Paul McCartney, Inflation, & Our Investments

Spring 2022

Our family are huge Beatle’s fans, and we could not miss Paul McCartney’s recent concert in Seattle. The show was amazing - as a friend said afterwards, it was a 3 hour sing-along with one of the greatest musicians of our lifetime.

McCartney jarred my financial brain back to the present when he opened with "Can’t Buy Me Love" and then went immediately to his ode to the inflationary 70’s "Junior’s Farm."

“… I took my bag into a grocer's store

The price is higher than the time before

Old man asked me why is it more”

Wings released this song in the mid 1970’s when inflation was raging. Today we once again are experiencing high inflation.

How bad is it?

The government figures for the preceding year through March show inflation at 8.5%, the highest rate since 1981. However, the actual impact on households might be far worse than the official numbers are showing.

According to the Bureau of Labor Statistics (BLS) from March 2021-March 2022:

ground beef up +14.9 percent

boneless stew beef up +24.3 percent

bacon up +23.1 percent

boneless chicken breasts up +17.6 percent

eggs up +25.9 percent

milk up +17 percent

frozen orange juice up +18 percent

ground coffee up +15.8 percent

fuel oil up a whopping +71.5 percent

natural gas up +23.3 percent

Used cars up +35.3%

We have been enjoying unusually low inflation for the last twenty plus years, but that idyllic period has abruptly ended, and many signs point to continued or even higher inflation going forward.

We seem to have entered a completely different financial era that requires us to adjust our thinking and mindset. What worked for you and me for the last twenty low inflation years might be counterproductive to our financial health in a new world of rapidly increasing prices.

Let’s briefly consider some practical and investment strategies for inflationary times.

Practical Strategies:

Cash Planning: CD’s and money markets until very recently were paying an amount close to the rate of inflation and so you may have not earned much but were not falling behind either. That has completely changed. With banks paying almost zero interest, that means that your cash is losing -8.5% in purchasing power annually. It is not smart to keep excess amounts of cash in the bank in the current environment.

You may want to keep just enough cash in the bank to cover your shorter-term lifestyle needs and major expenses. You may want to consider moving emergency funds from the bank to…

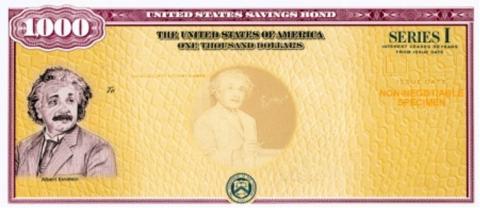

I Bonds: I bonds were the boring unpopular cousin of US EE Savings bonds. First issued by the US Treasury in 1999, they have not enjoyed much popularity because the rate they pay is indexed to the rate of inflation, which of course has been very low. As I write this letter, the current rate on I Bonds is 9.62%. (That is not a typo!) I Bonds can be a great place for your emergency cash and a much higher rate alternative than a bank.

See https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm for more details.

Debt Planning: Most homeowners refinanced their mortgages to extremely low rates. When inflation increases, a fixed rate loan might actually help to increase your wealth. For example, in the 1970’s my parents and many others of their generation saw inflation drive up the prices of everything – while their mortgage balance stayed the same. A secret of inflation is that it may greatly benefit debtors as it shrinks the value of the debt compared to the price of everything else. My father took special advantage of his situation as he stopped making extra payments on his mortgage, and instead used that money to buy CD’s which at the time were paying a much higher rate than what the bank was charging him for his loan. Mortgage holders should watch for similar opportunities like my dad did. If you can find investments that pay a higher rate than your mortgage is charging you, you might also be able to take advantage of that. Currently, the banks are still paying a very low rate, but if the Fed continues rate increases that could change.

However, if you have floating rate debt, then you could be hurt as inflation drives rates higher. Home Equity Line of Credit (HELOC) is a common form of floating rate debt. If you have a HELOC (or any other floating/adjustable-rate debt) check your terms and consider a plan to pay off and/or refinance to a fixed rate.

Property Insurance: Inflation has tremendously driven up the costs of building. You may want to review your homeowner’s policy with your insurance agent and check to see if your policy coverage would still cover the cost to repair or rebuild your home. Our neighbors had their beautiful home burned to the ground a few summers ago, and recently finished rebuilding it, at the insurance company’s expense. It would further compound the tragedy of a mishap if you found out after the incident that you were inadequately covered.

Buy Stuff Now: My wife and I did a massive Costco shopping spree at the beginning of the year. We stocked up on non-perishables like olive oil and toothpaste. If food prices keep going up at

20%+ per year, we will make a lot more money buying food and goods, than just leaving it in the bank. It is a no-risk investment – we will eat or use it all up anyways! My parents taught me to wait before I bought stuff and look for the good deal – but perhaps the best deal is right now, and we should buy what we need now before the price goes up even further.

