If 2020 was a Fish…I’d Throw it Back! & a GWM Team Update

January 2021

At the start of 2020 I was unusually optimistic. In January I worked late for successive evenings, and after one long day my wife asked me, “why are you working so much?” I told her that I was really excited about the upcoming year and that in 25 years had never been so enthusiastic about the outlook for the economy!

Our clients had enjoyed a great 2019, and it is significant to recall where we were only a short 12 months ago; US political volatility had subsided, international trade agreements looked like they had settled in the US’s favor, unemployment was at record lows and continuing to improve, real wages were going up for the first time in decades, UE in all demographic groups notably the African-American and Hispanic communities were improving at record levels, US GDP & corporate profitability were fabulous and trending higher, Small business confidence levels were sky high – there were so many reasons to be enthusiastic for continued economic progress.

But then…the pandemic and all the subsequent woes that followed. What a dismal year… that is why, if 2020 were a fish, I’d throw it back!

No need to repeat all the awful things that happened not long after I so blithely told my wife how good 2020 could be – we all know those sad stories.

Instead let’s review what happened to the investment markets in 2020, what the factors were that drove the spectacular recovery at year-end, and what to look out for in 2021. Let’s talk about Money Printing & the FED, Interest Rates, Vaccines, and the Bifurcation of Returns and resultant 2020 Winners and Laggards, and Default, Debt, Dollar and De-Valuation issues to watch out for in 2021.

Money Printing and the FED

“…The Federal Reserve and its free-flowing river of cash…”

MarketWatch Dec. 15, 2020

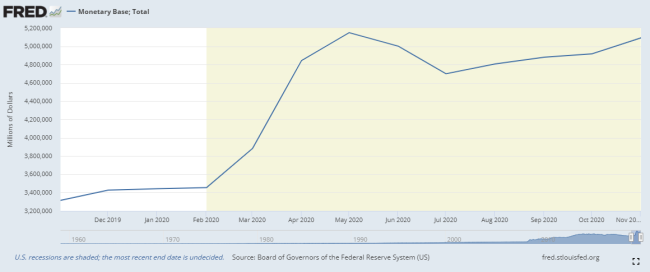

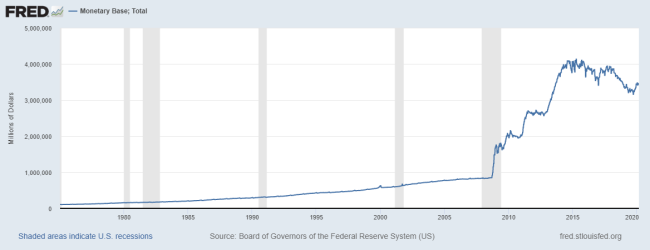

(The money supply in the US increased by about $3 TRILLION in 2020!)

The FED has created an almost unthinkable amount of money in 2020 – about $3T dollars. To put that in perspective – the FED monetary base at the beginning of 2000 was only three quarters of a trillion dollars – in other words, they printed 4 TIMES more money in 2020 than was created over the course of the entire last century.

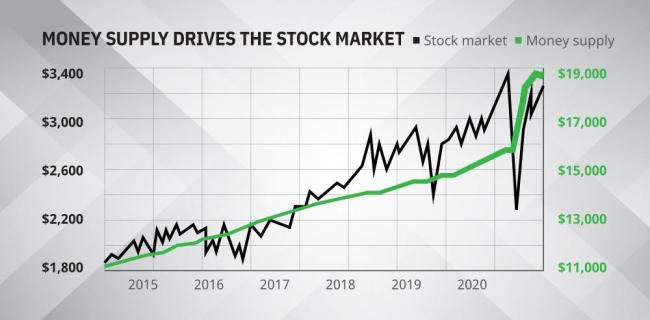

“The bull market of our lifetime is explained by two words, money printing. In other words, more money getting printed means more dollars in the system to chase assets and push prices higher.”

Howard Wang, Convoy Investments

The tidal wave of new cash being poured into the US economy is creating inflation in asset prices. Stocks, bonds, real estate, and gold have all soared upwards in price, and are at all-time highs.

