Presidents, Prices, Printing & Hugs and Kisses in Sedona – What to Watch for the rest of 2020

Summer 2020

Questions from the Field:

During the course of teaching seminars, writing articles and newsletters, and meeting with clients we hear lots of questions. We will try to address some of the more timely and relevant questions that investors, executives, and retirees are asking us. A question we have been asked a lot in recent weeks:

Q: Why is the US Stock market doing so well, when the economy is still mostly shut down?

As of mid-summer, the US stock market is close to recovering from the CV drop, and about at the same price that it was at in Fall 2019 – yet economic numbers like unemployment and GDP are still gloomy. How do you explain the upturn? There are powerful factors at play that help us to understand what is going on in the markets and bear close watch as we head into the last half of the year. Let’s look at Prices, Presidents, Printing and also savings and interest rates and see what story they tell us.

Stock Market Prices Go Up Before the Economy Recovers

In our investing lifetimes, the US stock market almost always recovers before the economy does. We have experienced numerous recessions since 1953. In almost every one, the SP500 stock index bottomed out 11 months (or less) before the recession was officially over, according to data from Strategas Research Partners. Perhaps what we are seeing now is the market pricing in a future recovery, just as it has many times in the past.

Let’s examine some of the powerful factors that might continue to power a recovery – and lets also look at some negative scenarios that could hurt our investments.

Family Income is going Up. Unemployment Benefits > Wages

More than two-thirds of Americans who are unemployed as a result of the coronavirus pandemic receive more money now through expanded unemployment benefits than they did through their ordinary wages according to researchers at University of Chicago's Becker Friedman Institute.

The first time I heard this I was astonished, and found it hard to comprehend. Many wonder if Congress was too generous with their rescue plan. But with the government’s largesse, many middle-class families have income to spend now. So, what are they doing with all that income? They are…

SAVING

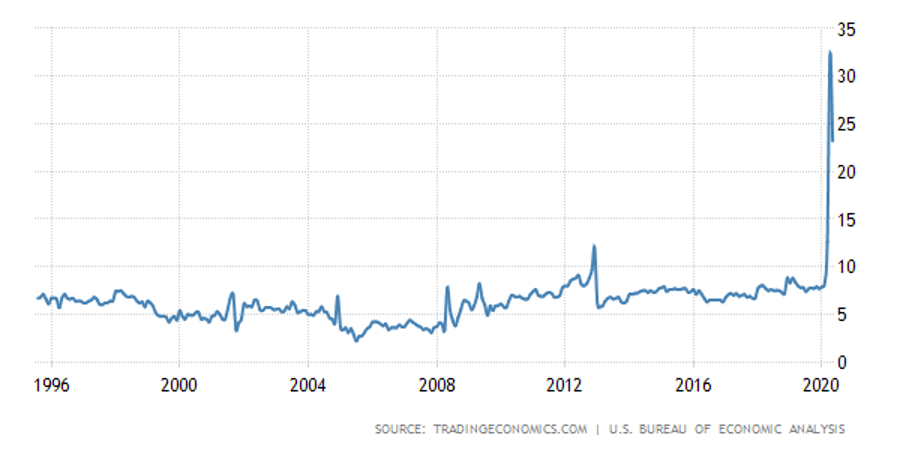

US Personal Savings Rates have Skyrocketed!

Americans have been poor savers for decades. Personal savings rates are typically in the low single digits. However, in April of this year the savings rate leaped to 17%, and in May the average person in the US saved a stunning 33%, the highest in recorded history! Of course, it is easy to explain the phenomenon, since we are all shut in at home, with no stores to shop and no entertainment to enjoy, so much of our regular spending just went away.

And where is all that saving going to?

Banks and Money Markets Levels at All Time Highs

Personal savings at US banks are approaching SIX Trillion USD, almost double normal levels. According to CNBC, “…The wall of money flowing into banks has no precedent in history: in April alone, deposits grew by $865 billion, more than the previous record for an entire year.”

As an advisor who has a passion for retirement planning and as someone who was raised to view savings as almost holy by my Dutch immigrant parents, it is encouraging to see Americans save more. A foundational principle of financial well-being is to be a good saver.

However, the question is what will all of these suddenly prolific savers do with their savings? Will they spend it when the economy opens up again? Or will they invest some of it? We can get a clue by looking at interest rates.

