A Return to Reality: The Good, The Bad, and The Ugly of Rising Interest Rates

A dramatic shift is happening to the structure of our economy, and it has the potential to drastically impact us as investors. I want to look at what has happened, how it is changing the future, and what we can do about it.

Interest rates have risen at a record pace for the past two years. Since most of the money that exists in the world originated from debt, a change in interest rates is hugely impactful on the economy. For borrowers it decreases the amount of money they have access to borrow and increases the amount of interest they owe on their debts. For lenders, it increases the amount of interest they earn on their lending but decreases the likelihood that borrowers will be able to repay their loans. Because of this, rising interest rates change the economy, investing, and how wealth rises and declines around the world.

I have identified three of the biggest impacts rising interest rates will have on investors and identified them as The Good, The Bad, and The Ugly. The bad that we see impacting the investment world now, the ugly impact on the economy that is beginning to grow on the horizon, and the good that comes with it for savers, investors, and responsible stewards of their money. I will give a brief introduction, review the good, the bad, and the ugly, and then end with what we can do in response as investors.

The last 5000 years of interest rates in a paragraph

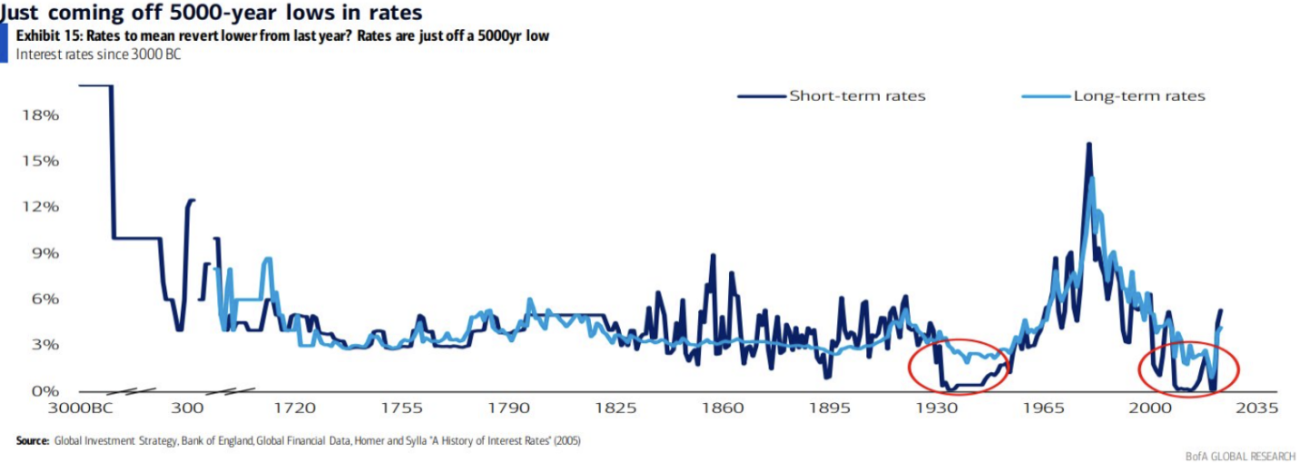

Investors are biased toward recent memory. This bias is especially true when that recent memory lasted for over 22 years, which is the last time interest rates were as high as they are today. There has been much focus in the media about how high interest rates are, but looking back over history the recent low is more of an anomaly than the level of current interest rates. This graph of interest rates over several hundred years though shows that only the Great Depression had interest rates close to as low as they have been the past decade. Many of us can remember rates 2 to 3 times as high during the early 80s.

This rise in interest rates is more of a return to reality than a change from normal. It is the speed at which they have risen that is shocking and impactful. The rate at which interest rates have risen, especially for longer term loans, is almost completely unprecedented. This increase impacts borrowers, investors, and the overall economy. To fully understand this impact we need to look at three big changes that it causes.

The Bad – Repricing

As investors accept that interest rates might be returning to a historical normal and the phrase “Higher for Longer” is thrown around about higher interest rates, a repricing of financial assets happens and their value drops. Why does this happen? Bonds pay investors in bonds at an interest rate, and as interest rates rise, bonds become available with a higher interest rate and are more attractive to investors. This causes the value of other investments to be lower by comparison. Let me give an example: One of the most common investments in the world is a treasury bond issued by the US government. As interest rates rise, the US government will now be paying a higher interest payment to the investors in its bonds than before. This causes these new higher interest bonds to become more attractive and, in response, other investments less attractive. Stocks, real estate, and old, lower interest bonds all lose value in response until a new equilibrium is reached in the value of these different investments. This phenomenon has repeated throughout history. A good example is when the interest rate high of the early 1980s happened, which is visible in the graph above, some of the lowest valuations in stock market history followed.