Think of it this way – all that new money must go somewhere, and a lot of those dollars are flowing into investments, pushing prices up. This phenomenon might continue well into the future because of government policies. For example, the new stimulus bill that was approved in December has a price tag of ~$1T. Although the bill might be necessary – we don’t have any way to pay for new stimulus, and so we will print even more new money to provide for the government’s largesse. It is quite possible that we will see even more stimulus bills and aid packages this year. Some estimates are that the monetary base will swell to $10T by year-end. Notice how the stock market’s recovery in 2020 almost exactly mirrors the rate of new money creation. (see chart below of M1 Money Supply & US stock market.)

If the money printing continues – will the stock markets follow?

“The “Stock Market” as represented by the S&P 500. Investors cannot invest into indexes directly and past performance is not indicative of future results.” Source:Marketwatch.com

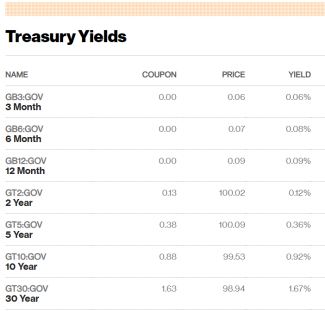

Interest Rates – Money Goes to where is it Treated the Best

Source: Bloomberg

Interest rates are at all-time lows, and essentially zero at shorter maturities. This is a simple story – Money tends to go to where it is treated the best. The bond market is significantly larger than the stock market, and new money is less likely go to bonds earning almost nothing, and more likely to go to stocks or real estate.

This trend is also likely to continue for some time as the FED recently stated that interest rates would most likely be close to zero until at least 2023 and would remain so until substantial further progress has been made in the post-virus economic recovery.

So, rivers of dollars and zero rates fueled the stock market recovery from the CV lows in late March. However, not all stocks had the same gains, in fact there were…

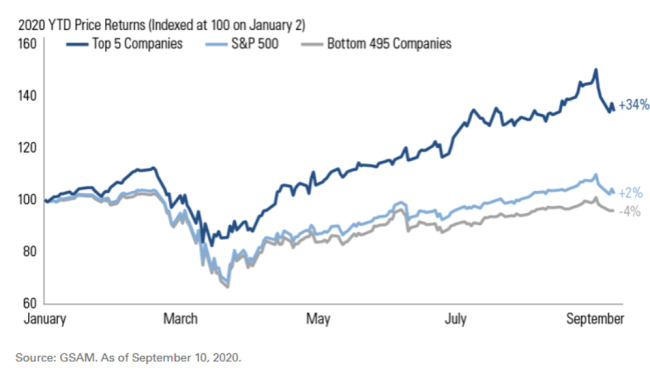

Winners and Laggards – Bifurcation of Returns in 2020

The shock of the lockdowns and fear of CV initially caused a tremendous drop in the overall stock market and nearly every sector and stock were down. The WFH phenomenon was very beneficial for some companies and extremely damaging for others. While online sales and streaming videos and web-based meetings went through the roof, air travel, food and hotels and most retail suffered staggering losses. This bifurcation showed up dramatically by the fall when the US stock market had separated into a handful of big winners, and the remaining group of laggards.

The incredible recovery from the bottom in March was primarily fueled by the top five companies in the SP 500 (The mega tech FANG companies.) These five WFH beneficiaries also make up over 25% of the total index. The remaining 495 companies’ stock prices were still negative as of mid-September. A portfolio of large cap tech companies earned spectacular returns despite and in-fact because of the pandemic, but a more broadly diversified portfolio might have had mixed returns.

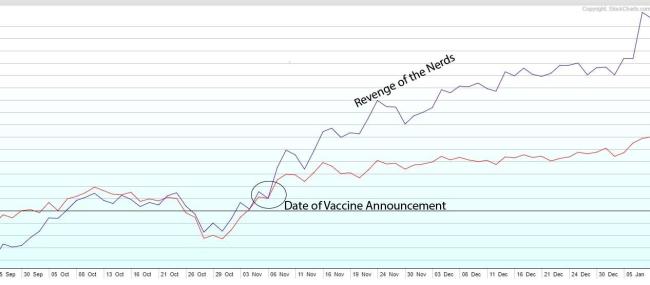

The Vaccine Bump – Revenge of the Nerds

The WFH stocks triumphed for most of the year while companies that relied on their customers to use their products in person suffered. But then promising results from the vaccine trials were announced in November. Analysts had been suggesting that if and when there was an effective vaccine that these laggards would recover, and it seems that they were absolutely right. The day of the vaccine announcement, hotels, cruise lines, casinos, shopping centers, and many other companies had dramatic one-day price increases of 20-40%! Meanwhile, many of the previously successful WFH stocks actually went down with the vaccine news.

