backpack trip per summer, often times on a section of the Pacific Crest Trail. When we depart the trail and arrive back home, I feel focused energized and have a renewed zest for life.

So, what’s the connection to investing? Here is where I sheepishly reveal my geekiness. Listening to podcasts while hiking is what I enjoy. I wander the trails of the Cascades listening to hedge fund managers, economists, personal finance gurus, currency analysts, professional athletes, pastors and other thought leaders. I sometimes feel that it’s like taking a class in the woods and find that I bring back creative thought and passion to my work helping highly compensated executives with their wealth management planning, needs and goals. Call it CE in the Trees!

By the numbers:

Miles hiked: 79 (Strava)

Longest day: 18.2 miles

Number of hours of podcasts: lots

Blisters: one

Pounds lost: 6 1/2

First meal afterwards: burgers at Issaquah Sunset Alehouse ?

Special thanks to our corporate sponsor, Super Jock n Jill (https://www.superjocknjill.com/) who provided footwear and clothing. A shout out to owners Chet and Judy and the team. Visit their Redmond or Green Lake stores for the best running and walking shoes and friendly and expert service.

We look forward to seeing you soon for your next review meeting.

Warm regards,

Willy Gevers

PPS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

The return and principal value of bonds fluctuate with changes in market conditions. If bonds are not held to maturity, they may be worth more or less than their original value.

Please note: Cetera Advisor Networks LLC is not registered to offer direct investments into commodities or futures. Instead, we provide access to this asset class via mutual funds, exchange-traded funds (ETFs) and the stocks of associated companies.

Investments in commodities may be affected by the overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments. Commodities are volatile investments and should form only a small part of a diversified portfolio. An investment in commodities may not be suitable for all investors.

Copyright 2021 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

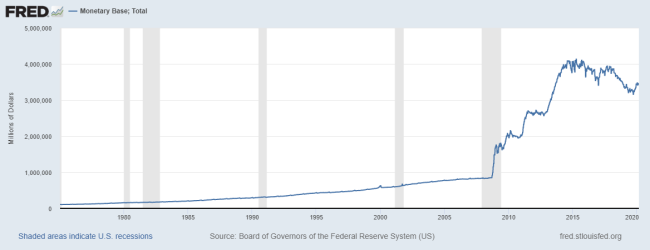

US Money Supply –Monetary Base

(https://fred.stlouisfed.org/series/BOGMBASEW)

US Dollar Price – (DXY) USD Index measured against other currencies

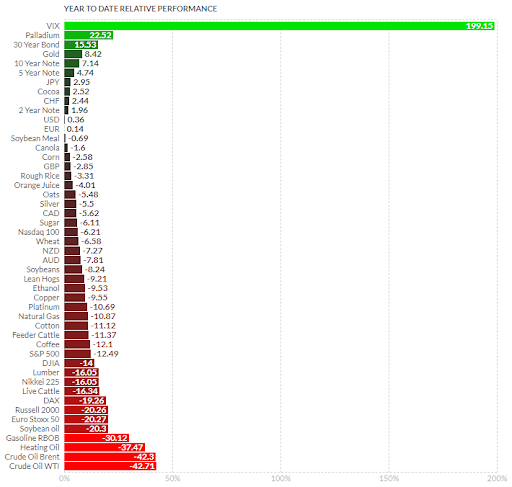

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

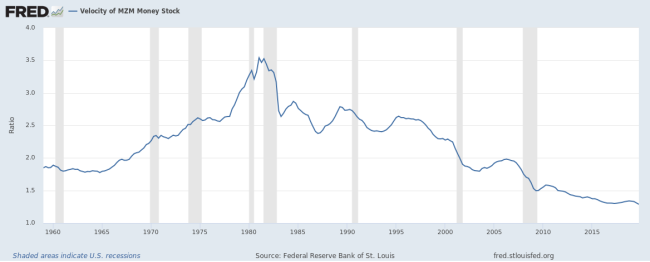

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

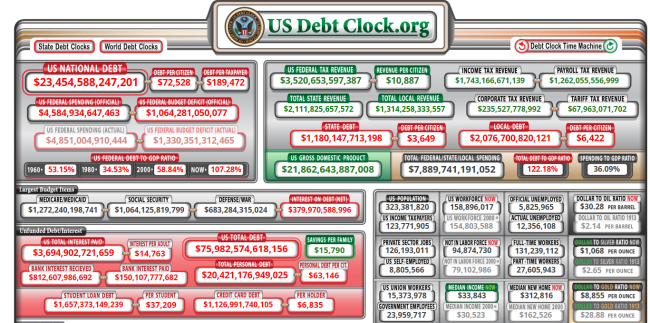

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Paul

Total US Debt

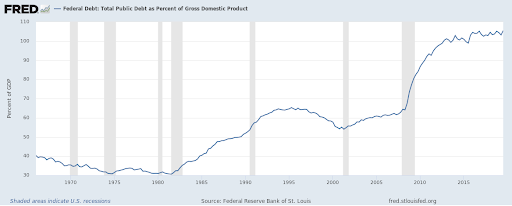

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

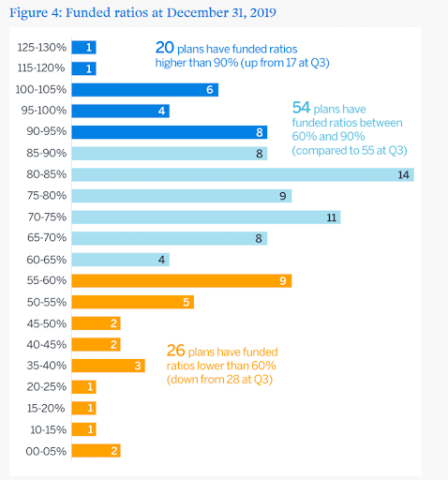

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.) http://www.milliman.com/ppfi/

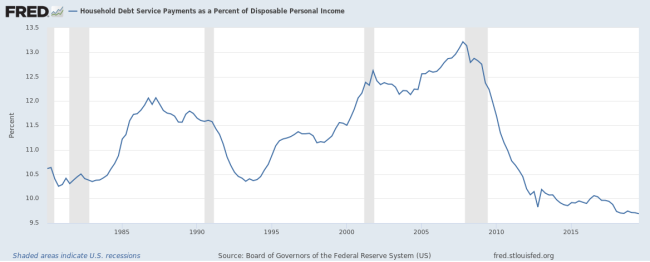

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)

https://fred.stlouisfed.org/series/TDSP