Interest Rates Drop! - Action Alert CV19 Redux - Perception & Reality Dissonance

Questions from the Field:

During the course of teaching seminars, writing articles and newsletters, and meeting with clients we hear lots of questions. We will try to address some of the more timely and relevant questions that investors, executives, and retirees are asking us. Our question(s) for this month are:

Q: What is going on with interest rates?

Q: Why is the stock market reacting so wildly to CV19?

Sunday night US Bond interest rates dropped to amazingly low all-time records. As I write this, the US Ten Year Treasury yields about 0.5% and the US Thirty Year Treasury is under 1.00%, both all-time historical lows. To give you some context, in October 2018 less than a year and a half ago, the US Ten Year Treasury yield was about 3.2%. The rate has dropped by over 80% since then!

https://www.cnbc.com/quotes/?symbol=US10Y

What does this mean and what should investors do? Some possible action items & conclusions:

- Bond Prices are Up: Good news for investors is that when interest rates drop, bond prices generally improve and go up in value. If you have a bond allocation in your portfolio (and most of our clients do) then you might expect that your bonds have appreciated nicely so far this year, and especially since last week. More good news for investors is the sharp rise in Gold prices YTD. Precious metals tend to appreciate when interest rates drop, and thus Gold is having a great year so far in 2020. Most of our clients have a small tactical allocation in gold. Real Estate has also appreciated with dropping rates and is generally up far more than the US stocks over the preceding 12 months. This is why we diversify by owning assets that might go up in value during periods that stock prices are not doing well. Owning bonds and gold and real estate has eased some of the sting of dropping stock values. 1a. Time to Rebalance? And, with bond prices going up and stock prices struggling these last weeks, a portfolio rebalance may make sense. We will be watching our allocations and looking for opportunities to rebalance back to goal/range allocations.

- Refinance Debt: With rates this low you will want to review all your debt; mortgages, HELOCS, HECM, personal loans, asset-based loans, student loans, etc. and see if now is an opportunity to refinance and save on future interest costs. If you call your banker or mortgage broker, it may take some time for them to get back to you. Loan applications were reportedly up over 20% last week, and there is certain to be a flood of even more new loan activity. Bankers and mortgage brokers might be overwhelmed with calls. Again, I can’t overemphasize how low rates have gone. This might be a wonderful opportunity to save money by lowering your interest costs. Please feel free to contact us if you want a referral for a mortgage broker, or you would like us to look at the numbers of a refi you are considering.

- Watch Your 401k Stable Value Fund: Review your retirement plan fund options carefully as many plans’ conservative options are tied to prevailing rates. For example, stable value type funds pay interest to investors based on current rates. Those types of funds might see their returns drop dramatically in the near future and follow prevailing rates downward. The issue of course is if those types of funds will still be appropriate for a future retiree’s financial goals and needs, given their now lower rates. A review of your allocation and goals might be very important to your financial future.

- Transfer Assets to Family: If you have a larger estate and are considering strategies to transfer significant assets to your children and grandchildren, these low rates might provide an incredible planning opportunity. Some types of trust and estate transfer strategies become much more favorable and effective at reducing tax and minimizing the costs of transferring and gifting assets the lower interest rates are. Now might be a great time to confer with an advisor who is knowledgeable in these types of strategies for higher net worth families. Low rates might provide a great window of opportunity to bless your family and save taxes at the same time.

- Pension Fund Viability: Public & private pensions depend heavily on bonds to fund their monthly retiree payment obligations. Rates have already been low over the previous decade, and underfunding has been an issue. This greatly exacerbates the pension funds challenge to keep making those payments – but that is a longer topic for a different newsletter…

Where will rates go from here? The answer depends on a number of issues.

- Will CV19 pass quickly or is it really a serious longer-term health hazard? And if it is, how will the travel bans, the quarantines, and work & school shutdowns impact the US and Global economy?

- Will the Fed continue to lower rates? And how will Central Banks around the world respond? In many other countries (especially Germany & Japan) interest rates have been negative since last year! This increases demand for US bonds and thus pushes our rates lower.

- Will stock market investors continue to sell stocks and move more money to bonds?

Alan Greenspan, the former Federal Reserve Chairman, declared in a speech last fall that he thought that interest rates in the US could fall to zero. His comments were laughed at then, but now only a short time later his prognostication seems prescient. Investors will want to watch the interest rate environment closely and take action as necessary according to your own goals and investment needs. We can discuss personal application to your situation at our next meeting or phone call.

CV19 Redux – Dissonance between Perception & Reality

“People are accepting the size of the crisis: they know the governments are doing the right thing, but what your brain tells you logically isn’t always how you feel about something emotionally. We’re seeing the market’s emotional brain leading today.”