To give further credence to the “Vaccine Bump” thesis, the smaller laggard companies actually went on to outperform larger companies for the remainder of the year.

Blue line represents S&P 600 Small Cap Index. Red line represents S&P 500 Large Cap Index.

How will this trend play out in 2021? A lot will depend on progress on the pandemic and most importantly government mandated shutdowns. If the country goes back into a hard lockdown again, you might expect the giant tech WFH companies to do well. However, if we open up again, and life goes back to some form of normal, you might expect consumers to start to spend much of the record piles of cash they have been saving and the smaller companies might continue the “revenge of the nerds” progress of November and December.

(BTW – just so I don’t inadvertently offend anyone, I use the term nerd with respect and affection. I was a true math nerd back in high school, a National Merit student with top SAT scores, the football players gave me grief, and did not get many dates either ?)

So, what should we expect and watch for in 2021?

Defaults, Debt, Dollar, De-Valuations

Well first of, the powerful twin forces of money creation and zero interest rates might well create a perfect environment that continues to push the price of all financial assets higher. A number of prominent analysts and experts have made compelling arguments for that to occur.

Add to that a (hopefully) effective and safe vaccine, which might kick-start the economy back into high gear. There is definitely a strong case for robust investment markets in 2021.

However, investors will want to watch several potentially troublesome areas, that might change that rosy investment scenario.

Defaults: Banks will be announcing quarterly numbers in January and there is great concern that a rising tide of loan defaults will show up in their results. Financial crises that households experienced due to the unprecedented increase in unemployment were temporarily papered over by stimulus checks, PPP loans and mortgage and rent forbearance programs. Much of that temporary aid went away at year-end, and the fear is that many loans might then go into default. Watch those January earnings for clues as how bad this might be. A tidal wave of defaults is obviously bad for the economy and the markets.

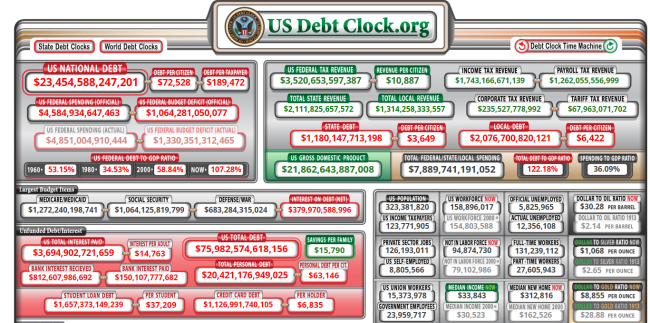

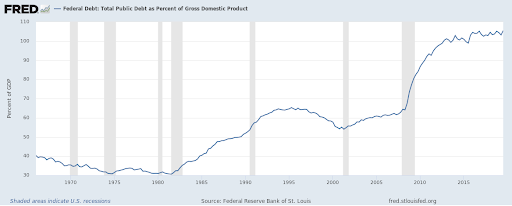

Debt: The US debt has skyrocketed because of deficit spending associated with the pandemic. The federal debt of now $28T pushes our debt to GDP ratio to 130% - anything over 100% is considered quite unhealthy. Proponents of Modern Monetary Theory (MMT) including many top government leaders and economists brush any concerns about the debt aside. My personal worry is that these debt levels are unsustainable in the long run and that we may eventually have a day of reckoning. When (and if) that day occurs is the question. In the meantime, the economy just marches on. Because of the debt, the…

US Dollar is Weaker: From the year’s high of 102 in March, the USD index (as measured against other currencies) has dropped over 10% to about 89 as I write this. That is a tremendous drop for a currency and has lots of implications for investors. A weak dollar is favorable for exporting companies, and tends to also favor overseas, especially emerging markets. During the last weak dollar trend, emerging markets stocks trounced the US index for over ten years, and not surprisingly the emerging markets sector had a much higher return than the overall US stock market in 2020 as well. A weaker dollar partially explains the record high gold price (close to $2000/oz now).

