Winners and Losers from 2023 – In the Financial Markets and at Gevers Wealth Management

2023 brought positive returns for many investors, but not without its challenges and uncertainty for stretches. Geopolitical turmoil, a banking crisis, government shutdowns, and wild swings in the interest rates all had their time in the spotlight, but investors who stayed true to their strategies and weathered the turmoil were rewarded as most major investment types finished the year positive.

It’s time to look at who the biggest winners and losers in the financial markets were in 2023, and we’ll end with some memorable events at our company with plenty of pictures.

Let’s get started!

In the Financial Markets

Winners

Stocks

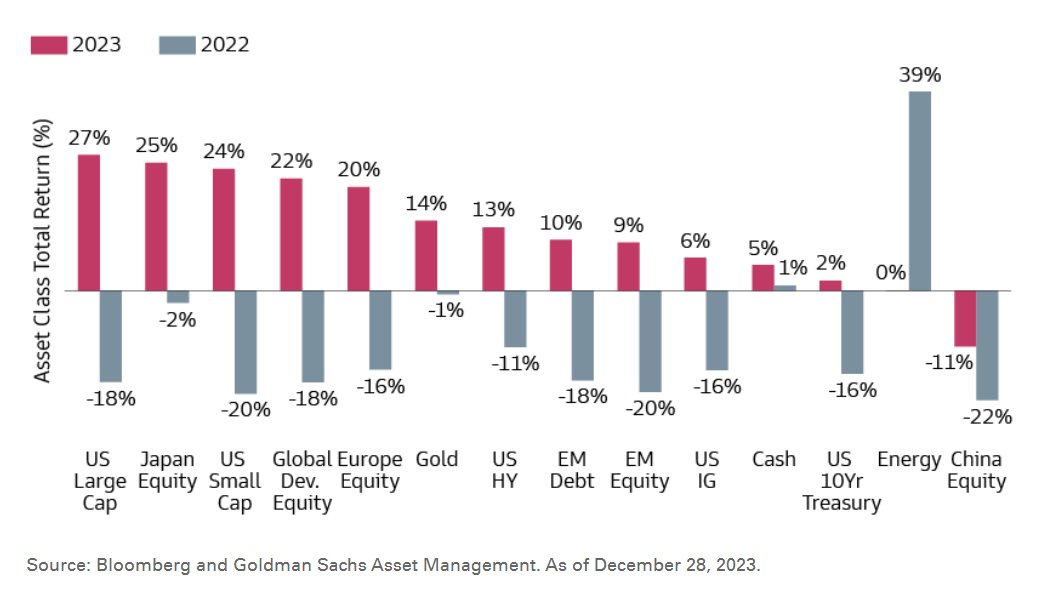

Investors saw above average returns in the stock market across almost every category. Indexes tracking the returns of small medium and large companies both in the US and internationally saw double digit returns in most countries. Major stock indices in the United States saw returns between 15% and 30% with global indices lagging a little behind that.

