Some Financial Advice from the Steve Miller Band

“This is a story about Billy Joe and Bobbie Sue

Two young lovers with nothin' better to do…

…Billy Joe shot a man while robbing his castle

Bobbie Sue took the money and run”

Believe it or not, these catchy lyrics not only point to Steve Miller’s lyrical prowess but also to an effective strategy to help manage income in volatile markets. If you have planned portfolio withdrawals in the near future, you may want to follow in the footsteps of Bobby Sue: take your money and run!

Let’s take a look at our current environment and see if this is the right time to utilize this classic rock themed strategy.

In a market where the word recession is thrown around like a football, many are puzzled by the impressive performance of major indexes this year. The S&P 500 and the Nasdaq are both surging through the year up ~17% and ~34% respectively. I’ll never be one to complain about a hot market, but it is unusual given the recent volatility and economic environment we’ve experienced. The markets seem to be defying the downward drag of recessionary fears, interest rate hikes, and decreased profit margins & growth.

From a distance, it might look like a market that is immune to the macro headwinds it faces. But as we dig a bit deeper into the numbers, what you’ll see is a group of approx. 5-7 companies that account for a vast majority of the overall return. In fact, top index analysts from S&P Dow Jones Indices showed that if the top seven companies were removed from the index, the market would be slightly underwater for the year.

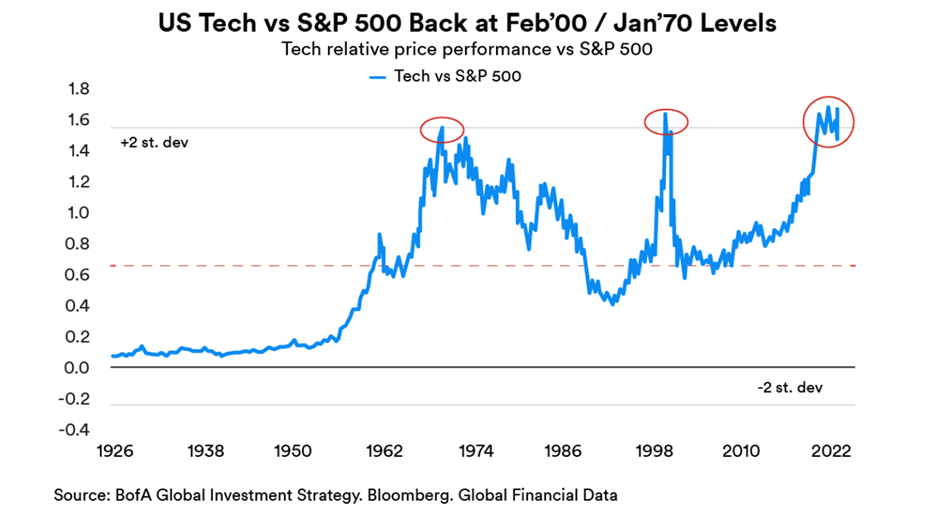

It's not unusual for a core grouping of companies to do the heavy lifting for the overall market. Since the S&P 500 is a market cap-weighted index (meaning that the largest companies have the most sway), this is a common occurrence. The recent heavy lifters have been FAANG (Facebook, Apple, Amazon, Netflix, & Google). In the late 90’s the “Four Horsemen” comprised of Microsoft, Cisco, Oracle, and Intel led the charge into the new century. Looking even farther back, the “Nifty Fifty” had a significant role in market returns during the 1960s and early 1970s.

If you look at the other 493 companies that are included in the index, only ~50% of those have shown a positive performance in 2023. The role of these top companies regarding overall market return hasn’t been this influential in 20 years.

In addition to this, the growth (in terms of share price) of these technology companies is moving at a pace that has created inflated valuations. Typically, a higher valuation environment could indicate a period of lower expected returns.

higher valuation environment could indicate a period of lower expected returns.

So what does this mean, and how does this apply to you?

As is the case in nearly every economic climate, the most prudent decision is to stay the course and stay invested. History has shown us that enduring the choppy waters is the key to enjoying smooth sailing. We have made several slight changes to our investment strategies and are happy with how they are positioned for current market risks, and we are ready to make future changes as needed.

For our clients who need to take withdrawals from their investments or have planned major expenses coming up, we may want to consider raising some cash to cover this. With uncertainty in the markets, we want to be swift and decisive with what we do know to be certain: your need to withdraw from your portfolio. It’s a great time to consider capitalizing on market opportunities and mitigate the risk of having to pull from your portfolio in a down market.

We are by no means foreshadowing a recession or bear market but rather highlighting the opportunity to capitalize on the current market conditions for your next 1-2 years’ worth of portfolio withdrawals. It may be a good time to take the money and run.

We hope for good markets for the remainder of the year but if things were to take a dive, we are confident that our portfolios are positioned for a downturn. Our goal is to always be on the lookout for opportunities to maximize our client’s finances similarly to how we have in past downturns (you may recall our “Eight Financial Strategies for a Downturn" from 2020).

On another note: I’ve had an amazing time getting to know many of our clients at Gevers Wealth. One of our foundational values is creating lasting relationships with our clients in the process of helping them achieve their goals. I would love the opportunity to get to know you better and, as part of our team, guide you in living an intelligent financial life. I will add a link to my calendar down below where you can directly schedule a meeting with me. Whether you have questions regarding your financial life or this newsletter, want to schedule a semi-annual review, or just want to get catch up, I’d love to meet with you.

https://calendly.com/treygevers/60min?month=2023-01

Summer has arrived, and I hope that you get to enjoy the sunshine with the people you love most!

Best,

Trey Gevers

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

The views in this letter are not necessarily the opinion of Cetera Advisors Network LLC and should not be construed directly or indirectly as an offer to buy or sell any secuirites mentioned herin. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be garaunteed. Past performance does not guarantee future results.

https://leverageshares.com/en/insights/tech-now-massively-overvalued-a-turn-could-be-imminent/

https://www.axios.com/2023/06/01/sp500-tech-companies-stock-price