De-Valuations – are Stocks Priced too High? A concern is valuation of stocks – in other words is the price of a company’s stock fair in relation to the amount of profits they generate? One truism of the investment markets is that stock prices need to be justified by the earnings of the company, either now or in the future. If the company does not deliver those expected earnings, then investors tend to abandon that stock and the company shares may drop quickly in value.

Some sectors and individual companies are currently priced at nosebleed levels, and they have very lofty earnings and sales goals they must continue to achieve if they hope to remain at elevated prices. If they disappoint - expect the stock price to take a sharp dive as investors tend to punish a company that fails to meet their expectations. There are many companies in the nosebleed category at the beginning of 2021.

Additionally, if the overall economy falters, perhaps due to Defaults, overall corporate profitability may drop and thus lead to stocks dropping in price. There is always risk in investing, and always things to worry about!

Biden Tax Plan

Expect major changes in the tax code for both corporations and individuals. This will be even more likely to happen as the Georgia Senate races gave the democrats a clean sweep of the three branches of government. We will be watching this closely as this might have significant implications for both personal wealth management and tax-strategies as well as how to allocate investment portfolios. We will follow-up and both write about this and review in our meetings as this develops.

Action Items – What Should an Investor Do?

We will discuss these issues in upcoming client review meetings. Here are some of the key issues to cover:

[ ] Income & Liquidity Plan: What are your portfolio withdrawal needs for the near future? Where will you draw from, and should we pre-emptively raise cash now since the markets are high? This might also be a great time to review our Robust Income Plan exercise to test how robust your income is should there be another downturn.

[ ] Risk & Rebalance: With the violent down and up movements of the markets, and bifurcation of returns in different sectors – is this a good time to rebalance? (We monitor that for most of our clients regularly.) What is the current risk level in your portfolio – and are you comfortable with it? This might be an especially good time to review bond allocations, whose rates and also their return expectations have dropped to near zero.

[ ] Diversification: Is your portfolio well positioned for the current environment? For new opportunities arising from a post-pandemic world? For the impact of a weaker USD and money printing? (for more see https://www.geverswealth.com/blog-01/your-portfolio-date-model-changes-rebalancing )

[ ] Cash Planning: With interest rates near zero, is your cash positioned correctly? Do you have a plan for cash?

[ ] Debt Review: If you have not already done so, near zero rate interest rates provide a wonderful opportunity to review existing debt. Does a refinance make sense? Is there a better way to structure your existing debt?

[ ] Tax-Planning: What are the tax hazards and planning opportunities that might arise under the new administration? How can we mitigate, reduce or avoid new taxes?

[ ] New Asset Classes: Lots of investor interest recently in sectors and assets. What are the opportunities, risks, and potential in these areas?

[ ] Are you Prepared for the next Downturn?: A strategy we created in response to the pandemic downturn was our Coronavirus checklist in which we identified ten tax and investment strategies to consider to try and take advantage of sharp declines in the markets. Many of our clients used some or all of these strategies in 2020, and helped to improve their financial outcomes. We modified this checklist to help us prepare in advance for the next repeat of what we suffered through early last year. Expect the best, but be prepared for the worst!

Stock market history tells us that the patient and wise investor may enjoy great rewards. We look forward to reviewing these issues and more with you at our next meeting.

GWM Team Update

As we spring in to 2021, I wanted to share with you some professional and personal updates on our fabulous team, and how we are working for you.

Garrett Grigas, CFA Financial Advisor – Great news and a remarkable achievement – Garrett passed his final exam and obtained his CFA certification. The CFA is perhaps the highest academic honor in the financial world, and it took 3 years of 20 hr./week study time, and three grueling all-day tests. Garrett is a vital part of our team and leads our investment initiatives and advanced wealth management strategies. Now that he has finished his CFA studies, you might find him lifting weights, trail running, playing soccer, or planning his next overseas adventure trip.

Kristy Brown, Director of Client Experience - Kristy has had an action-packed year. Her husband Pat accepted a senior position with Amazon in Boise and their family relocated in the Fall. Kristy is a vital part of our team, and fortunately WFH technology has improved greatly and she is now working remotely full time from her Boise home. You might not even notice that she is not physically in our offices as we have updated our phone system and technology. We are thankful she remains part of the team!

