Give Me Back My Money! Lessons from the Silicon Valley Bank Collapse

Winter 2023

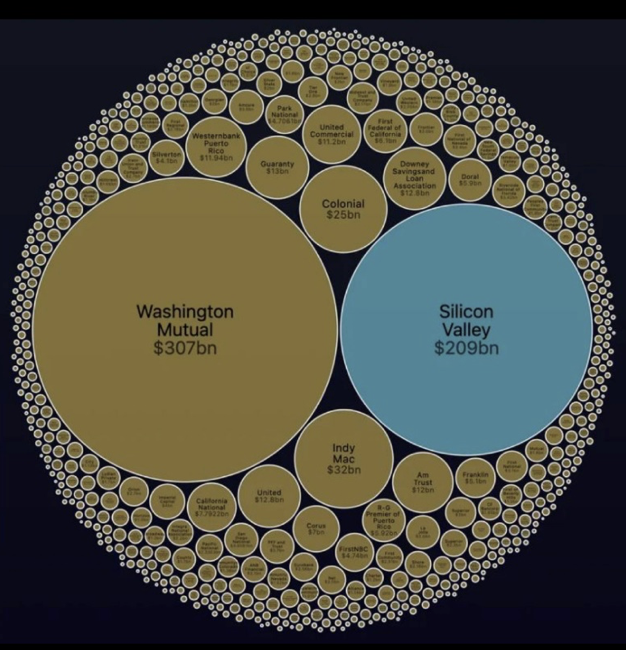

At the beginning of last week, Silicon Valley Bank was one of the largest and most respected banks in the US with total assets of $209 billion and forty years of success. Friday morning, the institution vaporized into receivership, the second largest bank failure in American history.

Much has been written about the why and how of this spectacular failure, but what are the lessons to us as individual investors? What principles should we use to protect our wealth?

Let’s examine the Need for Liquidity, Know Your Risk, and Banks are Risky.

Need for Liquidity: It’s a truism that liquidity/cash is hardest to come by when you need it the most. The SVB failure caused a cascade of crises. About 65,000 of its depositors had accounts greater than the $250k FDIC guarantee threshold, many or most of those small businesses and start-up companies. How will those companies make payroll this week? How will they survive if their funds are locked up in a drawn-out receivership? How much, or will they get their money back?

How did SVB’s customers respond when they first start hearing that the bank was having some struggles? Were they unconcerned because of the bank’s decades long history and FDIC backing.

They responded like little Michael Bailey, who yelled “Give Me Back My Money!” in the famous bank scene in Mary Poppins. Thursday $42 billion dollars was withdrawn from the bank, or about a million dollars per second over the course of the business day.

You can bet that there are hundreds of urgent boardroom meetings that happened over the weekend. My heart goes out to the entrepreneurs, business owners and employees who still have accounts at SVB and whose livelihoods have been threatened by such an unexpected danger.

Personal Principle: What will you do if you have a sudden need for liquidity? What if your bank unexpectedly fails? Do you have multiple sources of cash available to you? If you own/operate a business it may make sense to have two more bank relationships. You might keep several open lines of credit, equity or asset based, available to you. You might communicate with your vendors and employees and discuss how you might all work together if you suffer a liquidity crunch.

An individual investor might follow the same steps. We take our clients through a stress test that we call the Robust Income exercise to try and understand where each family’s vulnerabilities might be. Depending on the results, we might encourage and implement any number of strategies to try and improve their access to liquidity/cash.

Know Your Risk: It sounds like Silicon Valley Bank was unaware of, or ignored the risk inherent in their investment portfolio that backed their banking operations.

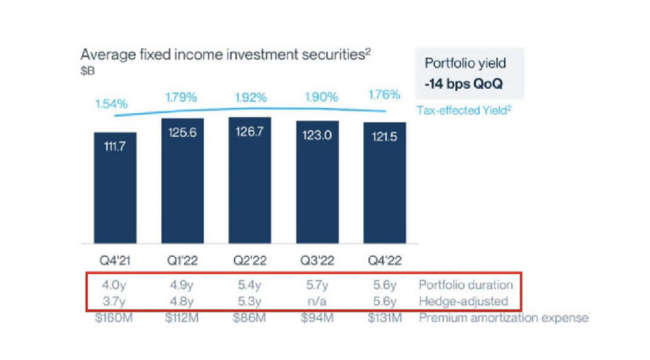

SVB reports indicate that they owned over a hundred billion dollars of bonds at a rate of 1.76% and a duration of 5.6 years. Any first-year finance student can tell you that bonds lose value rapidly as interest rates increase. Apparently SVB loaded up on bonds during the recent period when interest rates hit their 300 year low. In the last year the FED raised rates 4.50%, resulting in a steep decline in the value of those low-rate bonds. SVB was forced to liquidate those bonds at a steep loss which was the beginning of the end for them.