This effect of repricing is what led to the well-publicized collapse of two major banks earlier this year, Silicon Valley and First Republic. These banks used long-term, low interest bonds and mortgages as the collateral for the deposits at their bank. As interest rates increased, repricing pushed the value of those bonds lower. When their depositors came to withdraw money, the banks had insufficient funds in those investments to meet the withdrawal needs and were forced to close.

The good news about repricing is that it tends to happen quickly after a rise in interest rates, and once pricing has reached an equilibrium, investments can return to their growth trajectory. While repricing impacts the price of an investment, there is another impact of rising rates on the investment.

The Ugly – Deleveraging

Deleveraging is a reduction in the level of debt and borrowing in an economy. It happens when debt levels and debt payments are too high, and they become unsustainable. A low interest environment like we were recently in encourages borrowing, spending, and overall economic activity. Being in a close to 0% interest rate financial system is even more extreme and is like a sugar rush for the economy and encourages extreme levels of borrowing and spending.

Much like the comedown from a sugar high, the transition away from very low interest rates is often not pretty. What does this transition look like? The large increase in borrowing that happens during a low interest rate period results in a buildup of higher debt levels than normal. As interest rates increase, the payments owed on this debt also increase.

Currently people, businesses, and governments all have too much debt in this new world of higher interest rates.

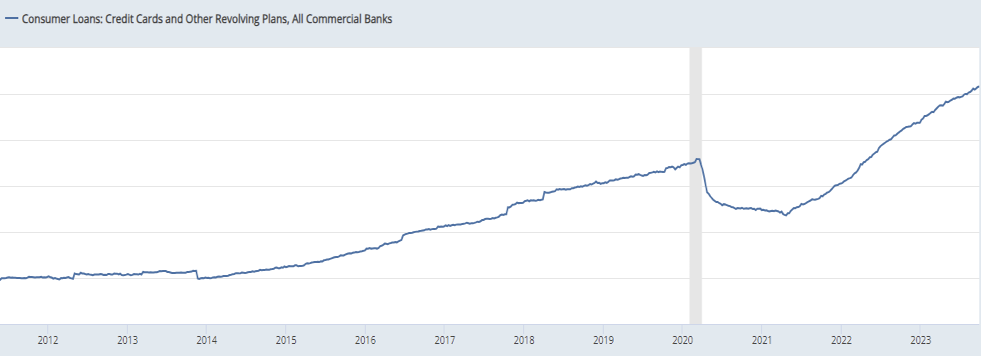

People - After a reduction in credit card debt during the COVID shutdown, when reduced spending and stimulus payments allowed many borrowers to pay down their levels of credit card debt, we have seen a sharp increase in credit card debt, and it has not stopped increasing even as interest rates rise.

