The Debt Ceiling, Defaults, and Diversifying

Section One: What is the debt ceiling?

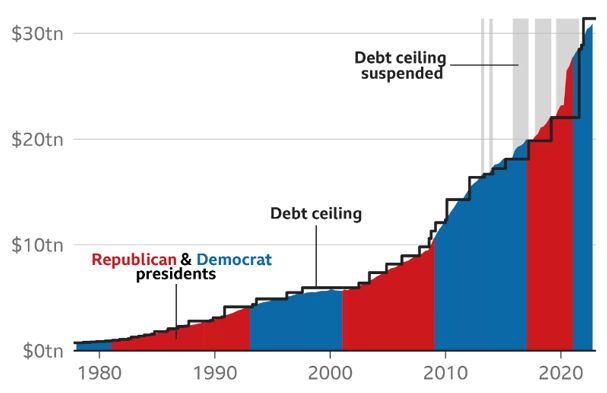

The US government has the largest budget of any organization in the world, but just like an ordinary household they cover this spending through their income(taxes), assets, and by taking on debt. They have earned quite the reputation for using their debt option, and of the $6.27 trillion that they spent in 2022, $1.38 trillion was covered by new debt. Congress places a limit on their own debt called the debt ceiling. This is unique and in fact the US and Denmark are the only two nations to have a debt ceiling. This limit has done little to keep spending in check though, and every few years congress revisits and increases this limit.

The United States recently reached the current debt ceiling of $31.4 Trillion and are now using the last of their reserves to cover spending. If Congress does not raise the debt ceiling soon, the government is likely to shut down along with other potentially bad ramifications. How this shutdown differs from past shutdowns like 2011, is the level of political weaponization of the debt ceiling. The debt ceiling is being used as a negotiating tool, bringing political risk into the equation, and making this issue much harder to resolve.'

“I say to the Republicans out there — congressmen, senators — if they don’t give you massive cuts, you’re going to have to do a default.” - Donald Trump

"The leaders (of Congress) have all agreed: We will not default. Every leader has said that." - Joe Biden

Let’s review some potential short-term and long-term impacts of the debt ceiling not being raised soon as well as some potential impacts on your investments and finances.

Section Two: What are the impacts of an unresolved debt ceiling?

Short-term Impact 1: Survival Mode

Much like a family who has maxed out their credit cards and other loans might begin to desperately sell their assets to continue their spending, the government is doing the same thing. What have they turned to? The retirement funds of the millions of government employees. Shocking right? As of today, the US government has almost completely drained the TSP stable value fund in the Federal employee’s retirement plan. This fund is supposed to be the safest investment option for retirees and still shows full value, but if it were forced to be liquidated for its owners, there would be very little left for them. The government has promised to repay this once the debt ceiling is raised, but I would be very nervous if this were my money. In fact, doing this would be extremely illegal and unethical for any private company.

Now that Federal employee’s retirement accounts have been drained, the US government is spending down their last cash balance which they estimate will last until sometime between early June and late July. At this point they will be out of both assets to sell and their reserves and will be forced to reduce spending.

Short-term Impact 2: Shutdown

As the government runs out of resources, they will cut back on what it deems non-essential spending. You may remember in 2011 when this happened the national parks and many other government services were shut down. The government workers who managed these sectors were furloughed until the debt ceiling was raised. Although they received backpay for this period, this was very hard on workers who did not have emergency funds set aside.

Short-term Impact 3: Downgrade

Another thing that can happen when a debt ceiling is reached is a downgrade of that nation’s debt. Think of a debt rating as a credit score, but for nations and companies instead of a person. A downgrade is when the debt(bonds) of a nation has their rating reduced. This happens when that nation is viewed as more of a risk to lend money to. AAA is the highest rating a nation can receive and might be the equivalent of an 800-credit score, a great person to lend money to.

The United States’ debt has almost always had a AAA rating, but in 2011 during the last debt ceiling crisis, their debt was downgraded to AA+. This is still a great rating, but the shock of US debt being downgraded resulted in some wild swings in the US stock market, with US stocks losing 16% in the following weeks.

Short-term Impact 4: Default

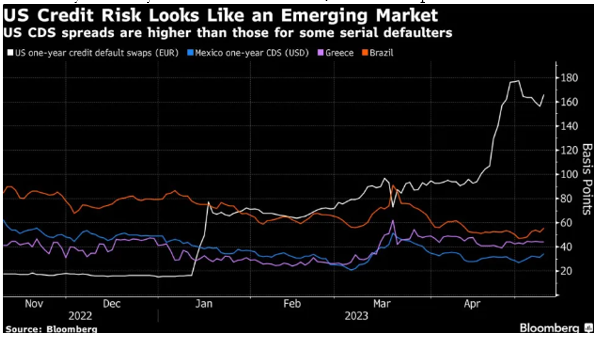

The final impact of the debt ceiling is the potential for a default. A default happens when a lender, like the US government, is unable to repay its debt. This has never happened in the history of the U.S. and would have major repercussions were it to happen. Politicians across the board have reassured investors that this will not happen, and most investors agree. A way to double check this is called a Credit Default Swap (CDS). Think of CDS as insurance against the default of a bond. The more likely a country is to default on its debt, the more expensive a CDS.

