Managing your Costco RSUs

Maximizing Your Wealth: A Guide to Managing Your Costco (COST) RSUs

Restricted Stock Units (RSUs) are a significant part of the compensation for many top employees, and for Costco team members, they represent a powerful wealth-building tool. Taking an intentional, well-informed approach to managing your Costco RSUs is crucial for maximizing returns and minimizing tax liabilities.

We'll manage your Costco stock compensation from two essential perspectives: investment strategy and tax planning.

Investment Strategy: Should I Hold or Diversify My Costco Stock?

When it comes to the shares you receive from your vested Costco RSUs, your investment decision boils down to a fundamental choice between concentration and diversification.

1. The Concentrated Approach: Aim Big, But Risky

The "Aim Big" strategy involves holding onto your vested Costco (COST) stock. Many long-term Costco employees have seen immense success with this "do nothing" approach because Costco's stock performance has historically outperformed the broader market.

- The Upside: Allowing a large portion of your wealth to remain concentrated in a single, high-performing stock offers the potential for superior growth.

- The Risk: Even for a company as stable as Costco, this strategy carries significant concentration risk. Your financial future becomes heavily dependent on the fate of one company. History is full of once-dominant market leaders (Sears, GE, Intel) that eventually suffered extended periods of poor returns, decimating employee wealth.

2. The Diversified Approach: Slow but Steady

The "Slow but Steady" strategy is the act of selling your Costco RSUs immediately upon vest and diversifying the proceeds into the whole stock market, typically via a low-cost index fund. RSUs are taxed when they vest to you, so there is not additional tax for selling if done immediately.

- The Upside: Returns may not match the best-case scenario of a single booming stock, but you gain consistency and reduced risk. The fortunes of any single company will not have a devastating impact on your overall portfolio.

- Recommendation: For most individuals using RSUs to fund essential goals like retirement savings, the disciplined approach of diversification is generally the most prudent and recommended strategy.

Which RSU Investment Strategy is Right for You?

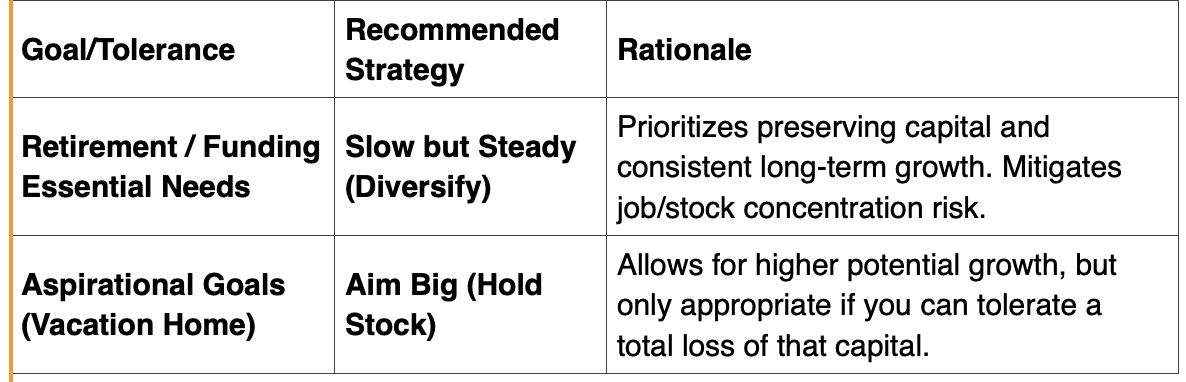

The best approach depends entirely on your personal financial goals and risk tolerance.

Tax Management: Minimizing RSU Tax Liability

Restricted Stock Units (RSUs) tax treatment is unique and requires specific planning to ensure you minimize what you pay to the IRS and avoid surprise tax bills.

The Three Key RSU Tax Events

Understanding the tax implications at each stage is the foundation of smart planning:

- Grant: Shares are allocated but not yet owned. Tax Impact: None. No planning is needed here.

- Vest (The Income Tax Event): Shares shift to your ownership. The fair market value of the shares at the time of vest is taxed as ordinary income and reported on your W-2.

- Crucial Alert: Costco typically defaults to withholding a flat 22% federal tax rate. If your ordinary income tax bracket is higher (e.g., 24%, 32%, or 35%), this insufficient withholding will lead to a large, unexpected tax bill or penalty at tax time. You must work with a CPA to adjust your estimated payments.

- Sale (The Capital Gains Tax Event): You sell the shares. Any gain or loss since the day they vested (your cost basis) is taxed as a capital gain. This is where strategic tax planning makes the biggest impact.

RSU Tax Planning at Sale: Timing and Quantity

You control two variables at the sale event that directly impact your tax bill:

1. Timing the Sale for Lower Tax Rates

- Sell Immediately: If you sell your shares immediately upon vest, the gain is essentially zero, resulting in zero capital gains tax. This is the cleanest tax move.

- Sell Within 1 Year (Short-Term): Any gain realized is taxed at your higher ordinary income tax rate.

- Sell After 1 Year (Long-Term): Any gain is taxed at the lower Long-Term Capital Gains (LTCG) tax rates (0%, 15%, or 20%). This is the main timing goal for any held stock.

2. Managing Quantity to Avoid Tax Cliffs

By spreading out sales over multiple years, you can control your realized income and avoid high-tax "cliffs." Watch out for these three major tax hurdles, which often stack on top of one another:

- Federal Capital Gains Tax Rate: Increases sharply from 15% to 20% at high-income levels at a little over $600,000 of total income for joint filers.

- Net Investment Income Tax (NIIT): An additional 3.8% tax on investment income for high-income earners (typically AGI exceeding $200k/$250k).

- Washington State Capital Gains Tax: A 7% state-level tax on gains from stock sales exceeding $270,000 per year (for Washington residents).

Conclusion: Build Your Personal RSU Action Plan

Your Costco RSU management strategy is a unique intersection of employment, investment, and tax law. There is no one-size-fits-all solution.

- Define Your Goal: If the money is for long-term security, prioritize the Slow but Steady diversification approach.

- Review Withholding: Immediately confirm that your vest withholding (especially the default 22%) is appropriate for your actual tax bracket to prevent a year-end surprise.

- Plan the Sale: Understand the difference between short-term and long-term gains, and strategize annual sales quantities to stay below the major tax cliffs (NIIT and WA State CGT).

Your financial health depends on making informed decisions. Don't let valuable Costco stock accumulate without a plan.

Work with a dedicated financial advisor and a CPA who understand the nuances of executive compensation and concentrated stock positions to ensure your strategy aligns with your long-term wealth goals.

If you are interested in seeing how these concepts apply to your finances, we are a fiduciary financial advisors based in Issaquah less than a mile from Costco headquarters, and you can schedule a meeting here.

|

| Garrett Grigas, CFA, CFP® Financial Advisor & Partner

Phone: 425-902-4840 Email: Ggrigas@geverswealth.com Website: www.geverswealth.com 5825 221st Pl SE Suite 102 Issaquah, WA 98027 |