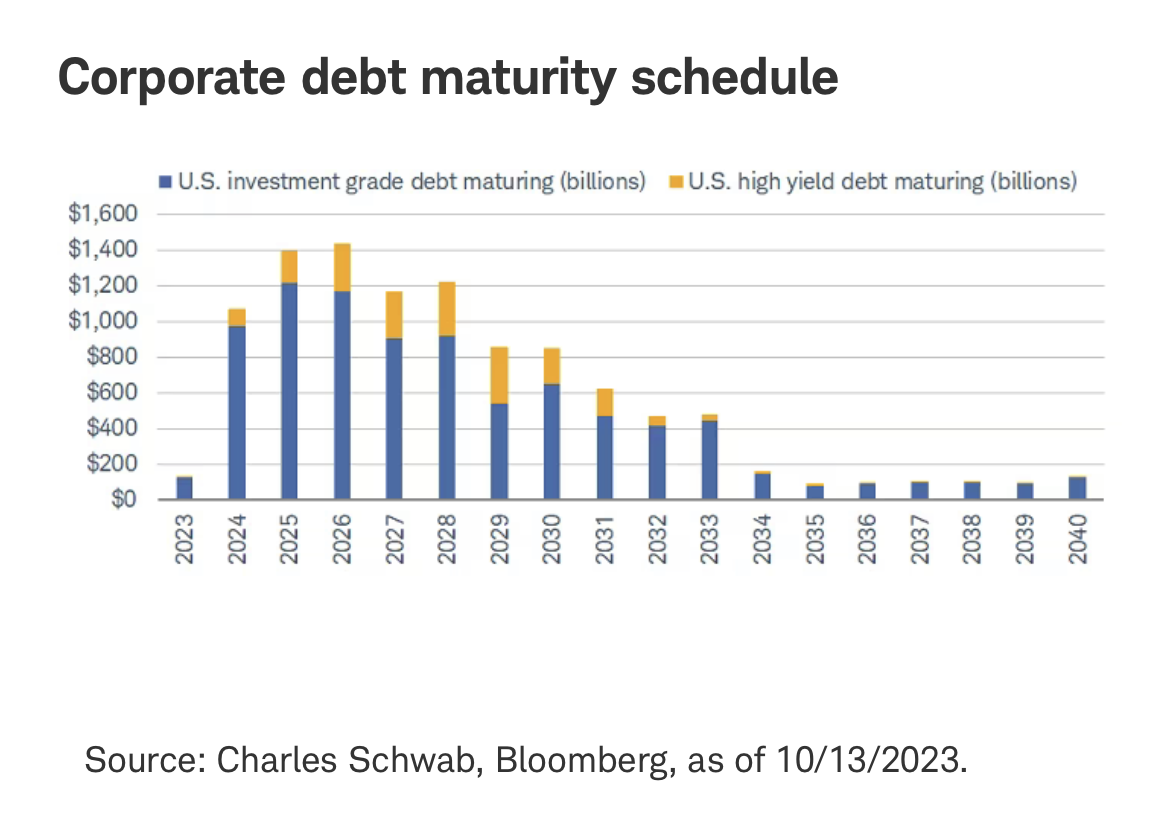

Businesses - Loans to large businesses, or corporate debt, are frequently fixed rate. This keeps the interest payment that they owe from changing as interest rates rise and has protected many companies from feeling the impact of rising interest rates. However as the term of these loans end and payment is due, they will need to be refinanced at new higher rates, increasing the interest payments companies owe. Over the next 7 years most corporate loans will need to be refinanced, and this “debt wall” creates a large future impact of higher interest rates. We are already seeing companies preparing for this increase in interest payments by cutting costs through layoffs and other measures.

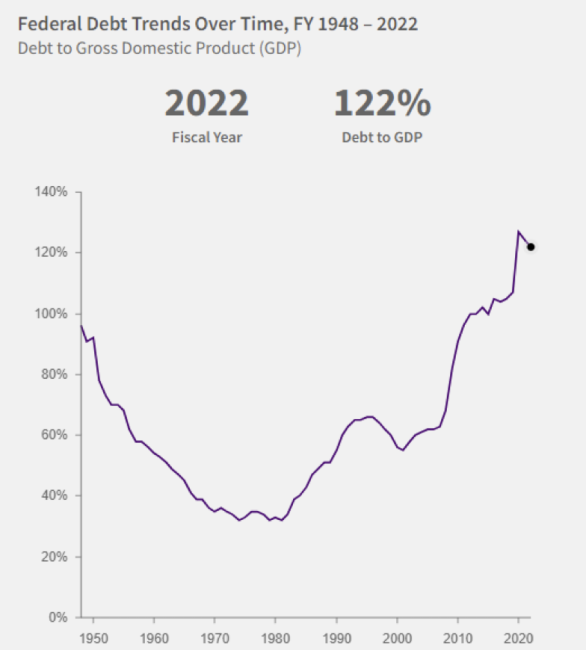

Government - The most aggressive borrower of all has been the government, with a large deficit and rapidly growing level of debt. Much like the debt of companies which have interest rate resets as the loans come due, the government’s debt is exposed to the same risk. Currently the average government bond or loan has an interest rate of under 3%. Refinancing at the current rate of over 5% will markedly increase the interest payments that they owe, and the deficit in the budget causing a snowball effect within their debt level.

For all three parties, this increase in interest payments is currently projected to far outpace the rate of growth in income and the economy. The result is too much debt for people, companies, and governments, and not enough income to cover those debt payments. The solution to this problem is deleveraging, and this reduction in the debt level can happen in several ways. Two primary deleveraging methods to know are the slow and fast routes. Slow - A slow deleveraging happens over a longer period and is the better route as it tends to be less painful for the economy and investors. Borrowers are able to restructure their loans with lenders and find solutions that work for both parties. Although they may not be able to pay the entirety of their loans, they can pay a portion or most of it, and the extra time allows income to grow and help pay loans, and for inflation to run its course and shrink loans.