What this chart tells us is insurance against a default by the U.S. on its debt in the next year is three times as expensive as it for Brazil and four times as expensive as it is for Greece and Mexico. This is shocking!!! Can you imagine that big investors are predicting that the US is more likely to not be able to make its debt payments than a country like Greece who has struggled with its debt for years.

Long-term Impacts

US treasury debt has been viewed as the safest holding place for money in the world for years and is the major reserve of central banks around the world. Owning the world reserve currency is very beneficial to the nation and its citizens. In fact, it is no coincidence that China is taking this very opportunity to challenge the US currency leadership status and begin to push its currency as an alternative to the dollar. The US government cannot afford to default on its debt and, if it did, would be a very dangerous and short-sighted action.

Although this may not warrant any action currently, it is a trend we are watching and will likely write more newsletters about in the future.

Section Three: What should I do about it?

Secure Your Income

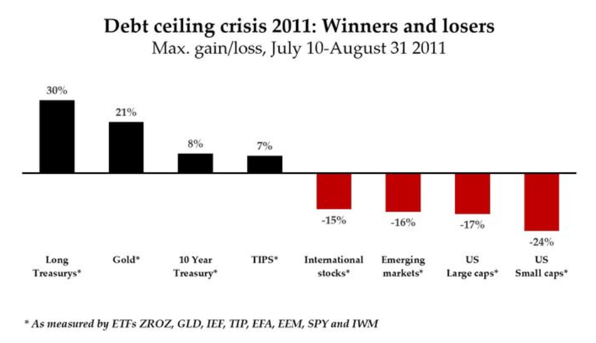

In a time of increased uncertainty in the markets, it is important to add security to your income. Although the 2011 debt ceiling downturn was a relatively small one, it was not inconsequential. The two graphics below show the downturn in 2011(circled in red) along with the following performance of the market in the first graphic, and the peak to trough performance of some major asset classes in the second graphic.

This graphics reinforces the principle that it is important to stay invested for the long term, but it is equally important to manage your risk and secure income in the short term. This could be in the form of an emergency fund in the bank or having a portion of your portfolio in cash or a money market fund for upcoming income needs. For government employees, it is an especially important time to revisit your emergency reserves, lines of credit, and other ways to cover your spending.

Diversify

Another important way to help reduce risk while navigating the debt ceiling is to keep your portfolio well diversified. As seen in the last graphic while some assets dropped in value during the 2011 shutdown, others increased in value and performed very well. Investments viewed as safe havens, like long term treasury bonds (US Debt where payment was not due until long after the debt ceiling had been raised) and gold both performed very well. The key takeaway from this is to maintain proper diversification.

Watch out for Short-Term Treasuries

Finally, reducing exposure to short term treasury bonds may be prudent. Despite it being unlikely that the US will default on its debt, it is not a non-zero risk. The treasury bonds that are viewed as being most at risk are ones with shorter maturity coming due during the pending government shutdown. This worry could cause volatility in this segment of the treasury market. In response, we have reduced our exposure to short-term US treasuries in many of our investor’s accounts and diversified to owning more international government bonds.

Closing

Our hope is that congress will come to an agreement and avoid this crisis while maybe revisiting the large budget deficit. We encourage you to review these action items and if you are interested in discussing any of these topics or evaluating your personal finances, please reach out to our office. As always it is important to approach any troubling financial news like this with the perspective of a long-term investor. I hope you and your family have great success in your finances and that you have a great summer!

The views are those of Gevers Wealth Management, LLC, and should not be construed as individual investment advice. All information is believed to be from reliable sources; however, no representation is made as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Investors cannot invest directly in an index. Please consult your financial advisor for more information. This material is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Past performance is not indicative of future results. All investing involves risk, including the potential for loss. No strategy can ensure a profit or protect against loss in a declining market. Securities and advisory services offered through Cetera Advisor Networks LLC Member FINRA/SIPC a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from an any other named entity.

The views in this letter are not necessarily the opinion of Cetera Advisors Network LLC and should not be construed directly or indirectly as an offer to bjy or sell any seucirites mentioned herin. Due to volatily within the markets mentioned, opionions are subject to change wihout notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guranteed. Past performance does not guarantee future results.