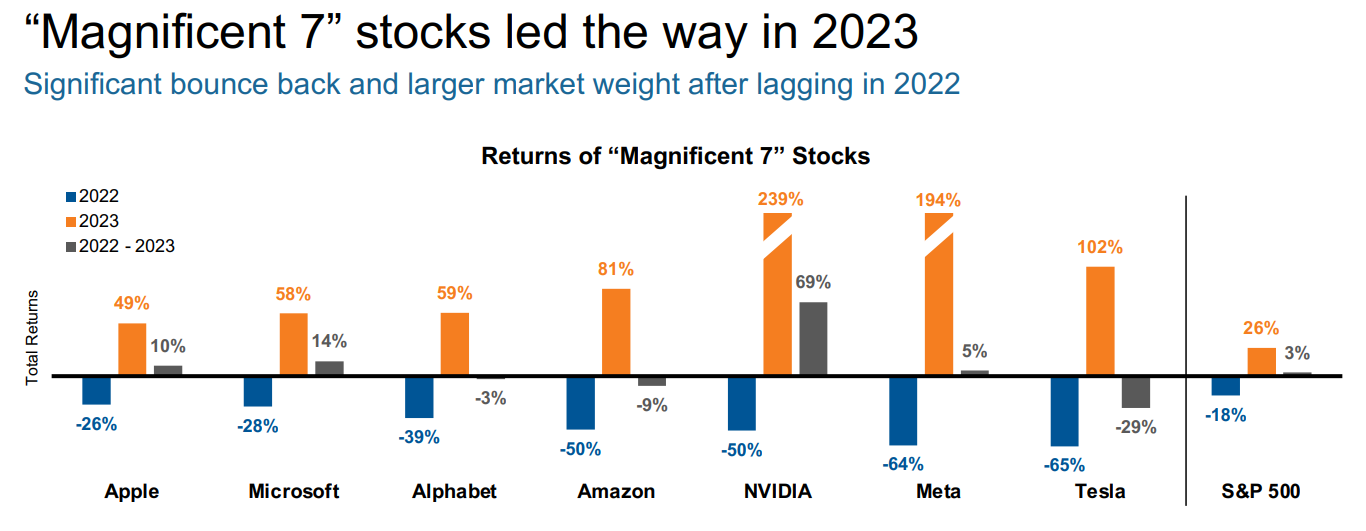

The Magnificent Seven

The best financial performance of 2023 was from a group of large companies who picked up the title “The Magnificent Seven”. Headlined by names like Microsoft, NVIDIA, and Facebook, they brought star power to rival Steve McQueen and Yul Brynner from the original Magnificent Seven. These companies were able to take advantage of the opportunity Artificial Intelligence brought to the business world and strong financial position to average a return of over 60% as a group.

Money Markets and Short-term Bonds

These investments were the slow and steady performers of 2023. Interest being paid by money markets and short-term bonds slowly increased throughout the year up to where many are delivering over 5%, while holding their value throughout the course of the year. This is textbook performance of what you hope to see from the bond portion of an investment portfolio.

Tax Planning

Each year, new tax rules are passed, creating an increasingly complex tax world to navigate, and 2023 was no different. This complexity also brings the opportunity to gain an advantage for those who are intentional about adding to planning to their finances. Roth conversions, larger 401(k) contributions, QCDs, and tax-loss harvesting are just of few of the strategies we saw investors use to gain a tax advantage.

Personalized Indexes

Personalized indexes are the next step of evolution in investing beyond ETFs. They offer customization down to the individual stock level that mutual funds and ETFs lack, and while ETFs and mutual funds have a tax negative or tax neutral impact, personalized indexes provide a tax benefit to investors. The secret behind what made personalized indexes an especially big winner in 2023 is the tax benefit they offer. This tax benefit grows bigger the more market swings happen, and 2023 saw plenty of those. Personalized indexes saw strong returns for investors along with mutual funds and ETFs, but due to the large market fluctuations saw a larger than normal tax benefit as a bonus.

Best Performing Stock: NVIDIA

The best performing stock in the SP 500 this year was Nvidia. A technology company that designs the hardware and chips behind much of the technological advancement we see, they were able to capitalize off the advances in AI and cloud computing. Return: Up 248%. Others in consideration: Duolingo up 220%, Abercrombie and Fitch up 274% (Not part of the S&P 500).

Losers

Long-term Bonds

Despite having a slightly positive return in 2023, medium- and long-term bonds end up in the loser category for another reason. They saw wild price swings throughout the year, gaining and losing as much as 10% in a single month. This level of volatility is the opposite of the performance you want from the bond portion of your portfolio and makes them a loser in 2023.

Commercial Real Estate

Not all real estate had a bad year, but in comparison to the rest of the investment world it performed poorly. Retail and residential real estate both had down years, but the office sector was truly awful. Work from home continued to take away tenants, while rising interest rates increased costs for borrowers, giving them a terrible year. Office buildings in some cities have seen decreases in price of more than 50%. Unless something changes, office buildings and specifically the loans associated with them are poised for what looks like another poor year in 2024.