Anna Williams, Client Service Associate – Anna is a loyal part of our team, but you may have not met her as she works remote. Her husband Josh serves our country in the military and they are currently stationed in Northern CA. In fact, she has been ahead of the work from home trend as she has been working remotely for several years. The big news for their family is that they had a second baby in August! Anna has a fabulous work ethic, and once again demonstrated that as a client noticed that she had been emailing him documents very late of the evening before baby Benjamin was born! We are hoping that her travels might eventually bring her back to the NW, but in the meantime, we are very grateful for her deep operational skills, accuracy and thoroughness and excellent understanding of advisory and wealth management.

Gabrielle Gevers - is taking a pause while finishing up her graduate degree in CA. She is planning to be back in late spring and may be helping us with some special projects. Besides her studies, she has been backpacking across the West, cooking amazing meals, has picked up archery, and is training regularly. You can see her in action here: https://www.linkedin.com/posts/willy-gevers-71ab154_retirementplanning-wealthmanagement-issaquah-activity-6750107069367619584-3Yga

Trey Gevers - most of you have met Trey as he has been helping us prepare our income tax projections for many of you for wealth strategies like Roth conversions. Trey has hung up his cleats and is done with college football and is now working while finishing up his business degree. He has been deeply interested in portfolio research and our recent portfolio changes. He is also building his investment knowledge and is particularly interested in 529 plans. Trey also is an expert videographer and drone pilot and has traveled overseas for his video work. He takes joy and is completely immersed in finance, and we frequently discuss heavy topics like option strategies and economics while we are lifting weights together. I am delighted that Trey has decided to join us full time after graduation!

Me & my lovely wife Vivienne – it was a very busy 2020, but I am delighted that our clients enjoyed a good year, despite all the bad events. I am starting an advanced wealth management class this winter, so will be buried in books for several months along with client meetings and running the firm. Hope to have the class done in time to enjoy more mountain biking and fly-fishing when the weather gets nicer. You can see a recent adventure here: https://www.linkedin.com/posts/willy-gevers-71ab154_wealthmanagement-mountainbike-tech-activity-6720077434462593024-0ual

Vivienne oversees administration and is busy behind the scenes making sure all things are running smoothly. Love you honey ?

Our whole team is dedicated to serving you, and we are striving to continually improve our skills, knowledge, and service. We are grateful for your trust and the privilege to help you, and look forward to seeing you soon.

May 2021 be prosperous, blessed and full of joy and good health – and to continue our fish story, let’s hope that we have a better catch this year!

Warm Regards,

Willy Gevers

PPS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

The return and principal value of bonds fluctuate with changes in market conditions. If bonds are not held to maturity, they may be worth more or less than their original value.

Please note: Cetera Advisor Networks LLC is not registered to offer direct investments into commodities or futures. Instead, we provide access to this asset class via mutual funds, exchange-traded funds (ETFs) and the stocks of associated companies.

Investments in commodities may be affected by the overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments. Commodities are volatile investments and should form only a small part of a diversified portfolio. An investment in commodities may not be suitable for all investors.

Copyright 2021 William R. Gevers. All rights reserved.

Gevers Wealth Management, LLC

5825 221st Place SE, Suite 102

Issaquah, WA 98027

Office: 425.902.4840

Fax: 425.902.4841

Email: info@geverswealth.com

Website: www.geverswealth.com

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

US Money Supply, US Dollar, Inflation/Deflation, Debt Watch

"Neither a wise man nor a brave man lies down on the tracks of history to wait for the train of the future to run over him." - Dwight D. Eisenhower

US Money Supply –Monetary Base

(https://fred.stlouisfed.org/series/BOGMBASEW)

US Dollar Price – (DXY) USD Index measured against other currencies

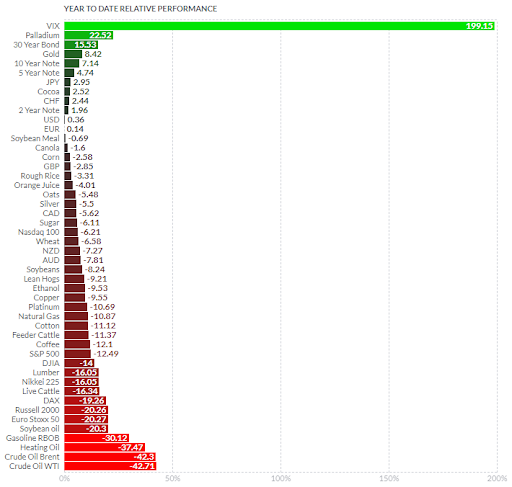

Inflation/Deflation:Year to Date price change in commodities as measured by futures