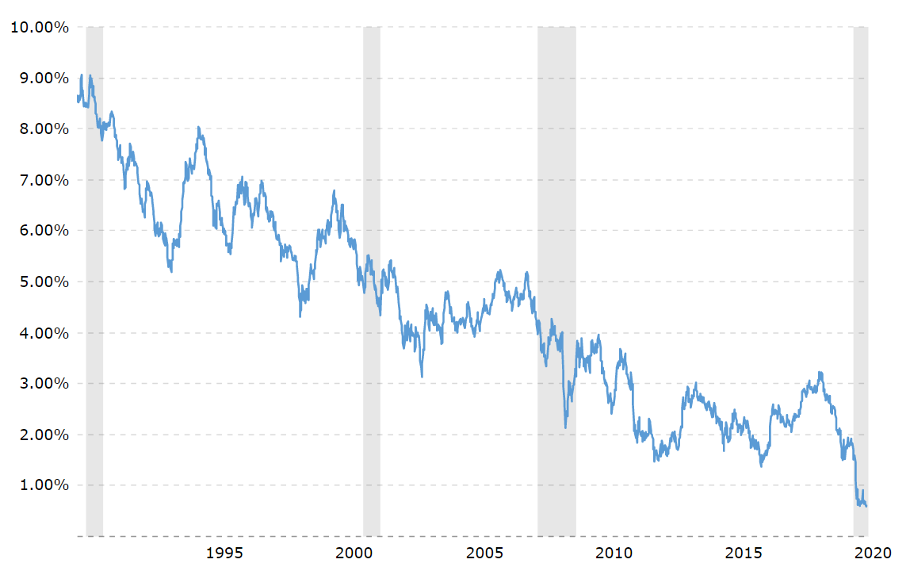

Interest Rates at All-Time Lows

When I first started in wealth management 25 years ago, a ten-year US government bond paid close to 6% per year, which was about its normal average rate going all the way back to the beginning of the last century. At 6% an investor got a decent and acceptable return, usually a little higher than the rate of inflation. In stark contrast, for most of this summer, that same ten-year US bond has been yielding only about 0.60%. Translation - if you invested in that bond and held to maturity you would earn a measly sub one percent return for the next ten years.

Ten Year US Bond Interest Rates at Historical Low

What does this mean to investors? A financial principle is that money tends to go where it is treated the best. An interest rate below 1% is not very attractive and so it’s quite possible that these huge amounts of cash might be possibly treated better in real estate or stocks – or just used for consumer spending. Watch the money flows from the immense deposits currently in banks. If it flows to the stock market it might push stock prices up. If it is spent, it may cause a spectacular surge in economic growth.

Why are rates going so low? You can look at the Federal Reserve’s actions for an explanation.