Sebastien Galy - Nordea Asset Management

We discussed the impact of CV19 on the stock market recently. Please see our newsletter here: https://www.geverswealth.com/blog/influenza-cv19-and-your-investments-perception-reality

Some updates since last week:

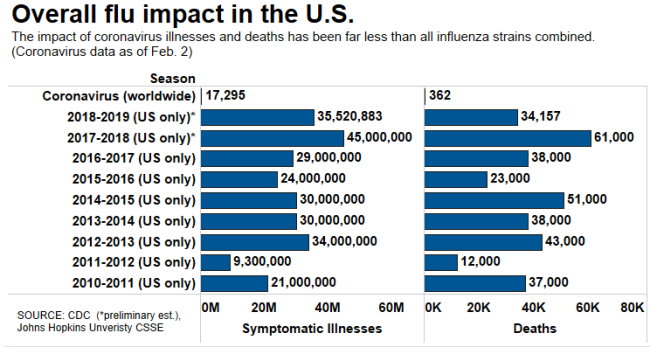

- The response still seems out of proportion with the size of the CV19 spread. The CDC reports that Influenza (the flu) numbers are up to an estimated 49 Million flu cases, and up to 52,000 deaths in the US alone since October 2019. By contrast, CV19 cases across the entire globe number about 113,000 with 3,996 reported deaths. The following chart shows in stark contrast how much worse the flu is and has been than CV19 coronavirus.

CV19 vs Seasonal Influenza (the flu). Note how many times worse the flu is in total cases and deaths.

- More Slowdowns: Locally, here in the Seattle area, there have been many cancellations of events and conferences, and most notably both the University of Washington and Microsoft have announced extended closures and are mandating classes and work from home for all their students and employees. (My son’s UW friends say that it is a great excuse to party a lot!) Goldman Sachs analysts have stated that if the quarantines/cancellations/slowdown due to public panic goes on for longer, it might take until mid-2021 until companies’ earnings and profits return to normal.

- Strong Economy: The jobs report came out last Friday and it was sensational. The economy has still been very strong – until this panic started a week ago. Additionally, the Fed announced a surprise .50% rate cut, and is widely expected to cut again at the next scheduled meeting later this month, in an attempt to stimulate the economy and the market.

- Oil Prices Drop: Completely unrelated to the CV19 scare, the price of oil dropped precipitously this weekend as OPEC members had a falling out. WTI Crude is just over $30/barrel as I write this, less than half of what the price was on January 1st of this year. According to famed Wharton Professor of Finance Jeremy Siegel, half or more of the stock market’s drop on Monday was attributable to the steep drop in the price of oil.

Are lower oil prices good or bad? It depends. It is:

Good: If you are a consumer, because you will save on heating and gasoline costs.

Good: If you are a farmer, as oil costs directly and indirectly are the highest cost of food.

Good: If you are an airline or any other transportation business.

Good: If you are a manufacturer in an energy intensive industry.

Bad: If you are an oil sector company or alternative energy company.

Bad: If you make electric cars or any other alternative energy usage product like solar or wind.

Bad: Shale oil sector as that type of oil production is costly and uneconomical when oil is only $30.

Bad: If you are a bank with lots of loans to oil-sector companies.

Bad: For the environment as it may not discourage petroleum users from using oil products.

Professor Siegel suggested that gasoline might return to $1 per gallon if oil prices stay at the current levels. (That makes me miss my favorite car of all times, our old gas guzzling kid hauling Chevy Suburban!)

Remember also that this is at least the fifth time in the last few decades that OPEC infighting have caused oil prices to tumble, and in every case the US stock markets recovered fairly quickly.

- Interest Rates Drop: (see our comments above.)

Stay Healthy!

In last week’s newsletter we concluded with an action list that investors should consider. You can find it here:

https://www.geverswealth.com/blog/influenza-cv19-and-your-investments-perception-reality

Let me add one more important one to the list.

Stay Healthy – and take simple steps to boost your immune system. I am tired of everyone telling me to wash my hands. However, there are some other things you can do that can help your body fight off a sickness like CV19. Farmer’s Almanac has 15 suggested ideas that are easy and inexpensive to implement. https://www.farmersalmanac.com/natural-immunity-boosters-29060

Personally, I have at least one cup of green tea and one cup of ginger turmeric tea per day. Also have a tablespoon of turmeric with a dash of raw honey in hot water with breakfast and take Vitamin D supplements in the non-summer months. We also bought elderberry supplements from Costco for the office team and plan to take at least until this scare goes away. Easy-peasy, and hopefully will give us a little edge at fighting off a bug like CV19 and keep us all in good health to keep serving our dear clients.

This has certainly been a crazy period for the stock and bonds and commodity markets. We remain completely committed to your financial well-being and look forward to our next meeting. If you would like to discuss some of these issues in more detail before your next appointment, please feel free to reach out to us.

Warm Regards & Wishes for your Good Health,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback.If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com