Other Income Streams: Another way to help combat rising prices is to create additional income streams. There are so many opportunities in the web-based world we live in. For example, my cousin is a Ducati enthusiast. He started a side business online renting and selling the specialized tools necessary to work on Ducati motorcycles, and he clears a nice sum each month. Perhaps you have an interest, expertise, or hobby you can monetize?

What is Your Personal Exposure to Inflation? Inflation does not impact everyone the same way. There are a number of factors that influence this. For example, if you have an income stream(s) that automatically adjusts for inflation like a military pension or rental income from a multi-family property, that adjustment will help offset some of the pain of higher prices. Other families do not spend as much, thereby reducing their inflation exposure.

We have an Inflation Impact Checklist we use to try and gauge a family’s relative inflation exposure. We can walk you through this exercise at our next meeting, or if you are not a client and would like a copy, please email us at info@geverswealth.com.

Update Your Retirement Plan: Retirement success is highly correlated to inflation. Have you updated and revised your retirement projections based on today’s higher inflation rates? Are you still on track to meet your financial goals? Do you need to make any adjustments to your plan? This is a great time to update your goals and planning to try and ensure that you are still on a sound path for your future financial security. We can run through an updated exercise for you at our next planning meeting.

These are just a few practical strategies that may help us to cope better with inflation. Have some more ideas? Please share them with us at info@geverswealth.com

Now let’s discuss how to allocate our investment portfolios in a higher inflation world.

Investment Strategies:

"History doesn't repeat itself, but it often rhymes."

Mark Twain

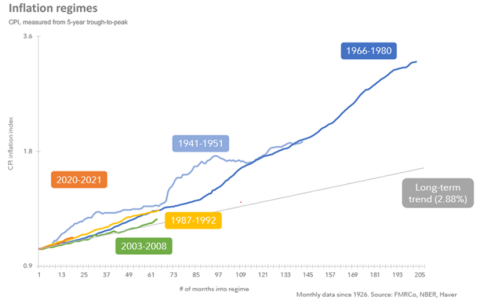

If we study market history during previous periods of higher inflation, we can understand what have been effective strategies, and what has not worked well. According to Fidelity, there have been four episodes of extended inflation in the US.

Most significantly to us as investors, Fidelity calculated that the real return (the return after inflation is subtracted) of the SP500 was 6.82% during those inflationary periods, which means the stock market on average, performed fairly well during those periods. The 70’s was the outlier, during which stock returns were below average, and there was a significant market downturn in 1973-74. (That was also the era when Paul McCartney’s Beatle follow-up band Wings was huge, and when he wrote Junior’s Farm referencing the inflation of that time.) Of course, the past is not a guarantee of future results. As investors we can find some solace in history as stocks have had decent returns in previous inflationary times.

Digging a little deeper, history teaches us that some investments have done poorly in inflation, specifically cash and longer maturity bonds. Cash suffers from a loss in purchasing power, and bonds tend to fall in value when rates and inflation are rising, and both have been unattractive this year.

This of course leads to a crucial question – how do you reduce risk in a portfolio if you don’t like bonds? That is a great topic for a future newsletter, but our clients know that we have been using a Robust Income Plan exercise to try and help answer that question.