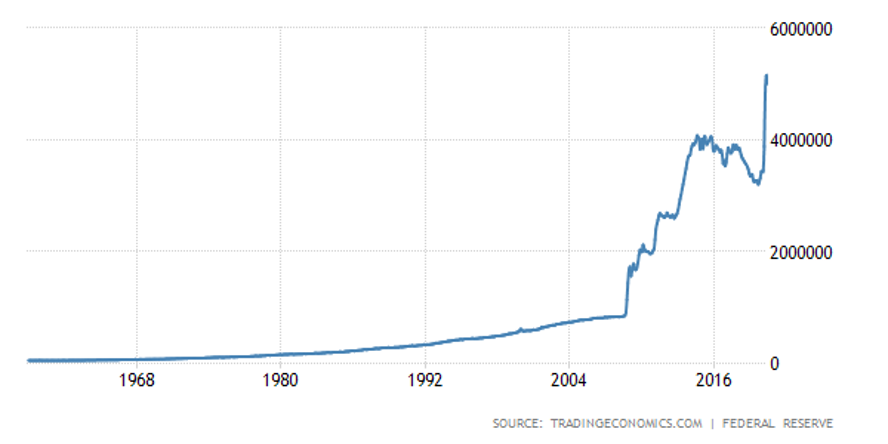

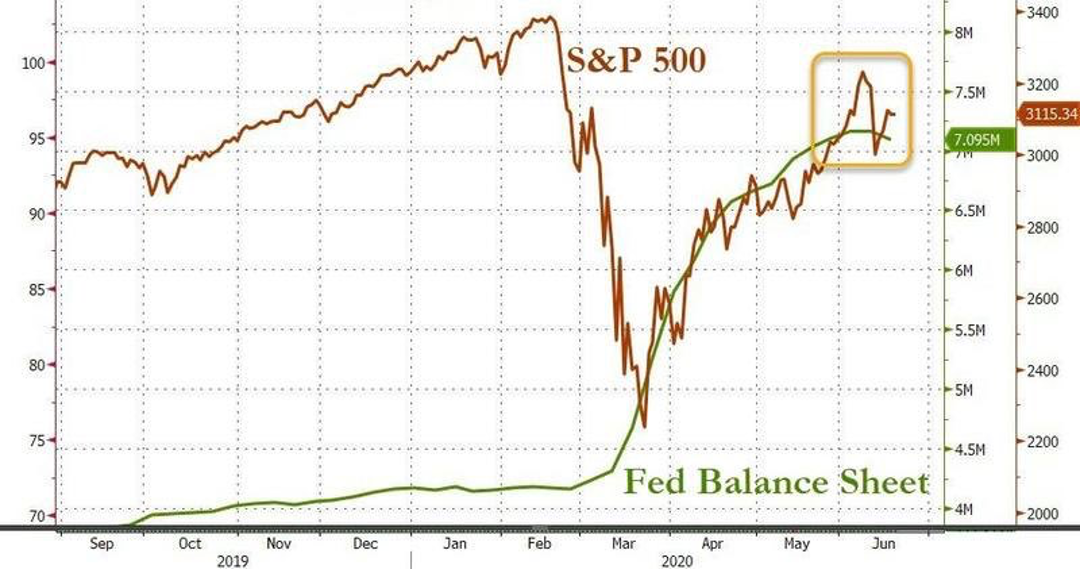

The Fed is Creating New Money in Record Amounts

Did you know that the Fed actions of the last 6 months are about equal to all the money printing and quantitative easing of the Great Financial Crisis of just a few years ago? The Fed and the US Treasury is flooding the country with new money through a variety of programs; PPP loans, Federal stimulus program, EIDL, Federal UE benefits, direct and indirect purchases of government and corporate and other bonds. All these programs are funded by new money created out of thin air by the Federal Reserve.

How have the investment markets been impacted by this? Quite dramatically. Gold, for example recently reached an all-time high and just eclipsed $2000 per ounce. Stocks seem to have also benefitted from this new money.

(BTW – I am making an observation, not an approval of Fed policy. If you want to read more about the Fed and QE, we wrote about this subject in-depth during the GFC. You can email us at info@geverswealth.com and ask for the article QE – Will the Fed’s Financial Experiment Work? in the subject line and we’ll send you a copy.)

Notice in the graph below how the recovery of stocks mirrors the rate of new money creation by the Fed in 2020.

So, what can investors conclude from all this information? Americans have income, they have an unusually high amount of savings, the banks are “swimming” in new deposits, interest rates are close to zero, and the Fed is creating new money in spectacular amounts.

These factors are all highly stimulative and help explain why the US stock market is up, while the economy is still mostly shut down.

However, there are some black clouds on the horizon that are worrisome and could negatively impact stock prices in the near future. We want to carefully watch; stock valuations, additional government shutdowns, and the presidential election.

Stock Prices are Overvalued

The price of a company’s stock is closely tied to that company’s earnings or profits, and over a long-time frame when a company’s profits increase, its stock price tends to as well. Last year was a wonderful year for most US companies who generally saw increasing profits due to the wonderful economic climate. Not surprisingly, last year was also a great year for the markets as stock prices in general went up.

When the CV pandemic struck the economy was shut down and many companies’ sales and profits plunged, and the stock markets of course dropped as well. However, since then, much of the economy remains partially shutdown, and earnings for many companies are lower than before the pandemic – yet stock prices have risen. At this point in time, stock prices, as compared to companies expected earnings, are overvalued. Why are stocks so overvalued? The points we discussed above help explain this phenomenon – however investors are nervous and justifiably so when stock prices rise faster than earnings do. What to look for? It is possible that we might have rapid recovery and better future earnings which will then justify today’s high prices. OR, and more worrisome, stock prices will drop to reflect current poor earnings during the CV shutdown.

Tach it Up Tach it Up – Buddy going to Shut You Down!?

Here in Washington State, business owners are watching Governor Inslee with trepidation and fear. The CV reports and mortality numbers seem to change almost weekly. The ethical and economic dilemma that Inslee and other governor’s face is how to best strike a balance between the economic damage of shutdowns versus the proper health response because of the pandemic. I don’t envy our leaders incredibly difficult situation and pray for their wisdom as they struggle with this.

As investors what we want to closely watch is policy on shutdowns. Are we going to continue opening up, and can we do so successfully? Or are we headed to more draconian restrictions – perhaps because of a second wave? If we see widespread restrictions come back, expect more economic damage, more bankruptcies, job losses and higher unemployment – and probably poor stock market performance.