How much would the bank have lost if they had the ability to hold the bonds to maturity? That is a trick question. The answer is that these US government bonds were scheduled to pay back principal and interest, and when that happened there would not be principal loss. (Now if the US government defaults on their bonds…that’s a different story.) The point is, they were not able to hold on, rather they were forced to liquidate at a terrible time, which forced them into realizing devastating losses.

Personal Principle: Do you know what the risk actually is in your portfolio? We run our client’s portfolios through a stress test to try and project what might happen during inflation, increasing interest rates, recession, and times of financial crisis. Knowing how your portfolio might respond might help prepare you to be a better investor during tough times, or perhaps it might motivate you to revise your portfolio to an allocation that might be more comfortable for your emotions and goals.

If (or when) your portfolio takes an unexpected dive in value, will you be able to hold on? Selling in the midst of economic distress usually results in loss, conversely time tends to heal all wounds in the markets. It is important as an investor that you are able to hang on when its necessary.

Banks are Risky:

“…deposit insurance tends to be detrimental to bank stability. The U.S. Savings & Loan crisis of the 1980s has been widely attributed to the moral hazard created by a combination of generous deposit insurance, financial liberalization, and regulatory failure…Thus, according to economic theory, while deposit insurance may increase bank stability by reducing self-fulfilling or information-driven depositor runs, it may decrease bank stability by encouraging risk-taking on the part of banks.”

World Bank Development Group

We somehow believe that banks are a safe haven. The truth is that there have been many bank failures in recent years.

The safety comes not from the bank itself, but from the FDIC which is a government agency that backs depositors’ money under certain stipulations. Because the banks know that they have this governmental backstop, many of them engage in risky behavior which in some cases like SVB has resulted in disaster. The graphic below illustrates just some recent bank failures.

Personal Principle: Do you know what the financial strength of your bank is? Do you have accounts that exceed the FDIC insured threshold amount? My opinion is that the local credit unions, are the better option in many cases, although of course you want to check their stability as well.

An Experiment: I did an experiment a few years ago. I went to the local branch of our bank, a prominent national bank, and asked to meet with our business banker. We have been banking there for years, and tend to keep a healthy balance as our payroll, rent and other expenses are paid from our business accounts there. I got the valued customer welcome and handshake from the fellow, who asked me how he could help. The smile melted off his face when I asked him if I could make a withdrawal of $100,000… in cash. He deflected and delayed a little, and said that he did not think that was possible right now. I looked around the lobby, which was empty, and told him I was in no hurry and would come back in a couple of hours if that was better for him. He then told me that he did not think it was possible today, and would have to talk to the manager, and it might take several days. I pointed at the giant vault that was a prominent part of the lobby and said surely you must have more than that in the vault. He would not answer me directly, but I left wondering if they even had that much money on the premise. To be fair, I did not actually plan to go ahead with the withdrawal. The experiment was part of my own personal financial stress test for liquidity.

To put this story in context, the branch is located in Issaquah, a very prosperous suburb of Seattle. Some of the wealthiest families in the state live within a couple of miles radius. It is astonishing that a bank that serves so many affluent families apparently does not even have a relatively small amount of physical cash on the premises.

Action Items:

Test your own personal liquidity sources and needs. How will you access capital in a worst-case scenario?

Go through a Robust Income Plan exercise as a stress test for your finances.

Understand your portfolio risk; how might it behave during high inflation? Rising rates? Financial crisis? And have a plan in place to for how you will deal with a major market event.

Evaluate your bank’s financial stability – how are they doing? Are your accounts inside the FDIC insured threshold?

Do you need or want to keep physical cash on hand? How much, and how will you get it?

The Silicon Valley Bank story is a tragedy, and there may be more repercussions and failures in the days to come. There will be detailed analysis of how and why this disaster happened. My hope is that we will learn our lesson as a country, and in the future, take steps to avoid what seemed like an avoidable disaster. Our team’s encouragement for you is to take pro-active steps to try and improve your liquidity, understand your risk, and keep your banking relationships with the sound and strong ones.

We will be watching closely as this saga unfolds. The team is available if you have any questions.

Warm Regards,

Willy Gevers

PS: We have been repeatedly asked by clients if they could share these e-mail notes with their friends or neighbors. Please feel free to forward this with the stipulation that it may only be forwarded if done so in its entirety with no portions omitted. We would be delighted to share our comments and opinions with your friends and welcome your comments and feedback. If you received this and would like to be included on our newsletter list, please email us at info@geverswealth.com

Copyright 2023 William R. Gevers. All rights reserved.

Did you enjoy this newsletter? Please like us on LinkedIn! https://www.linkedin.com/in/willy-gevers-cpwa%C2%AE-71ab154/