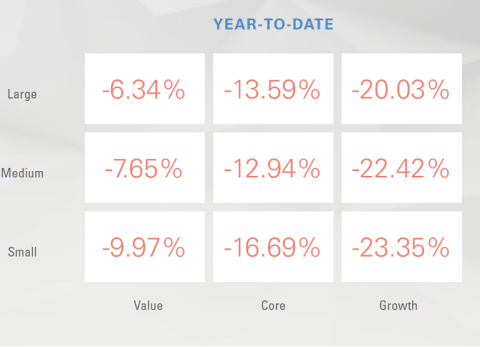

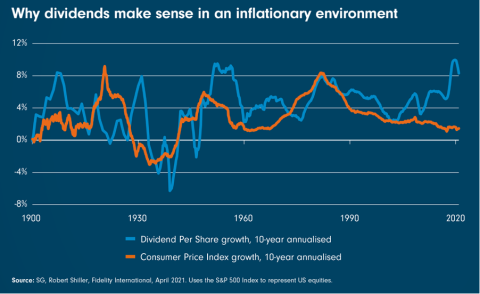

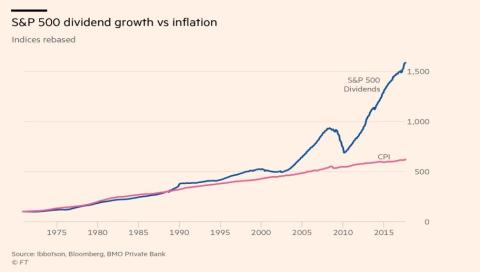

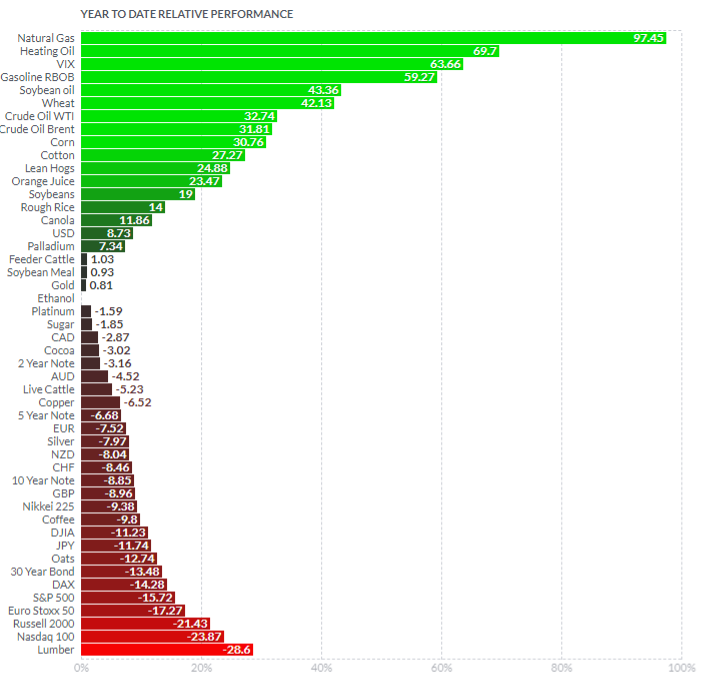

Some sectors and types of stocks tend to do relatively better when inflation is higher, most notably dividend paying stocks. Dividend payers have been out of favor the last few years, as the excitement and higher returns have been much more in the tech and growth stocks. That seems to be changing in 2022 – the YTD by sector chart below shows that value (including dividend) stocks are doing much better than the more glamorous tech/growth sector.

During periods of high inflation, stocks that increased their dividends the most considerably outperformed the broad market, on average, according to Fidelity's sector strategist, Denise Chisholm.

“Dividend stocks are protected against inflation, because firms have been able to raise their prices, their cash flows, and increase their dividends,” Siegel told CNBC. “I think that’s what investors are going to seek in 2022.”

Along with dividend paying stocks, other assets to help combat inflation might include commodities, rental real estate, energy, and gold. We have been discussing these asset classes in our client’s portfolio review meetings.

The financial world has changed dramatically, and higher inflation may be around for a while. Are you allocated properly? This is the right time to examine your allocation plan and try and check if market history and long-term data support the way your portfolio is currently diversified.

Allocating Investments for Inflationary Times

BAD – long bonds, cash

BETTER – dividend paying stocks, rental real estate, commodities energy, gold, maybe some BTC

We will review your current allocation plan and the use of asset classes with potentially favorable profiles during inflationary times at your next review meeting. The world is changing, inflation is impacting us all, and it is important that we try to respond appropriately.

Getting back to the concert, I was slightly hoarse from singing and a little emotional after it was all over. Belting out Hey Jude with 20,000 other fans and Paul McCartney himself was a wonderful way to end the night. Thanks Sir Paul – and thanks also for the economics lessons in your music!

Our whole team is dedicated to your financial well-being. We look forward to our next meeting with you.

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2022 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

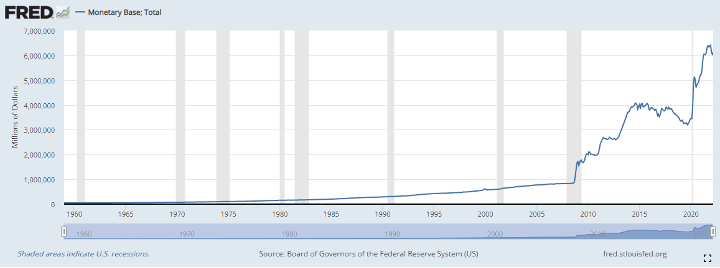

US Money Supply –Monetary Base

https://fred.stlouisfed.org/series/BOGMBASE

US Dollar Price – (DXY) USD Index measured against other currencies

(http://www.barchart.com/chart.php?sym=DXY00&style=technical&template=&p=MC&d=X&sd=&ed=06%2F11%2F2015&size=M&log=0&t=LINE&v=0&g=1&evnt=1&late=1&o1=&o2=&o3=&sh=100&indicators=&addindicator=&submitted=1&fpage=&txtDate=06%2F11%2F2015#jump