So, what will Inslee do? …Declinin’ numbers at even rate. At the count of one we both accelerate. My Stingray is light the slicks are starting to spin, but the four-thirteen’s really digging in… Tach it Up, Tach it Up buddy going to Shut you Down…

(In case you are not a Beach Boys fan… https://www.youtube.com/watch?v=09yyOQjvKdM)

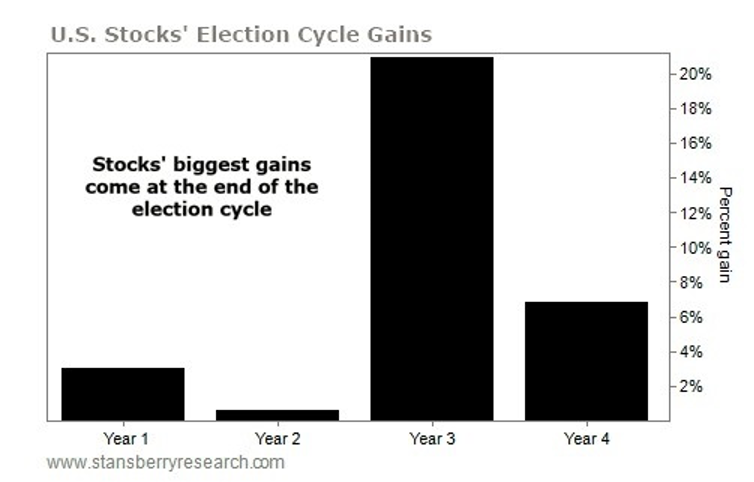

The Election. New President = Dropping Stock Prices?

US Stock Market Returns During each year of the Presidential Election Cycle

The stock market does not like new presidents – the first and second year has tended towards subpar returns. This seems to be true of both Democrat and Republican presidents, as the returns early in their presidency are usually worse than those at the end of their term. President Obama’s third year was a notable exception – US and global markets were all negative in 2015, the third year of his term. President Trump’s third year in 2019 followed history closely as the US market was up last year. The data has a lot of variability however, as first year returns have been as high as +43%, and as low as -23%.(Stansberry research, US stock market is represented by the Dow Jones Industrial Average)

I will write more about this as we get closer to the election, and we will want to review some allocation and risk strategies to consider if we do have a new president in 2021.

There is always something to worry about as an investor – in 2020 it is high valuations, new/renewed shutdowns, and the upcoming presidential election (and maybe some other unknown problem.) Any year has one or more ominous potential calamities and 2020 is no different. Remember that investment success often comes with patience and a degree of fortitude to make it through the rough times that the markets occasionally experience.

Action Items – Raise Cash for Income Now?

With the stock market and many investment portfolios getting close to recovery, and with the tremendous recent bounce back in stock prices – this may be an especially opportune time to consider raising cash for spending and income needs for next year, and maybe even beyond. We have been encouraging clients to project how much income they might require from their portfolios out into next year or farther, and discuss raising cash now for those income needs.

A simple example – suppose that a family has wedding in 2021 and they will need $50,000 from their portfolio for the cost. It might be a great time to raise some or all of the $50k now. If the markets go down next year, then we can rest easy knowing that we have cash to pay for it, and do not need to sell at a bad time.

If we implement liquidations now while the markets are recovering, we might avoid having to take withdrawals when markets are down (if one of those bad scenarios does occur) Of course we might miss out on some return if the markets continue to do well. Let’s discuss this in detail and specific to your personal situation at our next meeting. Of course, we are always available if you would like to review this before your next scheduled review.

This might also be a great time to review the Robust Income Plan exercise that we took our clients through a couple of years ago. The intent is to try and test how robust our income plan is if and when the markets next go down.

An Anniversary in Sedona

Still getting hugs after all these years!

My beautiful bride and I went to Sedona earlier this spring to celebrate our anniversary. We swam in desert springs, hiked every day, including an all-day exploration of an incredible slot canyon, all of which gave us a great appetite for the wonderful meals we had under the warm desert night sky. Sedona, despite the restrictions, was bustling with activity and the shops and businesses seemed to be doing well. Highly recommended as a recovery from a rainy and cold Seattle.

We hiked for miles up a slot canyon. Dinner was especially good after 13 miles on the trail!

We also met with a Fintech software developer whose company has a highly successful banking app, and which was fascinating to learn more about. Despite all the fear and drama surrounding CV19, there is still so much business development going on - the American economic engine keeps chugging along!

As we head into the heart of the summer, my wife and I are gearing up for a backpacking trip in August, and the exquisite joy of warm summer nights filled with dinners with family and friends, BBQ’s, and ping pong and outdoor games (all done with appropriate social distancing!) Hope that you and your loved ones are enjoying the summer as well.

We look forward to our next scheduled meeting, and of course please feel free to contact us if you have any questions before your next appointment. Our whole team is committed to your financial well-being.

Warm Regards,

Willy Gevers

Copyright 2020 William R. Gevers. All rights reserved.