Fast - A fast deleveraging is much more painful. Borrowers begin to default on their loans and stop all payment. Investors lose money, and the whole economy grinds to a halt. Although very painful, a major deleveraging like this has happened regularly throughout history and is survivable although not preferred. A good example is the 2008-2009 housing crisis. During this period there was too much debt (mortgages and other bank loans), and the borrowers began defaulting on their loans. The resulting slowdown in the economy and a collapse of investment and asset prices was very hard on the economy and investors alike.

As gloomy as these two consequences are we can end on a good note.

The Good

Thankfully along with the negative impact of increasing rates there are positive impacts from higher rates. Higher interest rates, which cause borrowers to pay more in interest, allows savers and investors to earn more in interest. The result is a real return for owners of cash, CDs, and bonds, with the highest interest rates available in these investments in 15 years. This allows investment strategies that rely on money markets and bonds to be more profitable going forward. Conservative investors especially are beginning to benefit from this as assets historically thought of as lower risk now pay higher interest rates.

There is also a change happening to the health of our financial system that I call A Return to Reality.

A Return to Reality

The phrase “The New Normal” has been thrown around frequently over the past decade. About astronomical growth rates in stocks, crypto, and real estate after COVID. Close to 0% interest rates, massive money printing, and many other areas of our financial and personal lives also received that label. Thinking that this time will be different as an investor has built a pattern of being wrong throughout history. So far in 2022 and 2023 this looks to be true once again, and for rising interest rates there is a beneficial result. Having interest rates close to 0% is not a healthy place for an economy to be in the long term. It encourages irrational decisions about finances and unusual borrowing, spending, and investing behavior. Low debt payments cause many people to lose the healthy caution of debt that should exist and take on more debts than is wise.

Very low interest rates also cause rapid inflation in asset prices, making it difficult for first time investors and home buyers. It also grows the gap between the wealthy(haves) and the poor or middle-class(have nots). The wealth gap in America is reaching new highs, and an extended period of low interest rates and money printing has played a major role in that.

The change from close to 0% rates will likely be bumpy and take time to work itself out, but once the adjustment period is over, we can hope for a more normal financial world.

As long-term investors, it is important that our perspective on the markets has a long-term bias. The short-term pain of repricing, or the medium-term pain of deleveraging, should not impact our focus on the improved long-term health of the economy as it navigates these changes and other. However, there are adjustments that can be made to reduce our exposure to these short-term risks that also keep our long-term focus.

What Can I Do?

Keep your income secure- If you rely on your investments for income, it is prudent to keep 2-3 years of income needs in conservative assets such as money markets or short-term bonds to use during market downturns. If you rely on a job for income, an emergency fund of 3-6 months of spending needs is appropriate. Either way, keeping income and your lifestyle safe is the priority.

Reduce floating rate debt you owe; increase floating rate debt you own – This is a topic we discussed in depth with our investors over the past several years and is important to revisit. As interest rates rise, debt with a floating rate will begin charging higher interest payments. Loans with fixed rates lock in your payment and reduce the risk of rising with interest rates. When borrowing it is valuable to use fixed rate options, when possible, to reduce that risk. When investing, the opposite is true, and short-term and floating rate bonds/CDs/debt are better to own in a rising rate environment. Rates have risen dramatically over the last two years and this strategy has been very beneficial for our clients. It may make sense to begin exploring investment options with longer maturities but with caution.

Look for new investment opportunities – When the financial world is in flux, opportunities appear. After the 2008-2009 collapse, real estate became a great investment opportunity. After 2020 energy stocks and others had areas of opportunity. This new disruption in the financial markets likely brings the opportunity to find long-term investments at attractive prices.

Stay diversified – As risk and uncertainty increases, staying diversified helps to manage that risk. Staying true to this investment principle and avoiding having too much money in any single investment, sector, or market is more important than ever.

In Conclusion

The topics we explored here are daunting to us as investors. Both repricing and deleveraging have the potential to impact investment markets significantly. However, if either materializes, they are not the first or last time a repricing, rate rise, or deleverage has impacted investors. Stagflation and repricing in the 1970s, high interest rates in the early 1980s, and deleveraging in 2008-2009 are all market events that investors have faced, survived, and for those who stayed committed to their investment strategies, flourished on the other side. It is important to view these events and others that will come with the perspective of being long-term investors, allowing the markets to reward us over the long-term for our patience.

We will go over these topics at your next review along with any opportunities or changes/adjustments that will be impactful for your finances. Our team is here to support you and your financial life, and I look forward to our next discussion.

Warm Regards,

Garrett Grigas, CFA

Financial Advisor