Inflation/Deflation:Year to Date price change in commodities as measured by futures

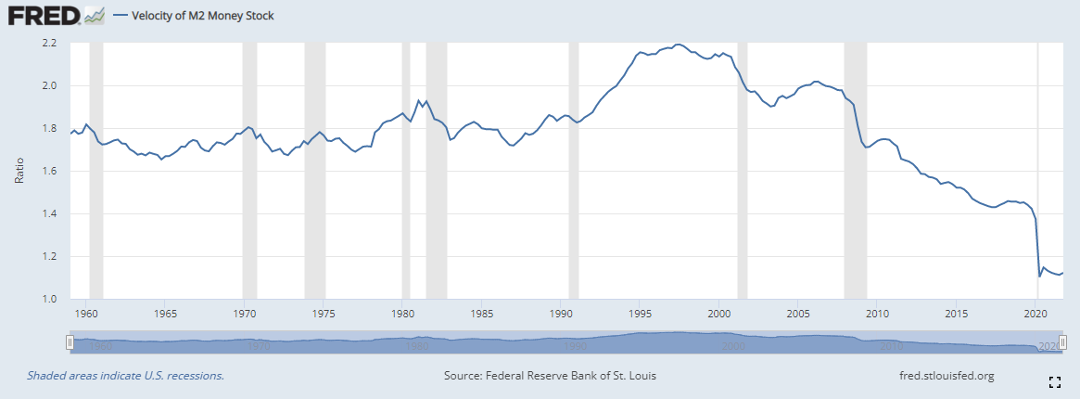

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Paul

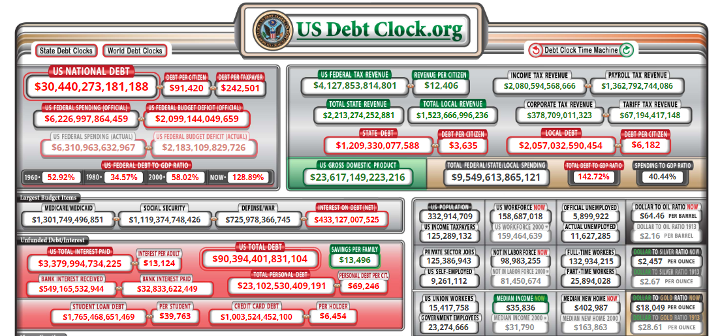

Total US Debt

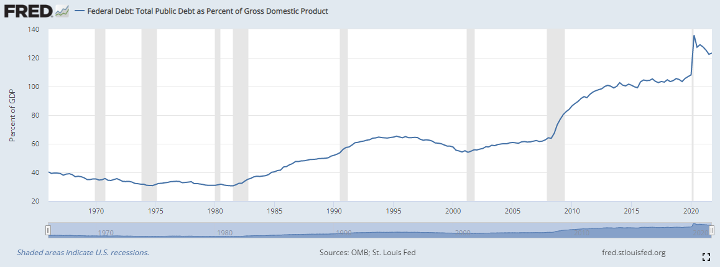

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

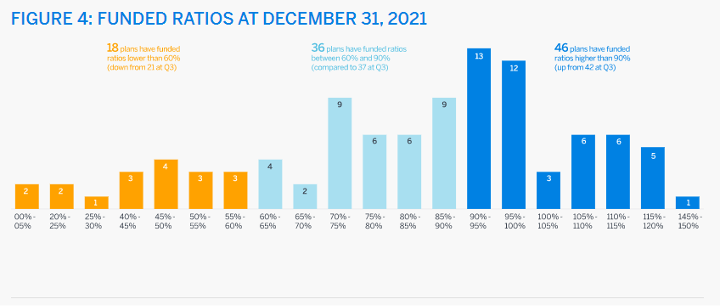

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.)

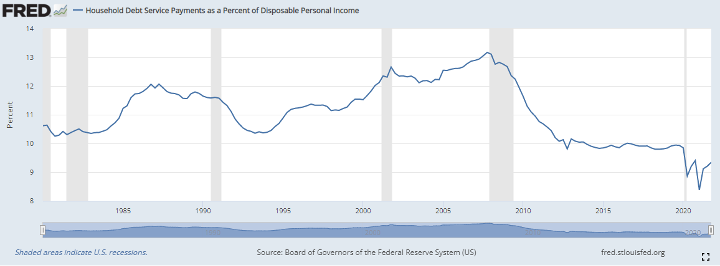

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)