Banks

Rising interest rates over the last two years caused the collapse of two major banks, First Republic, and Silicon Valley Bank, earlier in the year and placed the whole banking sector at risk. Although things have stabilized, the banking sector underperformed the rest of the market, and banks are still in a precarious position going into 2024.

WA State Capital Gains Tax

Early in 2023 the Washington State Supreme Court upheld a new tax passed in 2021 that makes capital gains from most non real estate investments taxable. The tax of 7% applies to long-term capital gains of more than $250k and is in addition to the Federal capital gains tax. There are many complexities and details still being decided about this tax, and there are planning opportunities to help reduce its impact for investors. However, it has already motivated several high-profile Washington residents to move to other states, most notably Jeff Bezos.

Increasing Paperwork and Disclaimers

Our clients who have had to sign paperwork this year have seen the pages and pages of disclaimers that regulations now require for basic financial actions. It is a frustrating reality that our clients, our team, and all financial companies that follow regulations correctly are facing. (We considered starting a petition to address this but discovered that petitions from financial companies also require 100 pages of disclaimers.)

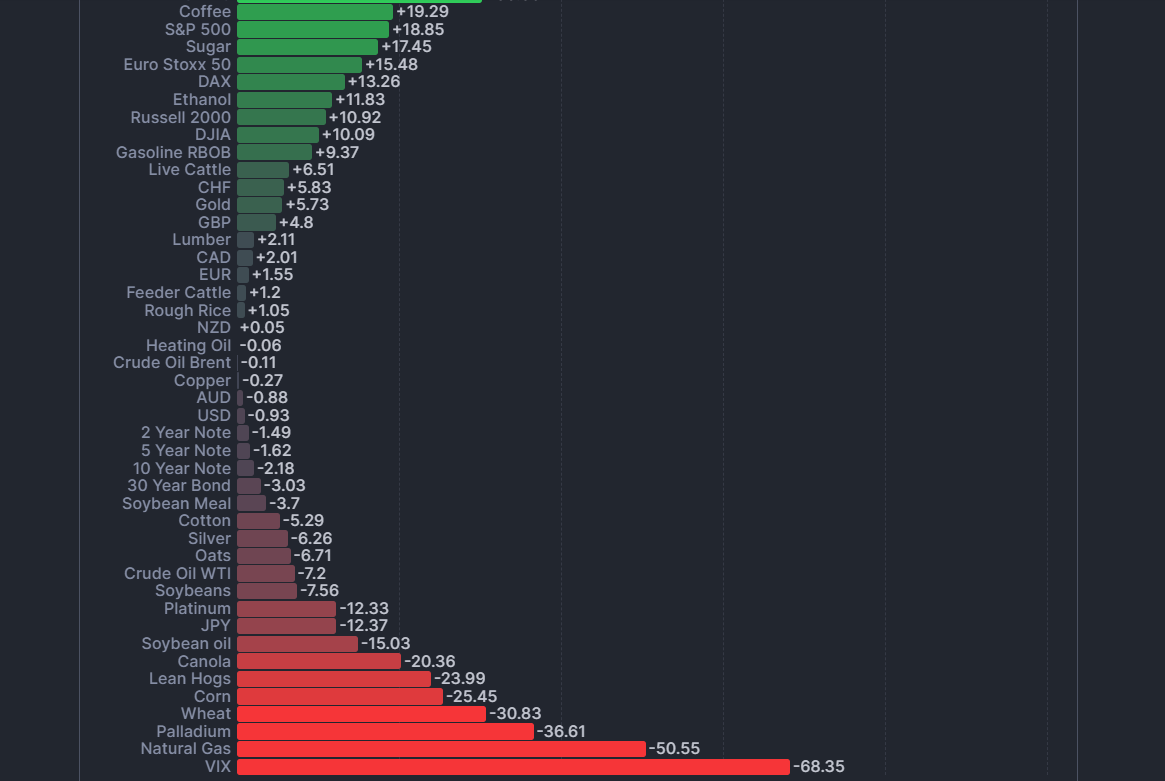

Commodities

A big winner of 2022 has switched spots to being a loser for 2023. After inflation pushed the commodity prices of agriculture, energy, metals, and others higher across the board last year, there was a reversal in 2023. Many major commodities stayed flat or even retreated over the course of 2023.