(http://www.finviz.com/futures_performance.ashx?v=17)

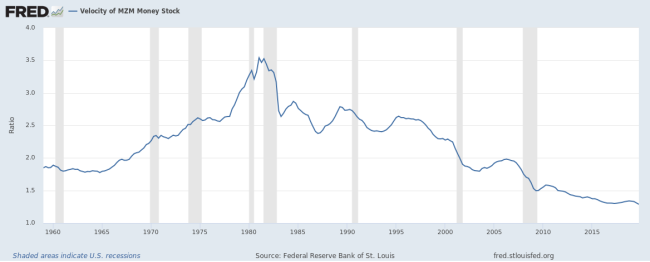

Velocity of Money – Velocity is a measure of how quickly money is spent. High velocity is typically a precondition for inflation.

(http://research.stlouisfed.org/fred2/series/MZMV)

Debt

Tracking US Debt Levels - remember that increasing debt levels generally push up asset prices; stocks, real estate, and other investments. Eventually, debt levels will need to be reduced, or else we'll reach a point where extreme monetary fiscal policy must be taken if the debt reaches unsustainable levels. A family that lives beyond their means for too long and goes deeply into debt may end up in financial ruin. A country that goes too deeply into debt for too long may also have to have a day of reckoning.

“Let no debt remain outstanding, except the continuing debt to love one another, for whoever loves others has fulfilled the law.”

Paul

Total US Debt

US Debt to GDP Ratio

(note: ratio of US Federal Debt to Gross Domestic Product. Ratios >100% are unusual and considered economically unhealthy. https://fred.stlouisfed.org/series/GFDEGDQ188S )

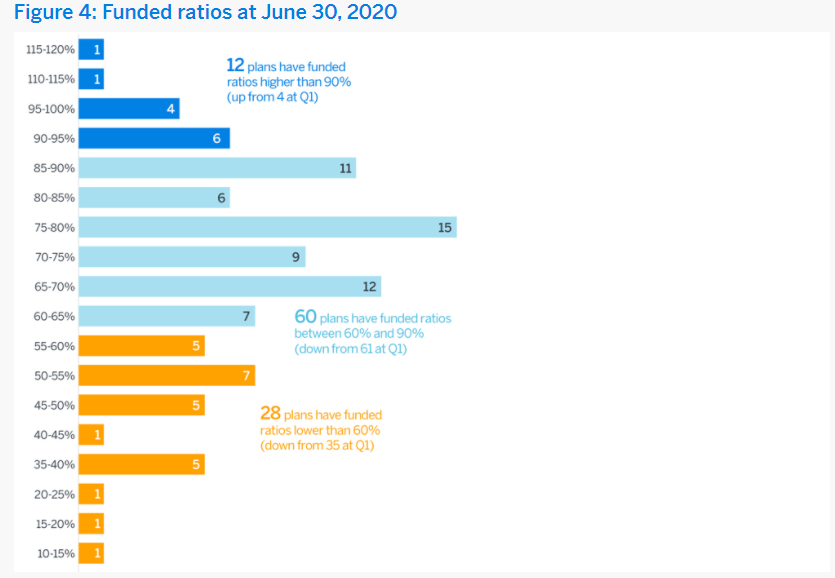

Pension to Liabilities Chart – Public Pensions

(note: 100% funding means that the pension plan has enough assets to pay its projected retirement benefits.) http://www.milliman.com/ppfi/

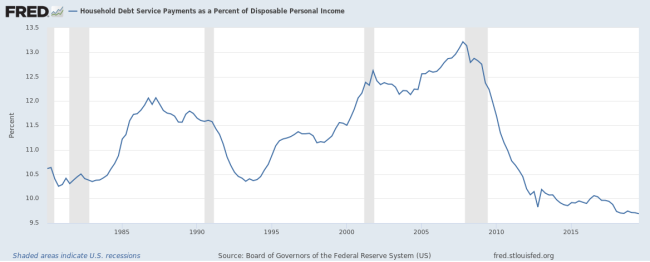

Household Debt Payments as a Percentage of Personal Income

(Note: the lower the ratio – the better that households are able to make their loan payments.)

https://fred.stlouisfed.org/series/TDSP