Chinese Stocks

The Chinese stock market was one of the few major markets around the world to see negative numbers this year. A slowdown in their economy and trouble in the real estate markets pushed down returns for investors in this asset class.

Worst Performing Stock: AMC Entertainment

AMC saw their stock price explode in 2020 and 2021 despite week financials and COVID negatively impacting their business. The drop in price that followed has been equally drastic in the opposite direction and continued into this year. 2023 Return: Down 80%. Others in consideration: Dollar General down 45%, Pfizer down 44%.

At Gevers Wealth Management

Winners

Team Holiday Parties

For this year’s holiday party, we tried a Taiwanese hot pot restaurant in Seattle that Trey discovered. Chengdu Memory for anyone interested in trying it out. (Feel free to ask Trey for recommendations of what to order.) The food, culture, and comradery were unmatched, and it put a bow on what was a great year for the team.

Planting Our 300th Tree!

Several years ago, before e-signature existed, our firm made a commitment to plant a tree each time a new investment account was opened. The goal was to help offset the paper being used to open an account by planting young trees in deforested regions around the United States. We have transitioned to mostly electronic paperwork, but kept our tree planting commitment and this year reached the milestone of 300 trees planted. Many thanks to our clients who helped make this happen!

The Gevers Family Time Together

It’s a treat for any family with adult children to get everyone together, and in 2023 the Gevers family were able to do that more than ever. A trip to Indonesia and Tokyo, weekly family dinners, and finishing the year in Cannon Beach for the holidays were all highlights of the year. The memories and bonds created during this year make it a top winner of 2023.

Volunteer Positions New and Old

Our whole team has a heart for helping, none more than Gabrielle. She has started working three days a week as a counselor at a homeless shelter. Trey also started working with Young Life, a Christian ministry to high schoolers. Willy continues his position as a board member and the treasurer for Stronger Families who work to strengthen the families of military members and first responders. Garrett also has a new position as a board member and the treasurer for CFA Society of Seattle who work to promote professional excellence and ethical behavior in the local investment community.

Gabrielle Gevers – Top Athlete

The employees of Gevers Wealth Management hold a mini-Triathlon each Friday after work to finish off the week. We are a competitive group, and in the final race of the year, Gabrielle took home the gold. We hope this success doesn’t go to her head, and the rest of the team are looking forward to racing her again in the new year.

Losers

Unattended Boxes or Stuffed Animals

If you stopped by our office over the past year, you may have met Milo, the newest and friendliest member of your team. Despite this friendly nature he has a personal vendetta against boxes and stuffed animals, and they were big losers in 2023.

The Office Keurig Machine

Our trusted Keurig has provided many cups of coffee for clients and employees. In 2023 after years of loyal service, the wear and tear took its toll, and our Keurig gave out. We took this opportunity to upgrade our drink options and now have a Nespresso coffee maker along with a mini fridge of chilled drink options. If you haven’t had a chance to yet, we hope you stop by our office in 2024 to give it a try.

Closing Notes

It has been an honor to serve all our clients in 2023, and we were blessed to see the positive impact prudent investing and planning has had for them and their families. We stay committed to your financial success and look forward to the coming year and both the opportunities and challenges it will bring with it.

Happy New Year!

Your team at Gevers Wealth Management

Garrett Grigas, CFA®

Investment Advisor

Phone: 425-902-4840

Fax : 425-902-4841

Email Ggrigas@geverswealth.com

5825 221st Pl SE, Suite 102

Issaquah, WA 98027